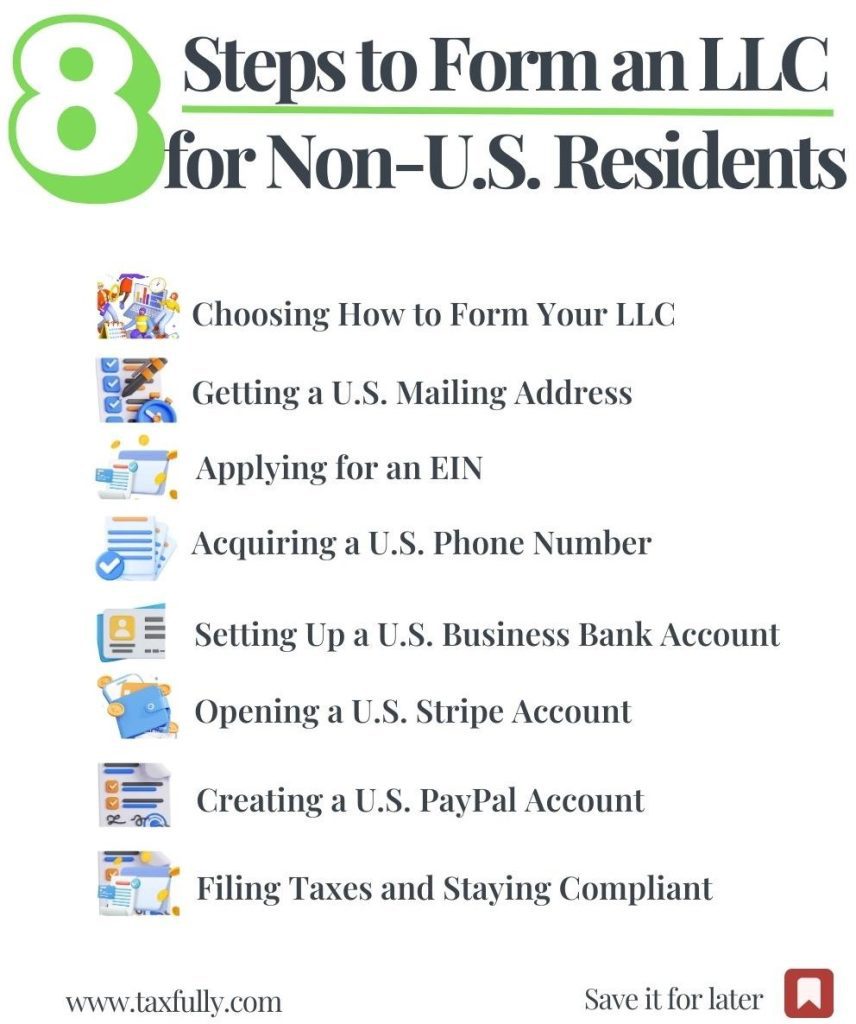

Step-by-Step Guide to Forming an LLC for Non-U.S. Residents

1. Choosing How to Form Your LLC

- You can use a comprehensive service that handles everything from LLC formation to tax filings, or file independently by registering online with the state, ensuring you have a registered agent and verify your LLC name’s availability.

- Getting a S. Mailing Address Services offer physical mailing addresses for remote operations.

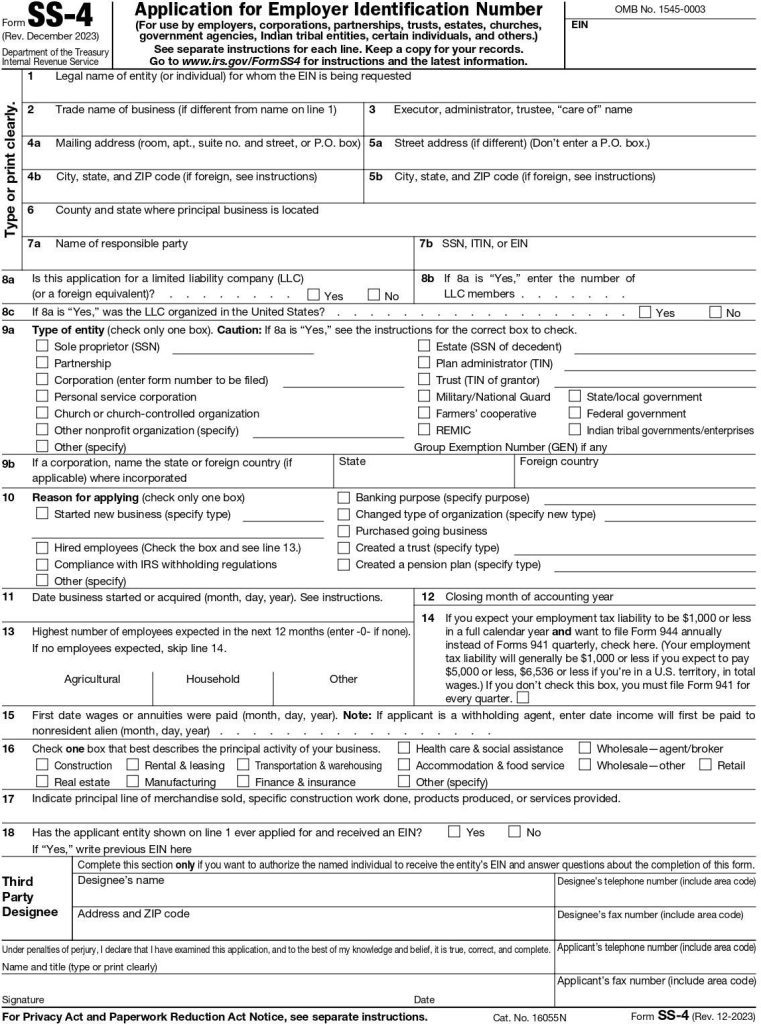

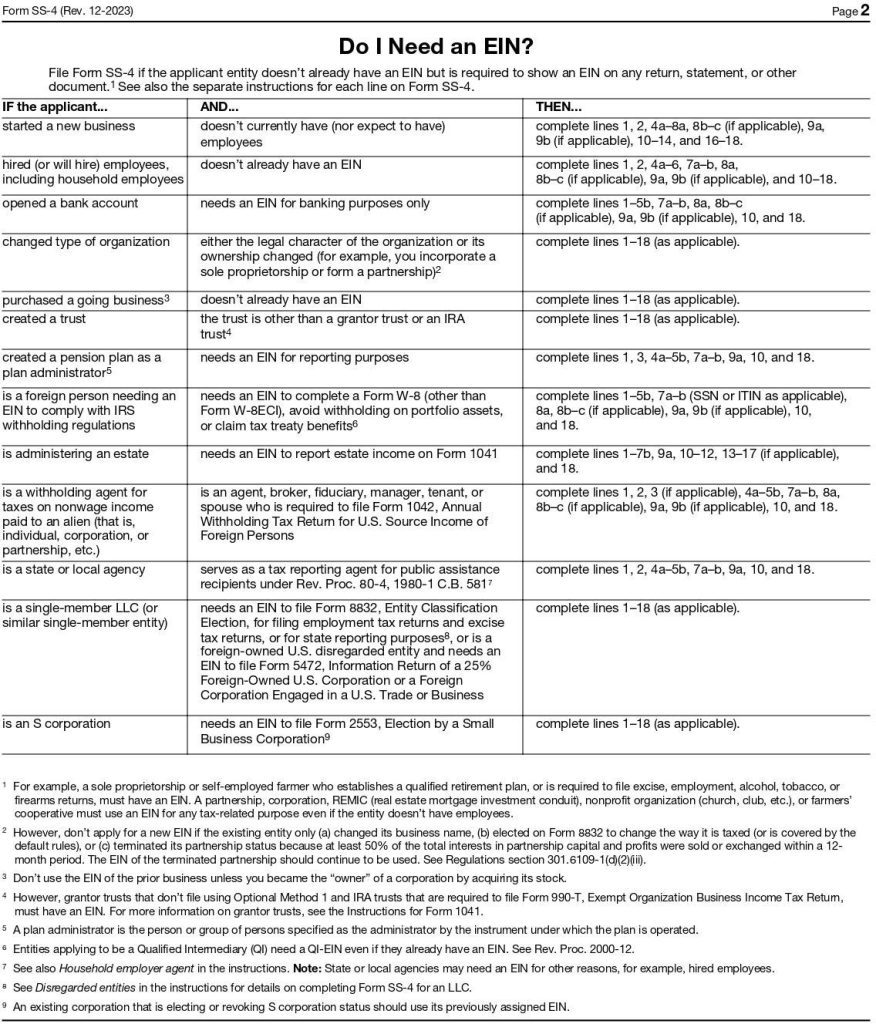

- Applying for an EIN

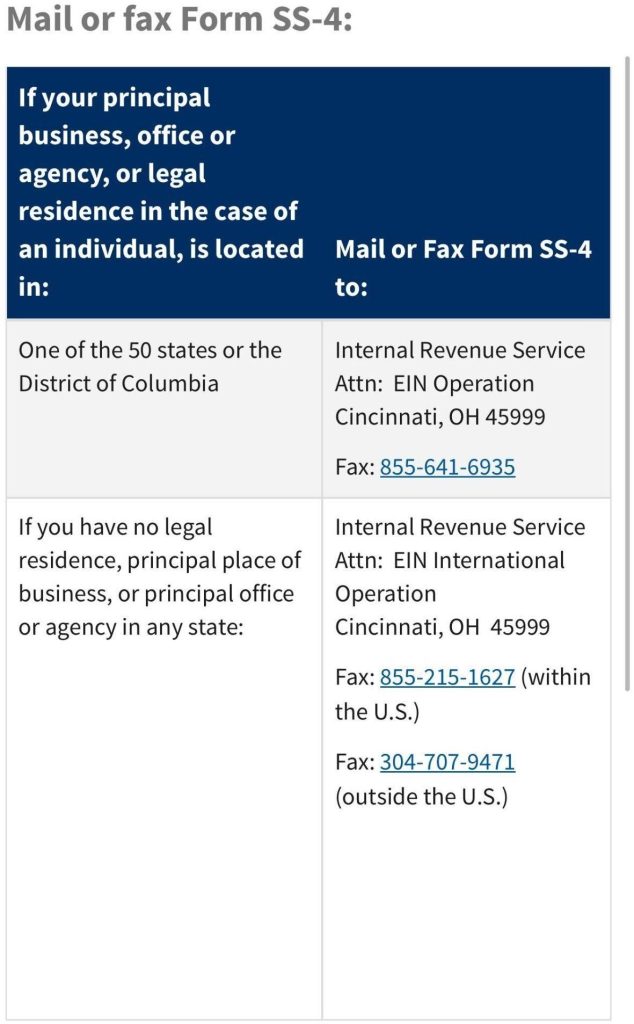

- If you have an SSN or ITIN, you can apply for your EIN online and get it within minutes. If you don’t have an SSN or ITIN, you’ll need to submit Form SS-4 by fax or mail, which can take 8-11 weeks for processing.

- Acquiring a S. Phone Number A U.S. phone number is necessary for bank accounts, payment processors like Stripe, and other business verifications. Many providers offer suitable options online.

- Setting Up a S. Business Bank Account Some banks support non-U.S. residents without a U.S. SSN. Other banks have varying requirements.

- Opening a S. Stripe Account Requirements include:

- An LLC

- An EIN

- A S. address

- A S. phone number

- A government ID

- Creating a S. PayPal Account You’ll need:

- An LLC

- A company phone number

- A company address

- An EIN

- An SSN or ITIN

- Filing Taxes and Staying Compliant Foreign single-member LLCs that aren’t doing business in the US usually don’t file personal income taxes but must report corporate details. Multi-member LLCs file partnership returns, with specific deadlines and forms

Annual Report Filing

LLCs must submit annual reports and pay fees, such as Wyoming’s $62 annual fee and Delaware’s $300 annual franchise tax. Guides for submitting these filings are available for each state.Obtaining an EIN for a Foreign-Owned U.S. Entity

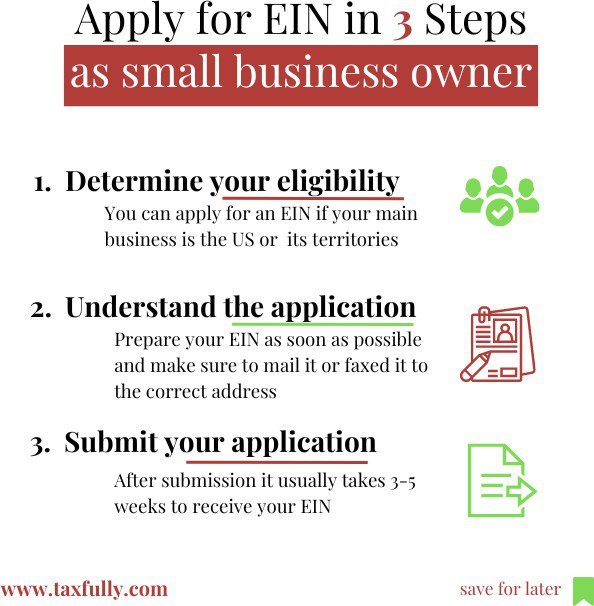

Before applying for an EIN, your business must be officially formed. The IRS requires details like your business formation date and legal business name.

What is an EIN?

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number issued by the IRS to identify a business entity for tax purposes. It functions similarly to a Social Security Number for individuals.

Why Foreign Investors Need an EIN

Foreign investors must obtain an EIN if they:

- Form a corporation or an entity taxed as a

- Operate a business entity that hires

- Merge with or acquire a S. business

Key Uses of an EIN

- Tax Purposes: The EIN is used for all tax-related interactions with the

- Bank Accounts: An EIN is necessary to open a S. business bank account.

- Payroll and Benefits: Establishing payroll and applying for health benefits require an

Without an EIN, your U.S. business operations can face significant delays, affecting your market entry and operational efficiency.

Filing Requirements and Penalties

Even minimal reportable transactions require filing Form 5472. Failure to file or maintain records can result in severe penalties, starting at $25,000 per LLC, with additional penalties if the

non-compliance continues. Criminal penalties may also apply.

New Compliance Update

As of January 1, 2024, the Financial Crimes Enforcement Network (FinCEN) requires beneficial ownership information reporting under the Corporate Transparency Act (CTA). This aims to enhance corporate transparency and combat illicit financial activities. All U.S.-registered entities must comply with these new standards

Necessary Forms and Procedures

- EIN: Foreign-owned SMLLCs must apply for an EIN using Form SS4, signed by a Responsible Party.

- Form 5472: Must be filed for any reportable transactions, including formation and

- Pro forma Form 1120: Also required to accompany Form

- Record Maintenance: Adequate records must be kept to support the

Seeking Assistance

For those needing assistance, professional services such as CPAs can help manage the compliance and filing process to avoid significant penalties.

FAQs on Foreign-Owned U.S. LLCs

Can Foreign Entities Own U.S. LLCs? Yes, foreign individuals and corporations can own U.S. LLCs without needing to be U.S. citizens or green card holders. The process is the same for both foreign and U.S. owners, except for S-Corporations, which restrict foreign ownership.

Do Foreign-Owned LLCs Have to Pay Taxes? It depends on the type of income your LLC earns. Any income that comes from business activities in the United States must be reported on a tax return.

Which Tax Return Should You Use? For a single memebr LLC report income on form 1120 Proforma and add form 5472 to the filing to avid penalties

For Multi LLC prepare form 1065 and make sure to add forms 8804 and 8805 and mail them to the IRS separately to avoid penalties, you may be required to file 1040NR as well to report sch K-1