What is the IRS mileage rate for 2024

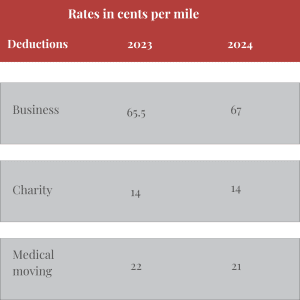

This year, the IRS raised the mileage rate for 2024 to 67 cents per mile, which is 1.5 cents more than the previous year’s rate of 65.5 cents per mile. These rates apply to different types of cars, like electric, hybrid-electric, gasoline, and diesel vehicles, including cars, vans, pickups, and panel trucks. The new rates started on January 1, 2024, and they are for using your vehicle for business, medical, and charity purposes.What does the standard Mileage Rate mean?

The standard mileage rate is a set sum you can request for each mile driven for business purposes. This fixed rate, provided by the IRS, allows businesses to deduct vehicle mileage expenses for business-related activities such as travel and meetings.How to calculate the mileage rate?

Calculating your mileage rate is easy. You can do it yourself to check your reimbursement amount. Simply multiply the miles you drove by the mileage rate of the IRS.(miles) * (rate)

Comparison of mileage rate 2023 and 2024

When Standard Mileage rate can be used?

You’re eligible to use the standard mileage rate if you own or lease your car and meet specific criteria:- Business: You qualify if you own or lease the car and use it for business purposes. However, you should not use it for more than five cars simultaneously.

- Charitable: For charitable purposes, you’re eligible if you use the car to transport passengers or property without receiving reimbursement for the costs.

- Medical: If you use the car to take yourself or a family member to a medical appointment and aren’t reimbursed for the costs, you can use the standard mileage rate.

How to calculate business and personal mileage?

If your car serves various purposes, it’s essential to maintain accurate records and deduct the cost of personal travel accordingly.- Track your total miles driven for the entire period.

- Divide the number of business miles by the total miles driven to get a rough estimate of your business use percentage.

- Use the estimated business use percentage to approximate your business mileage deduction and personal mileage costs.

Can I deduct Mileage on my personal car?

If you use the car for both work and personal reasons, you can only subtract the expenses related to its business use.What methods I can use to deduct my car Expense?

There are two methods to deduct your car expense.- Actual rate

- Standard Mileage Rate