Managing taxes for an e-commerce or online business can be challenging, but with the right approach, you can take full advantage of e-commerce tax deductions. This guide will help you maximize your tax savings by navigating essential deductions, understanding sales tax obligations, and applying smart strategies.

Key Tax Deductions for E-commerce and Online Businesses:

Maximize your tax refund by taking advantage of these top deductions for e-commerce businesses.

Home Office Deduction:

If you run your e-commerce business from home, you may qualify for the home office deduction. This allows you to deduct a portion of your home expenses, such as rent or mortgage interest, utilities, and insurance. The space must be exclusively used for your business. If you use 15% of your home’s total square footage for your business, you can deduct 15% of your home expenses.

Advertising Costs:

Any money you spend on promoting your business, including online ads, influencer partnerships, and social media marketing, can be deducted as advertising expenses. This also includes expenses for graphic design, content creation, and sponsored posts.

Software and Tools:

Running an e-commerce business often requires various software subscriptions, website hosting, and digital tools. These expenses are fully deductible. This includes your accounting software, email marketing tools, and any other platforms essential for your business operations.

Shipping and Packaging:

You can deduct the costs associated with shipping products to customers, including postage, packaging supplies, and shipping insurance. This is particularly beneficial if you sell physical products and manage your own shipping.

Vehicle Expenses:

If you use your personal vehicle for business purposes, such as delivering products or running business-related errands, you can deduct a portion of the vehicle’s expenses. This includes gas, maintenance, insurance, and depreciation. You can choose between the actual expense method or the standard mileage rate. The 2023 standard mileage rate is 65.5 cents per mile driven for business purposes.

How to Track and Report Income from Digital Sales?

Stay organized and compliant with these tips for tracking and reporting your digital sales income.

Digital Sales Tracking Systems:

Using a reliable digital sales tracking system is crucial for accurate income reporting anddeduction calculations. Tools like QuickBooks, Xero, or specialized e-commerce platforms like Shopify provide easy ways to keep detailed records of your sales, expenses, and profits.

Income Reporting:

All income from digital sales must be reported on your tax return. This includes revenue from platforms like Amazon, eBay, Etsy, or your own website. Make sure to report the gross income, not just the net profit after fees and expenses.

Expense Tracking:

Keep track of all business-related expenses to maximize your deductions. This includes everything from shipping costs to software subscriptions. Accurate expense tracking can significantly reduce your taxable income.

Best Practices for Managing Sales Tax Obligations

Navigating the complexities of sales tax compliance can be overwhelming, especially with varying state rules. However, with the right tools and strategies, you can simplify the process and stay compliant.

Understanding Nexus:

Nexus determines your tax obligation in a state. If you have a physical presence—such as an office, warehouse, or even a remote employee—in a state, you likely have a sales tax nexus there. This means you are required to collect and remit sales tax in that state.

State-by-State Sales Tax Rules

Each state has its own rules regarding sales tax, particularly for digital goods. It’s essential to know where you need to collect sales tax and the applicable rates. For instance, states like California, New York, and Texas have specific requirements for e-commerce businesses. Here’s where Taxfully can be a game-changer. They can assist in filing your sales tax returns based on the state where you live and where you ship your products, helping you avoid costly mistakes.

Collecting Sales Tax

When selling to customers in states where you have nexus, it’s crucial to collect sales tax at the point of sale. Ensure your e-commerce platform automatically calculates and applies the correct sales tax rate. If you don’t yet have a Sales Tax ID, Taxfully can help you obtain one in the state where you collect sales tax.

Sales Tax Exemption:

If your customers are reselling the goods they purchase from you, you may not need to charge sales tax on these items. By collecting a sales tax resale certificate, you can ensure compliance and avoid unnecessary charges.

You may also like to read:

20 Essential Tax Deductions for Doctors and PsychologistsTop 8 Tax Deductions for Construction and Renovation LLC Owners to Save $19,200 Annually

Are you a construction, remodeling, or renovation LLC owner? Taxes can be …

Read More

Tax Tricks to Save Money:

Discover clever tax strategies to boost your savings as an e-commerce entrepreneur.

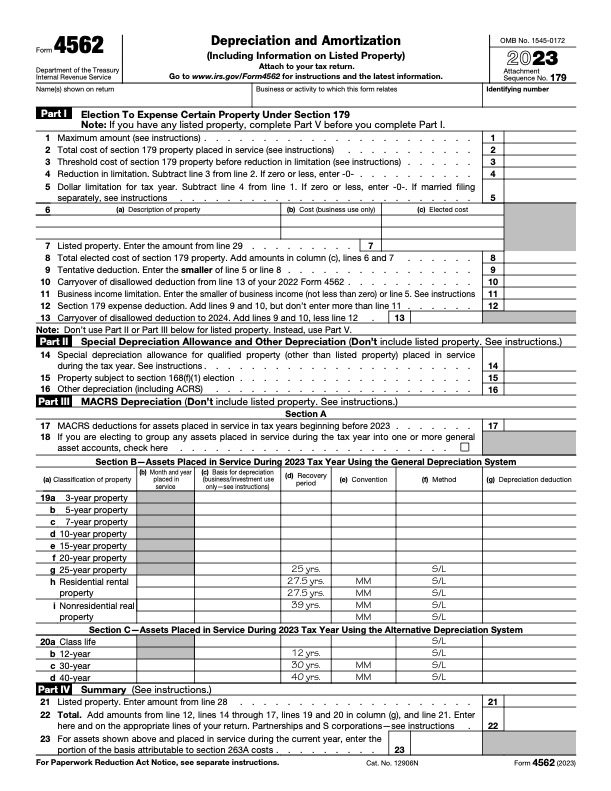

Section 179 Deduction:

Section 179 allows you to deduct the full cost of qualifying equipment and software purchased or financed during the tax year. This is particularly beneficial for businesses that invest in expensive tools or equipment. If you purchase a new computer for $3,000 for business use, you can deduct the entire amount under Section 179.

Per Diem Rates:

If you travel for business, you can use per diem rates to simplify meal and travel expense deductions. Per diem rates are set amounts that you can deduct daily for lodging, meals, and incidental expenses, rather than tracking actual costs.

Retirement Savings:

Setting up a SEP IRA or Solo 401(k) allows you to save for retirement while reducing your taxable income. Contributions to these accounts are tax-deductible, and they can significantly lower your overall tax liability.

Health Insurance Deduction:

If you’re self-employed, you can deduct health insurance premiums for yourself, your spouse,

and your dependents. This deduction is available even if you don’t itemize your deductions.

Enhancing Compliance with Taxfully

Let Taxfully handle your sales tax and filing needs to keep your business running smoothly.

Sales Tax Certifications:

Taxfully can help you set up sales tax certifications with the state, ensuring you’re legally ready to collect and remit sales tax. This is essential for compliance and avoiding penalties.

Sales Tax Filing Made Easy:

Filing sales tax returns can be complex, especially if you sell in multiple states. Taxfully simplifies this process by filing your returns based on the state where you live and where you ship your products.

Obtaining a Sales Tax ID

If you don’t have a Sales Tax ID, Taxfully can help you obtain one in the state where you collect

sales tax. This ID is crucial for compliance and legal operation.