Introduction

The push for sustainable living has brought a variety of financial incentives, including EV and Home Energy Tax Credits, to the forefront. These credits are designed to encourage eco-friendly decisions, making it easier and more affordable to adopt sustainable practices. Whether you’re considering an electric vehicle (EV) or upgrading your home with energy-efficient systems, this guide will help you understand these valuable tax benefits and maximize your savings.

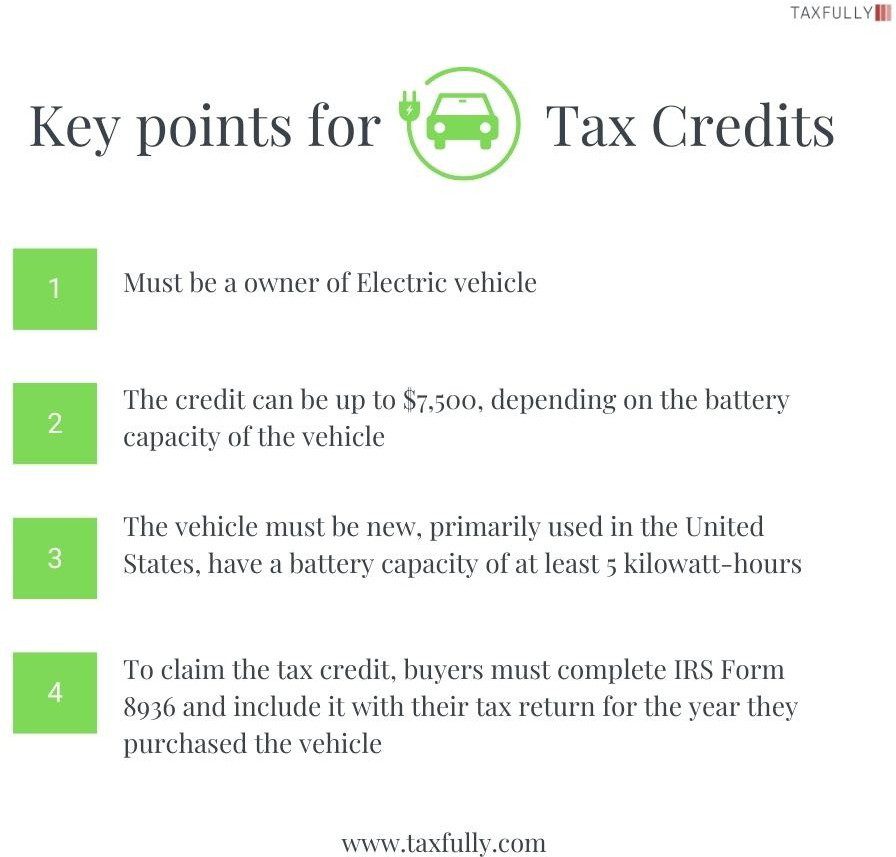

Electric Vehicle Tax Credits

What is the Electric Vehicle Tax Credit?

The federal government provides a tax credit for consumers who purchase qualifying electric vehicles (EVs). This credit reduces your tax liability, making EVs more affordable.How Much Can You Save?

The credit amount can be up to $7,500, depending on the battery capacity of the vehicle. The exact amount varies based on the make and model of the EV.Eligibility Requirements:

✍ The vehicle must be new and primarily used in the United✍ The vehicle must have a battery capacity of at least 5 kilowatt

✍The manufacturer must not have sold more than 200,000 qualifying vehicles (phase-out rules apply).

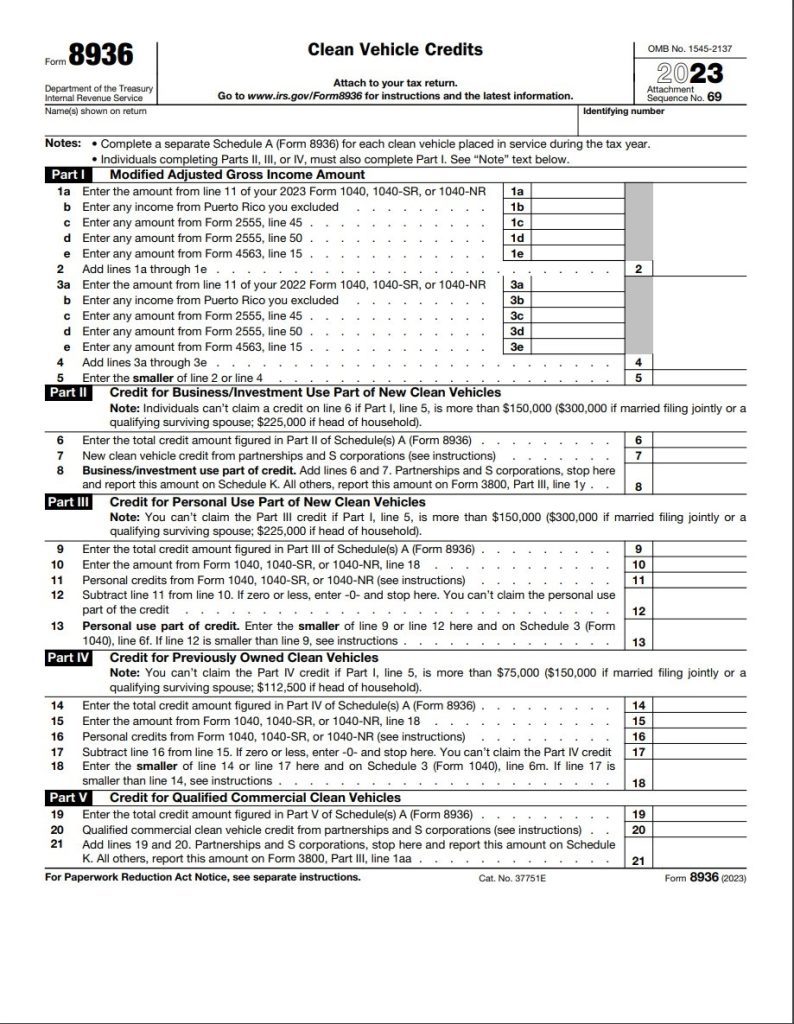

How to Claim the Credit:

⏩ Complete IRS Form 8936 (Qualified Plug-in Electric Drive Motor Vehicle Credit).⏩ Include the form with your tax return for the year in which you purchased the vehicle.

Example Scenario: If you purchase a new electric vehicle with a battery capacity of 8 kilowatt-hours, you may be eligible for the full $7,500 tax credit, significantly reducing your overall tax bill.

State Incentives: Many states offer additional incentives for purchasing electric vehicles. Check with your state’s Department of Motor Vehicles or energy office for details.

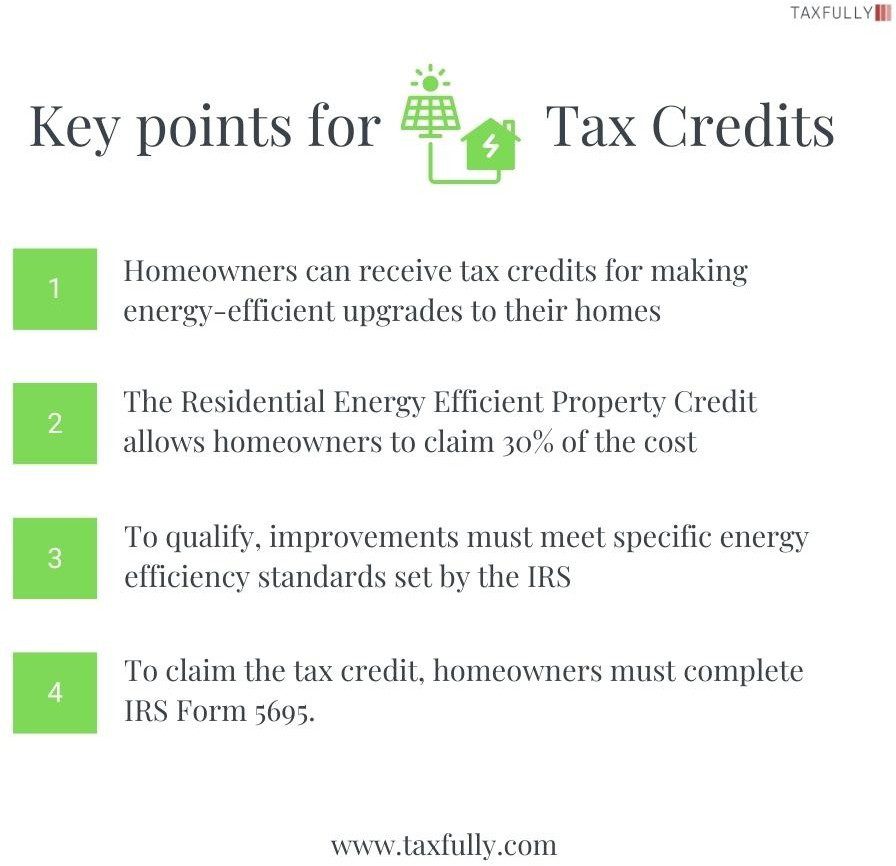

Home Energy Efficiency Tax Credits

What are Home Energy Efficiency Tax Credits?

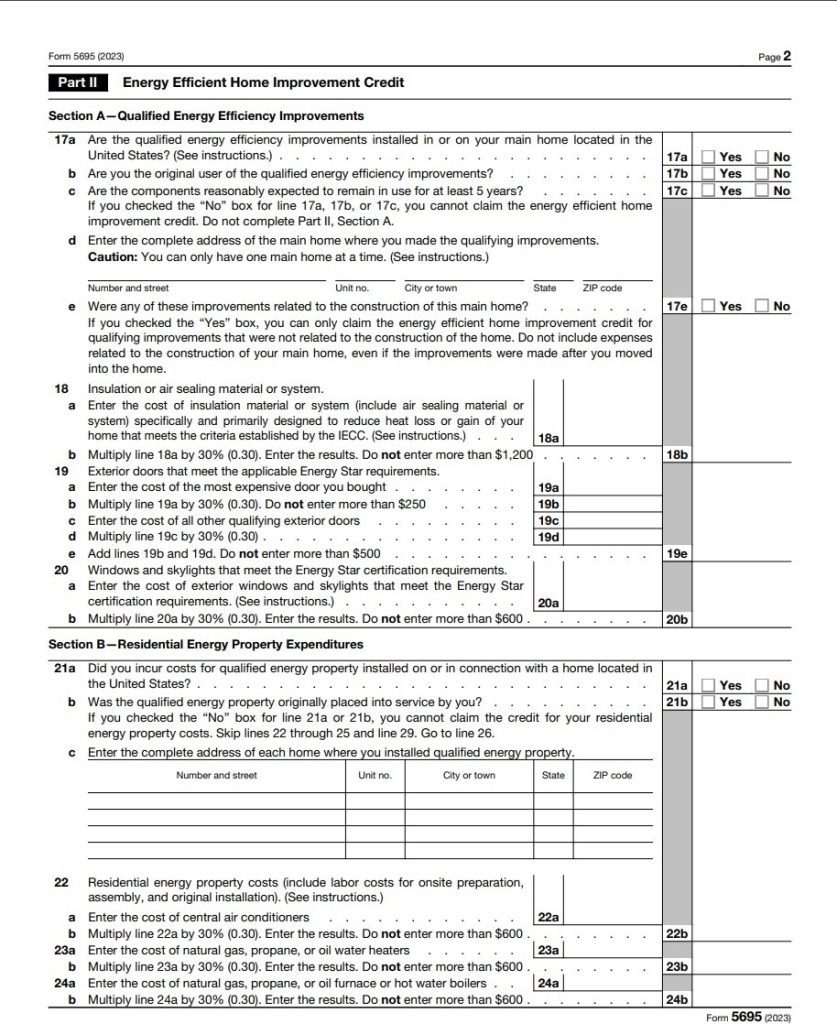

The federal government offers tax credits for homeowners who make energy-efficient upgrades. These credits apply to various improvements, including energy-efficient appliances, windows, doors, and insulation.Eligible Improvements:

- Energy-efficient windows and doors

- Insulation materials and systems

- High-efficiency heating and cooling systems

- Solar panels and water heaters

- Geothermal heat pumps

How Much Can You Save?

The Residential Energy Efficient Property Credit offers a credit of 30% of the cost of qualified improvements. There are no upper limits for solar, wind, and geothermal systems, while other improvements have specific caps.Eligibility Requirements:

- The improvements must meet specific energy efficiency criteria set by the

- The property must be your principal residence or a second home, excluding rental

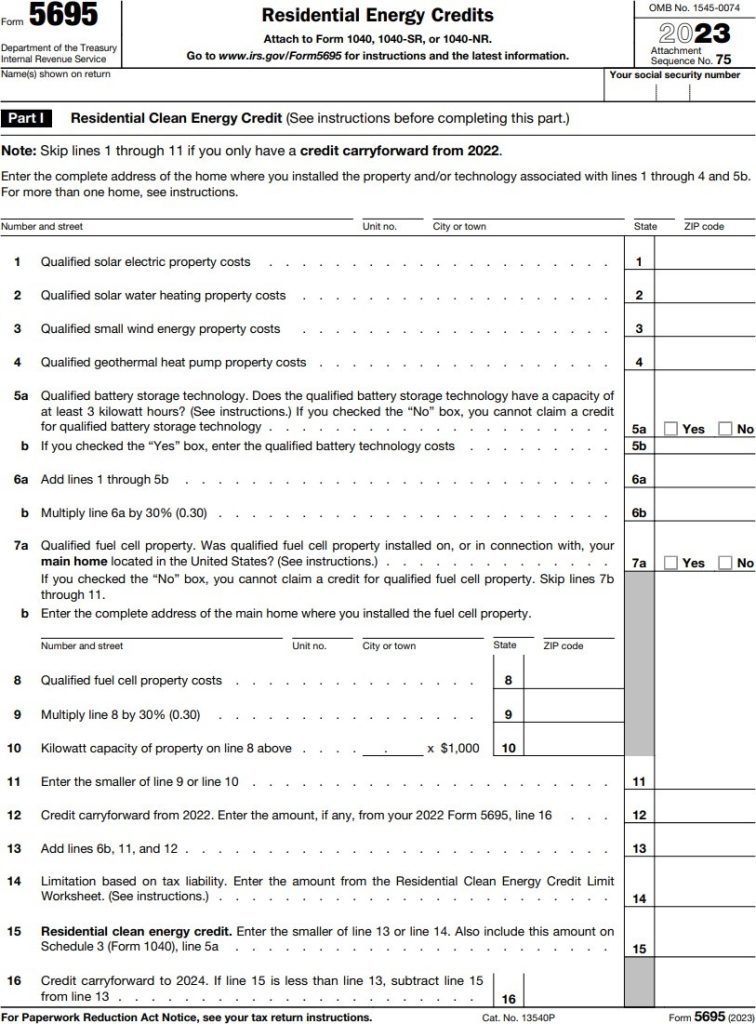

How to Claim the Credit:

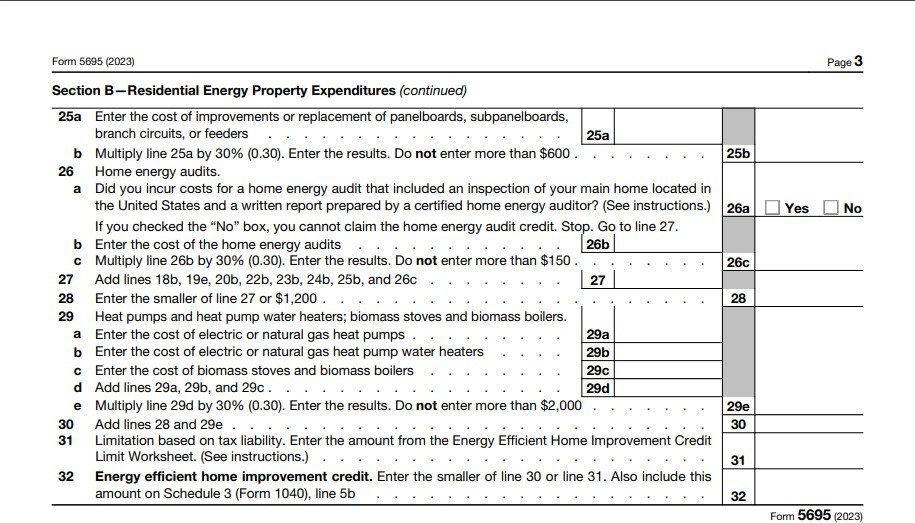

- Complete IRS Form 5695 (Residential Energy Credits).

- Include the form with your tax return for the year in which the improvements were

Example Scenarios:

- Solar Panels Installation: If you install solar panels costing $20,000, you could claim a tax credit of $6,000 (30% of the cost).

- Heat Pump Installation: If you install a new heat pump costing $10,000, you could claim a tax credit of $3,000 (30% of the cost).

Strategies to Maximize Your Federal Tax Savings

👉 Combining Credits: You can combine the Electric Vehicle Tax Credit and Home Energy Efficiency Tax Credits to increase your overall savings.

Conclusion

Taking advantage of federal tax credits for electric vehicles and energy-efficient home improvements can lead to substantial savings. By understanding the available incentives and planning your investments wisely, you can significantly reduce your tax liability while contributing to a more sustainable future.

You may also like to read:

What is the IRS mileage rate for 2024

This year, the IRS raised the mileage rate for 2024 to 67 cents per mile, which is 1.5 cents more than the previous year’s rate of 65.5 cents per mile. These rates apply to different types of cars, like electric, hybrid-electric, gasoline,…

Read More