Understanding Passive Income vs. Non-Passive Income

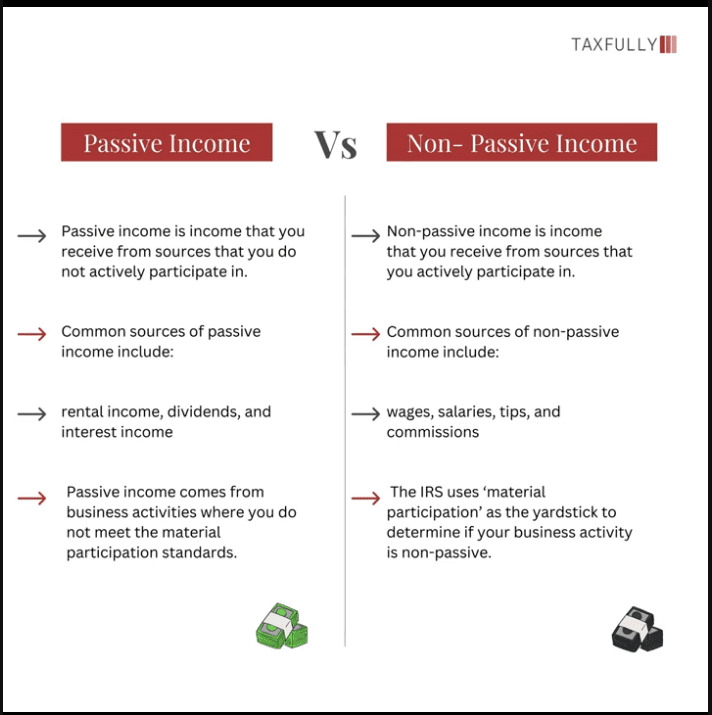

What is Passive Income?

Passive income is money you earn from activities where you don’t have a material role. This includes earnings from a rental property, limited partnership, or other business where you’re not actively involved. Essentially, any business activity where you don’t materially participate counts as a passive activity.

What is Non-Passive Income?

Non-passive income is the money you make from activities where you regularly and continuously take part in the day-to-day operations. If you’re actively involved in running a business, the income generated is considered non-passive.

Key Differences Between Passive and Non-Passive Income

| Aspect | Passive Income | Non-Passive Income |

| Involvement Level | No material participation | Regular and continuous participation |

| Examples | Rental properties, limited partnerships, other non-active business ventures | Actively managed businesses, day-to-day operational roles |

| Tax Treatment | Subject to passive activity loss limitations | Not subject to passive activity loss limitations |

Understanding the difference between passive and non-passive income is crucial for tax purposes and financial planning.

How the IRS Defines Material Participation

Material participation in an income-producing activity generally means active involvement, not passive treatment. Individuals can meet the participation requirements by passing one of seven tests set by the IRS. These tests focus on the individual’s engagement and time spent participating in the activity throughout the year. It’s crucial to consult with your CPA if your level of involvement in your rentals changes.

The Seven Material Participation Tests

Overview of the Seven Tests

Material participation tests are a set of IRS criteria that help determine if a taxpayer has materially participated in a trade, business, rental, or other income-producing activity. If you meet any one of these seven tests, your activity is not considered passive. This is important because passive activity rules limit the deductibility of losses when you don’t meet at least one of these tests.

Detailed Breakdown of Each Test

- 500-Hour Test: You participate in the activity for more than 500 hours during the year.

- Substantially All Participation: Your participation is almost all the participation in the activity of all individuals, including non-owners.

- 100-Hour Test: You participate in the activity for more than 100 hours during the year, and no one else participates more than you.

- Significant Participation Activities: The activity is a significant participation activity, and you participate in all significant participation activities for more than 500 hours.

- Material Participation in Five of the Last Ten Years: You materially participated in the activity for any five of the last ten years.

- Personal Service Activity: The activity is a personal service activity, and you materially participated in it for any three prior years.

- Facts and Circumstances Test: Based on all the facts and circumstances, you participate in the activity on a regular, continuous, and substantial basis.

Common Misconceptions About the Tests

- Misconception 1: You need to meet all seven tests. Reality: Meeting just one test is enough.

- Misconception 2: Only business owners need to worry about these tests. Reality: These tests apply to various activities including rentals and other income-producing activities.

- Misconception 3: Passive activities are always bad. Reality: Sometimes, passive participation can be beneficial depending on your situation.

It’s a good idea to get help from a tax advisor to understand which test you meet and how it affects your taxes.

Passive Income: A Contrast

Passive income comes from business activities where you do not meet the material participation standards. This includes rental activities or business ventures where you’re not regularly and substantially involved. For example:

- ATM Machine Business: If you manage your ATM business for more than 500 hours a year, it’s non-passive. If not, it’s passive.

- Rental Properties: Generally passive unless you’re a real estate professional meeting the material participation rules.

- Amazon Sellers: If you’re involved in the business for over 500 hours a year or meet any other material participation criteria, your income is non-passive.

Tax Implications of Passive vs. Non-Passive Income

Deductibility of Losses

When it comes to income and losses, the IRS treats passive and non-passive activities differently. Passive losses, for instance, can only offset passive income. This means if you have a loss from a rental property, you can’t use it to reduce your wage income. However, if your activity qualifies as a trade or business and you materially participate, you can deduct the losses against your other income.

Impact on Tax Rates

Passive income is usually taxed at your regular marginal tax rate. But if your modified adjusted gross income is above a certain threshold, you might also have to pay the Net Investment Income Tax (NIIT), which is an extra 3.8% on certain types of income, including passive activities. Non-passive income, on the other hand, is subject to self-employment taxes if it comes from a trade or business.

Strategies for Minimizing Tax Liability

To minimize your tax liability, consider these strategies:

- Group Activities: Combine multiple passive activities to meet the material participation rules.

- Real Estate Professional Status: If you qualify, your rental activities might not be considered passive, allowing you to deduct losses against other income.

- Tax-Deferred Accounts: Use accounts like IRAs or 401(k)s to defer taxes on passive income.

It’s generally an advantage for losses to be listed as non-passive because they can ‘shelter’ taxes from wages, capital gains, and other income.

Common Pitfalls and How to Avoid Them

When dealing with passive and non-passive income, it’s crucial to understand the risk rules involved. Misclassifying income can lead to serious consequences, so it’s essential to pay attention to the specific criteria. Failing to meet participation requirements is another common pitfall that individuals encounter. Ignoring IRS guidelines can also put you at risk of penalties and audits. To navigate these challenges successfully, it’s important to seek professional advice and stay informed about the latest regulations.

Why Understanding These Rules Matter?

Understanding the difference between passive and non-passive income is crucial for managing your finances and taxes. Passive income, like rental earnings or investments, requires minimal effort but comes with specific tax rules. On the other hand, non-passive income involves active participation and is subject to different tax treatments. Knowing the IRS’s material participation tests can help you determine how your income will be classified. Always keep track of your activities and consult a tax professional to ensure you’re compliant and making the most of your income. By staying informed, you can better navigate the complexities of passive and non-passive income.