Introduction to R&D Tax Credits

Maximizing R&D tax credits can provide substantial benefits for businesses investing in innovation. These government incentives are designed to offset costs related to R&D activities, potentially reducing a company’s tax liability or even offering a direct cash refund. This guide is crafted to help small businesses across various industries understand and leverage these credits effectively for maximum advantage.

Eligibility Criteria for R&D Tax Credits

To qualify for R&D tax credits, businesses must demonstrate that their projects meet specific criteria, including:

- Purpose: The research should seek to create new or improve existing products, processes, or software.

- Elimination of Uncertainty: The project must aim to resolve technical uncertainties, meaning the company must not know if or how it can achieve the desired outcome at the project’s outset.

- Process of Experimentation: The activities should involve a systematic process of experimentation, including testing and refining prototypes.

- Qualified Expenses: Eligible costs include wages for R&D personnel, costs of supplies, and payments to contractors engaged in the research.

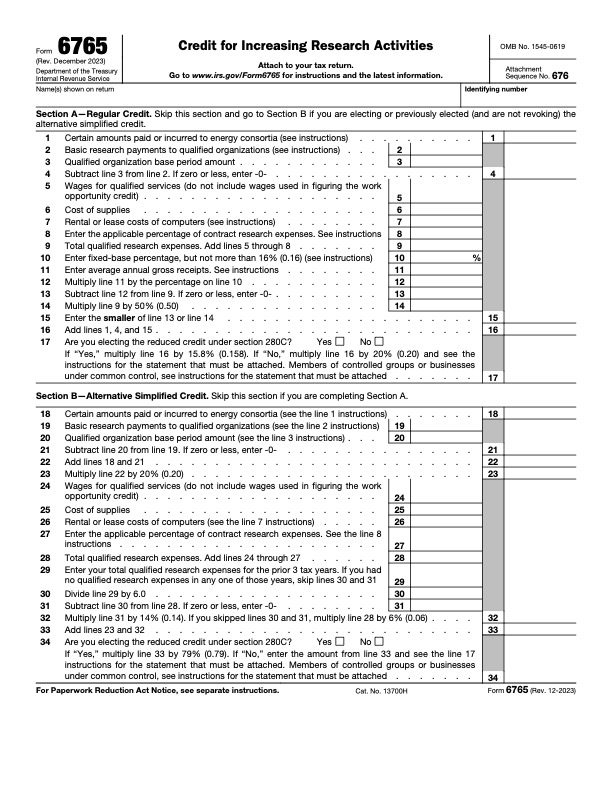

How to Calculate and Document Expenses

Calculating the Credit

- Identify Qualifying Research Expenses (QREs): These include wages, supplies, and costs related to contractors working on R&D.

- Apply the Appropriate Formula: Businesses can typically claim a percentage of their QREs against their federal taxes. The percentage and method of calculation can vary by jurisdiction and company size.

Documentation

- Detailed Records: Maintain comprehensive records, including project descriptions, objectives, methodologies, results, and expenses.

- Time Tracking: Keep accurate records of the time spent by employees on R&D activities, as this supports wage claims.

Example Form: Time Tracking Sheet

A standardized time tracking sheet can help businesses log hours spent on R&D activities by different team members, which is crucial for accurate expense claims.

Examples of Qualifying R&D Activities

Different industries engage in various R&D activities that can qualify for tax credits. Here are some industry-specific examples:

- Life Sciences: Developing new pharmaceuticals, conducting clinical trials, creating medical devices.

- Technology: Developing new software solutions, creating algorithms, improving cybersecurity measures.

- Manufacturing: Innovating production processes, designing new materials, developing prototypes.

- Agriculture: Advancing sustainable farming techniques, developing genetically modified crops.

Case Study: Manufacturing Innovation

A hypothetical case study detailing a small manufacturing company’s development of a new, more efficient production process and how they successfully claimed R&D tax credits.

Common Mistakes and How to Avoid Them

While R&D tax credits offer significant benefits, businesses can face challenges such as:

- Incomplete Documentation: Ensure all R&D activities and expenses are meticulously documented to substantiate claims.

- Misclassification of Expenses: Verify that all claimed expenses are eligible under current tax regulations.

- Missed Deadlines: Be mindful of deadlines for submitting forms like Form 6765 to avoid penalties.

Leveraging R&D Tax Credits for Business Growth

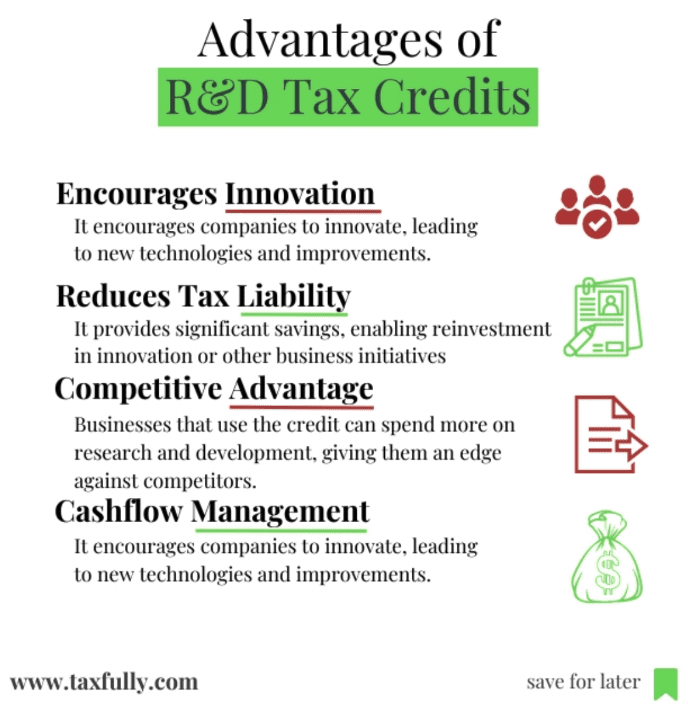

R&D tax credits can provide a vital boost to businesses by:

- Improving Cash Flow: Reduced tax liabilities or refunds can be reinvested into the business.

- Encouraging Innovation: Financial savings can fund further R&D projects, fostering a culture of innovation.

- Creating a Competitive Edge: Companies that innovate can enhance their market position and stand out from competitors.

Practical Tip: Reinvest Savings in R&D

Encourage businesses to reinvest the savings from tax credits into new R&D projects, which can perpetuate a cycle of innovation and growth.

Conclusion and Additional Resources

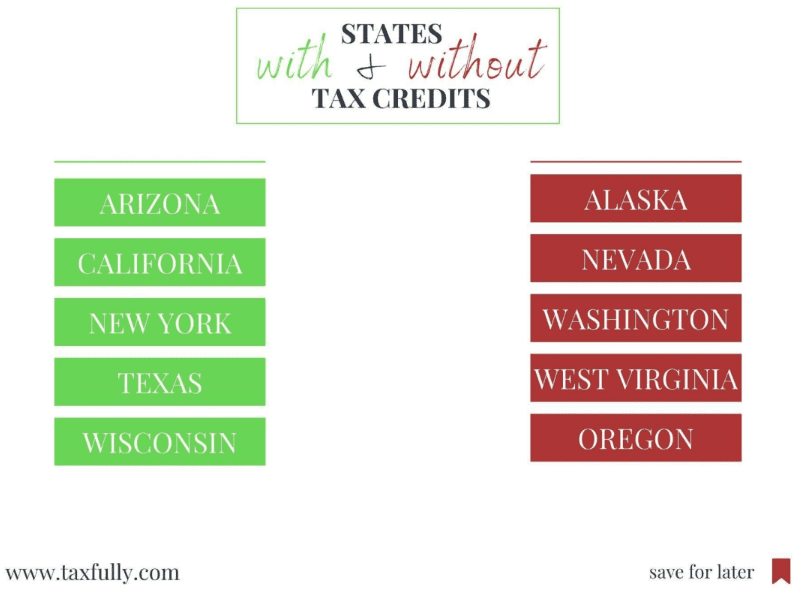

Maximizing R&D tax credits can be a strategic advantage for businesses, driving innovation and growth. For further assistance, consider consulting tax professionals or referring to official resources such as the IRS or state tax agencies.

You may also want to review IRS Form 6765, which is essential for claiming R&D tax credits. If you need assistance with completing the form or maximizing your credits, feel free to contact us for expert guidance.

You may also like to read:

The Power of R&D Credits: A Closer Look

Research and Development (R&D) credits are not just incentives; they’re powerful tools that can significantly impact a…

Read More