Tax time gets overwhelming if you can’t find your receipts. Business owners become active and organized only during tax deadlines but often forget or become inconsistent with record-keeping during the rest of the year.

The result is that receipts end up in either shoeboxes or drawers. Ever thought about how organizing receipts can make your taxes easier and help with write-offs? Because only some bills are taxable.

How to keep your receipts organized for tax purposes?

Organizing your receipts for tax purposes is essential for accurate recordkeeping and smoothly filing your tax returns.

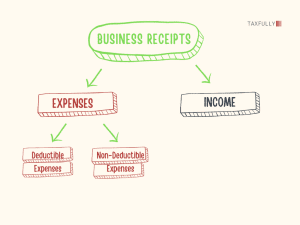

Separate your expenses and income. Once you have your receipts, it’s better to categorize them into expenses and incomes. Expenses are of two types: one that is deductible and the other that is not.

Deductible Expenses: Expenses should be categorized further into deductibles and non-deductibles. As per the IRS, some deductibles make your taxes easier, and you can deduct them easily if they fall under these categories defined by IRS.

- Travel

- Meal

- Transportation

- Office Supplies

- Marketing and Advertisement

- Education Expenses

- Employee Compensation and Benefits

Non-Deductible Expenses: Expenses you must pay that the IRS doesn’t allow you to deduct from your taxable income. They’re either personal, capital-related, fines, gifts, investment-related, or unreimbursed employee expenses.

Income: Keeping income receipts is super important for handling money well and following tax rules. They help you show exactly how much you earned and get the most deductions. These can reduce your taxable income, such as mortgage interest, charitable contributions, and medical expenses.

Keep your records up to date:

Keeping your receipts organized and up to date is crucial for tax preparation. Record them every day, or at least weekly, to avoid any issues later.

Small businesses can also use free apps to record their receipts for tax purposes. Here are some free options:

Zoho Expense

Expensify

Evernote

Wave

Shoeboxed

What should you not do with your business receipts?

- Don’t scatter important receipts randomly: Keep them organized in a safe place.

- Avoid mixing personal and business receipts: Keep them separate.

- Don’t lose or throw away your business receipts: Keep them safe for records.

- Don’t overlook small expenses: Record and track them diligently.

- Avoid modifying or altering receipts: Keep them in their original state.

- Don’t rely solely on memory: Instead, use a digital system for storing receipts.

Which tax receipts are more important?

However, it’s essential to keep and organize all receipts. Some may be more crucial than others.

1099 Forms:

Form 1099 is an IRS document used to report non-wage income like freelance earnings, contract work, interest, dividends, and more. People use these forms to report their earnings on their taxes.

Invoices:

They are evidence of key tax receipts because they show what a business earns from sales and what it spends on goods or services. Which can be used to accurately report taxes and claim deductions.

Fixed Asset Receipts:

Receipts for purchased fixed assets like property, vehicles, or other items are crucial for claiming deductions on your taxes.

Donations:

Receipts for donations serve as proof of your charitable contributions throughout the year. They’re vital for claiming deductions for charitable giving on your tax return.

Some other important expenses, such as educational and medical expenses, can also be claimed as tax deductions. Medical expenses exceeding 7.5% of your adjusted gross income (AGI) may be eligible for deductions.

FAQ:

Can I scan receipts on my iPhone?

Yes, you can scan receipts easily using your iPhone’s Notes app. Just open the Notes app, create a new note, tap the “Camera” icon, and now you can scan documents.

What should I do before the tax deadline if my business records are not organized?

Start organizing your taxes as much as you can, but consulting a professional tax expert would be a great help during this time.

Receipts are like proof that shows what money comes in and goes out for your business. If you are not organizing your receipts well, you’re missing out on potential tax savings and the opportunity to optimize your financial performance.

But if you’re busy and forgot what to do with receipts or didn’t have time to organize your taxes, reach out to our tax professionals for a free call. They can help reduce your stress.