Missed the Tax Deadline? Here’s What You Need to Know Before the IRS Comes Calling

If you’re reading this and you didn’t file your taxes by April 15th, 2025 — and you didn’t file an extension either — don’t panic. But don’t ignore it either.

Because here’s the thing the IRS doesn’t always say out loud:

The longer you wait, the more expensive it gets.

But the good news? You still have options — and in some cases, you might even be able to erase penalties or uncover refunds you didn’t know you were owed.

This post will walk you through what happens when you file late, what penalties you might face, and the smart steps you can take right now to fix it before it snowballs.

So… What Happens If You Didn’t File or Extend by April 15th?

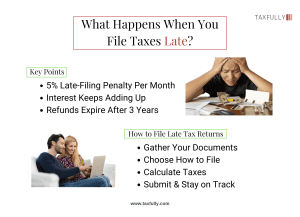

Let’s be clear. If you owe taxes and didn’t file or extend by the deadline, the IRS starts the clock. There are two main penalties that kick in:

-

Failure-to-File Penalty: 5% of the unpaid tax per month, up to 25%

-

Failure-to-Pay Penalty: 0.5% per month of the unpaid amount

These penalties stack, and interest is added on top.

If you’re 3–6 months late, the penalties alone can rival what you actually owed in taxes.

But — and this is important — the IRS doesn’t always issue aggressive penalties immediately. Many people still have time to file and resolve things before it becomes a bigger problem.

Did You File an Extension? That Only Buys You Time to File — Not to Pay

A lot of people think filing an extension gives them until October to handle everything.

That’s only half true.

The extension gives you more time to file, but not to pay. Your tax payment was still due on April 15th — whether you filed or not.

If you didn’t pay, interest and late payment penalties are still accruing.

But again — this doesn’t mean you’re out of options.

Penalty Abatement Is Real — And Often Ignored

If this is your first time filing late — or if you have a solid reason (medical issue, family crisis, natural disaster, etc.) — you may qualify for penalty abatement.

There are two main types:

-

First-Time Abatement: Available if you’ve been compliant the last 3 years and just slipped this year.

-

Reasonable Cause Abatement: If you have a documented, legitimate reason for filing late.

The IRS won’t just offer this — you have to know how to ask.

At Taxfully, we’ve helped dozens of late filers get penalties reduced or removed altogether by handling the request properly and backing it with documentation the IRS actually respects.

Still Owe Taxes? You Might Not Owe as Much as You Think

If you didn’t file because you were afraid of what you’d owe — you’re not alone. But waiting never helps.

What might help is reducing your actual tax bill.

Depending on your situation, we may be able to apply deductions or credits you missed — or even strategies retroactively, including:

-

Claiming the home office deduction (yes, even if you have a W-2 and a side hustle)

-

Using the Augusta Rule if you’re an LLC owner and homeowner

-

Applying business startup deductions you forgot to claim

-

Correcting your depreciation schedules for STRs or rentals

-

Claiming overlooked credits like the Child and Dependent Care Credit or Saver’s Credit

These aren’t guesses — these are real examples of how we’ve helped clients get refunds instead of owing money they thought they had to pay.

Think You Filed Everything Right? Let’s Double Check That

Even if you filed on time, it’s possible something was missed. We offer a free prior year tax return review to make sure:

-

You claimed everything you were eligible for

-

Your income was properly categorized

-

There’s no opportunity to amend for a refund

We’ve seen a lot of self-prepared returns where people left $1,000–$8,000+ on the table — money that could still be recovered with an amendment.

If your return was filed in a rush or by someone who didn’t dig deep, you deserve a second look.

Final Thoughts: The Sooner You Act, the Better Your Outcome

The IRS gets more aggressive as time passes. But most of the people who get hit the hardest are the ones who go silent.

If you didn’t file by April 15th — or you did, but something feels off — now is the time to get ahead of it.

We can:

-

Help you file your taxes now — even if you didn’t file an extension

-

Request penalty abatement (the right way)

-

Review your return for overlooked deductions or credits

-

Explore strategies to reduce what you owe

Just action. And possibly a refund.

Need help catching up or cleaning up?

Schedule a free call with Taxfully — we’ll talk through your situation, no pressure, and help you take the next right step.