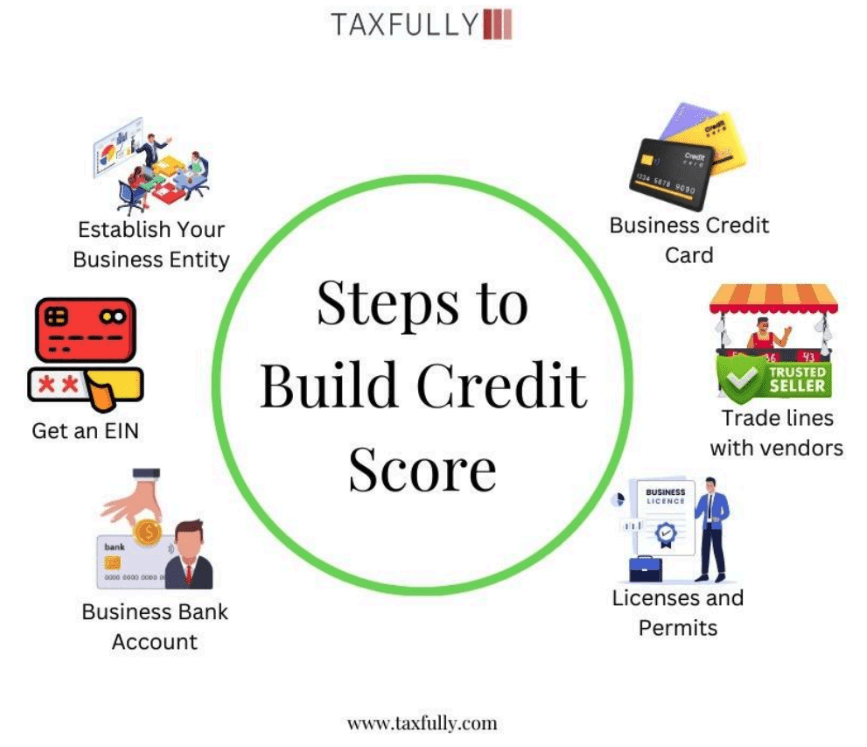

Building a good credit score for your LLC is essential to growing your business, securing financing, and building trust with vendors. A strong business credit score can help your business access favorable loan terms, higher credit limits, and better opportunities for growth. Whether you’re just starting or looking to improve your business credit, this guide will walk you through each step to help you build a solid financial foundation.

Step 1: Establish Your Business Entity

The first step in building business credit is separating your business from personal finances. To do this, you’ll need to form an official business entity, such as an LLC (Limited Liability Company), which separates your personal assets from your business. This step provides legal protection and allows you to begin building your credit history.

Step 2: Get an EIN

An Employer Identification Number (EIN) is like a Social Security number for your business.You’ll need it to open a business bank account and apply for business credit. It’s easy to obtain through the IRS website and ensures that your business is recognized as a legal entity for tax purposes.

Step 3: Apply for Licenses and Permits

Every business needs the proper licenses and permits to operate legally. These vary depending on your industry and location. It’s crucial to maintain current licenses to avoid penalties and demonstrate that your business operates responsibly.

Step 4: Open a Business Bank Account

To keep your personal and business finances separate, open a dedicated business bank account. This helps maintain financial organization and makes it easier to track your business expenses and income. A business bank account is also essential for establishing your credit history.

Step 5: Build Relationships with Vendors and Suppliers

One of the easiest ways to start building business credit is by establishing trade lines with vendors and suppliers. Many suppliers allow you to order goods on credit, paying after delivery. Consistently paying your vendors on time will help build a positive credit history for your business.

You may also like to read:

Maximizing R&D Tax Credits for Small Businesses Across Industries

Maximizing R&D tax credits can provide substantial benefits for businesses investing in innovation. These government…

Read More

Step 6: Apply for a D-U-N-S Number

A D-U-N-S Number from Dun & Bradstreet helps establish your business credit profile. This nine-digit identifier connects your business with one of the major credit reporting agencies, making it easier for lenders to check your business credit score. Regularly monitoring your credit profile ensures that any errors are quickly addressed.

Step 7: Get a Business Credit Card

A business credit card allows you to separate your business expenses from personal ones while helping you build credit. Make sure the card reports your payments to business credit reporting agencies. Always use the card responsibly by keeping your balance low and making payments on time.

Step 8: Apply for a Line of Credit

Similar to a credit card, a business line of credit provides flexibility for managing cash flow. Use the line of credit for business expenses that require cash rather than card payments. Keeping your credit utilization low and making regular payments will further improve your credit score.

Step 9: Make Timely Payments

Timely payments are the cornerstone of building strong business credit. Paying bills on time—or even early—shows that you are responsible and reliable. Late payments can harm your credit score and may affect your future ability to secure favorable terms on loans or credit lines.

How Taxfully Can Help:

At Taxfully, we understand that managing finances and building business credit can feel overwhelming. That’s why we’re here to support you every step of the way. Here’s how we can help:

- Expert Guidance: Our team of financial experts can guide you through the process of building your business credit, ensuring you take the right steps to establish and grow your credit score.

- Financial Planning: We help you create a financial plan that works for your business, from selecting the right credit products to managing your cash flow effectively.

- Tax Compliance: Taxfully ensures your business stays compliant with tax regulations, avoiding penalties that could harm your credit score.

- Penalty Abatement: If you’re facing penalties for late filings or missed payments, we can help you request penalty abatement, potentially reducing or eliminating those penalties.

- IRS Representation: If you’re dealing with issues like audits or unpaid taxes, we can represent you and work directly with the IRS to resolve these matters efficiently.

With Taxfully by your side, you’ll have the tools and expertise needed to build and maintain a strong business credit score while keeping your finances in order.

Conclusion:

Building good business credit takes time and dedication, but it’s worth the effort. By following these steps, your LLC can secure better financial opportunities, attract reliable partners, and grow without being limited by a lack of credit. Remember, your business credit score is crucial in helping your company thrive, so make it a priority.