New BOI rules for Business Owners

Starting January 1, 2024, the latest Beneficial Ownership Information (BOI) rules issued by the Financial Crimes Enforcement Network (FinCEN) requires businesses, particularly small businesses, to disclose details regarding their beneficial owners. Failure to comply may result in severe penalties and potential criminal charges.

What is a beneficial ownership information report?

The Beneficial Ownership Information Report (BOIR) identifies individuals who ultimately control or own a company. And, it considers individuals who own or control a company directly or indirectly as beneficial owners.

Who needs to file a Beneficial Ownership Report (BOI)?

The Corporate Transparency Act (CTA) requires reporting companies to report beneficial ownership information (BOI) on January 1, 2024. Except for 23 categories of entities that are not required to report. Reporting companies are those that are required to report.

There are 2 reporting companies.

- Domestic Reporting Companies: Corporations, limited liability companies, and any other entities formed by submitting documents to a secretary of state or similar office in the United States.

- Foreign Reporting Companies: However, Foreign Reporting entities created in a foreign country but registered to do business in the US by filing documents with a secretary of state or similar office.

What is the purpose of a beneficial ownership report?

According to the law, entities must report beneficial ownership information to enable the U.S. government to make it more difficult for bad actors to use shell companies or other opaque structures to conceal their ill-gotten gains.

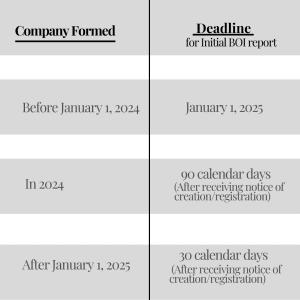

Deadlines for BOI reporting

Penalties

Violation of BOI reporting requirements could result in daily civil fines of up to $500. Furthermore, a person may also face criminal penalties up to $10,000 fine and 2 years in jail.

FAQ’s

Who can file a BOI report on behalf of a reporting company?

Anyone authorized by the reporting company, like an employee, owner, or third-party service provider, can submit a BOI report on the company’s behalf.

Who is a Beneficial Owner?

A beneficial owner is a person who owns or controls at least 25% of the ownership interests in the reporting company and also who either directly or indirectly exercises significant control over the reporting company.

Are there any exemptions for this BOI report?

Yes, 23 categories of entities have an exemption from reporting BOI. You can check here if you have an exceptional case.

How can a Tax professional help you?

With the deadline approaching, it’s important to check if your business needs to follow the BOI, and in this regard, tax professionals can guide you to the new BOI updates.

Our experts at Taxfully have already helped many small businesses, and now it’s your time to receive personalized guidance from us.