Operating an LLC comes with numerous responsibilities, and staying compliant with the latest regulations is essential to avoid hefty fines. The new BOI filing for LLCs requirement is one such regulation that LLC owners need to be aware of. Starting January 1, 2024, this mandate requires certain businesses to report their beneficial owners to FinCEN (Financial Crimes Enforcement Network), a division of the U.S. Treasury. This guide will help you navigate BOI filing for LLCs, the submission process, and how to prevent penalties.

What is BOI and Why It Matters

BOI stands for Beneficial Ownership Information, a regulation under the Corporate Transparency Act (CTA) that requires businesses to report information about their beneficial owners. Beneficial owners are individuals who directly or indirectly own or control 25% or more of the company. The purpose of BOI reporting is to combat financial crimes, including money

laundering and tax evasion, by increasing transparency in business ownership. This means businesses can no longer operate anonymously, which helps protect the integrity of the U.S. financial system.

Who Must File a BOI Report?

To comply with the BOI regulations, businesses must report details about their beneficial owners to FinCEN. The key elements required in the report include:

- Full legal name of each beneficial owner.

- Date of birth.

- Current residential or business address.

- Unique identifying number from an acceptable document, such as a driver’s license or passport.

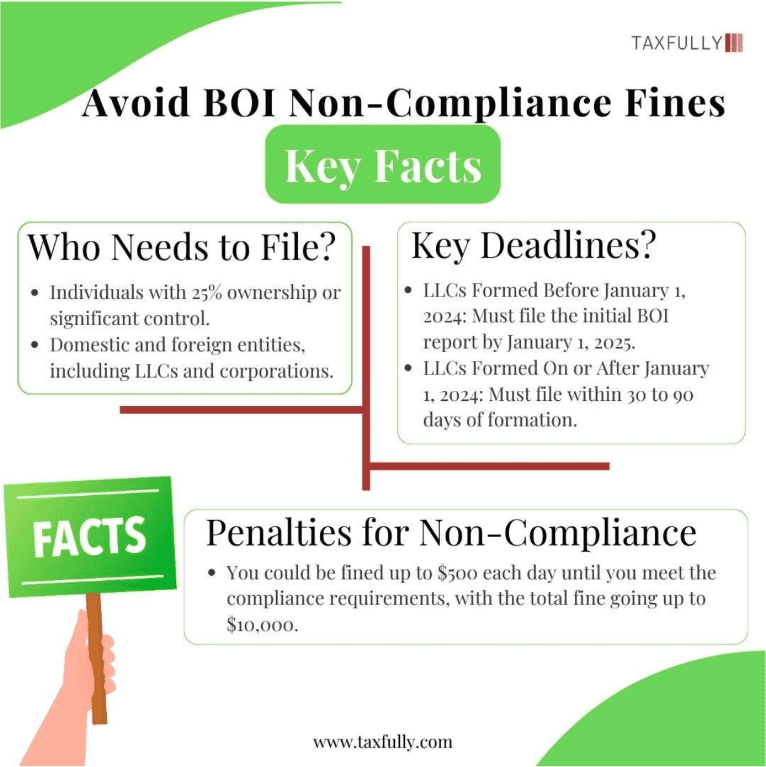

Two types of reporting companies are subject to BOI requirements:

- Domestic Reporting Companies: These are entities formed within the U.S., such as LLCs, corporations, and similar entities created by filing documents with state offices.

- Foreign Reporting Companies: Entities formed under the law of a foreign country but registered to do business in the U.S.

Exemptions to BOI Filing

While many businesses must comply, some are exempt from BOI reporting. Exempt entities include:

- Sole Proprietorships and General Partnerships: These businesses are not required to report BOI as they do not create entities through state filings.

- Large Operating Companies: Entities with more than 20 full-time employees in the U.S., over $5 million in gross revenue, and a physical office in the U.S. are exempt.

- Heavily Regulated Entities: Banks, insurance companies, publicly traded companies, and other businesses already subject to stringent reporting regulations do not have to file BOI reports.

Filing Deadlines and Penalties

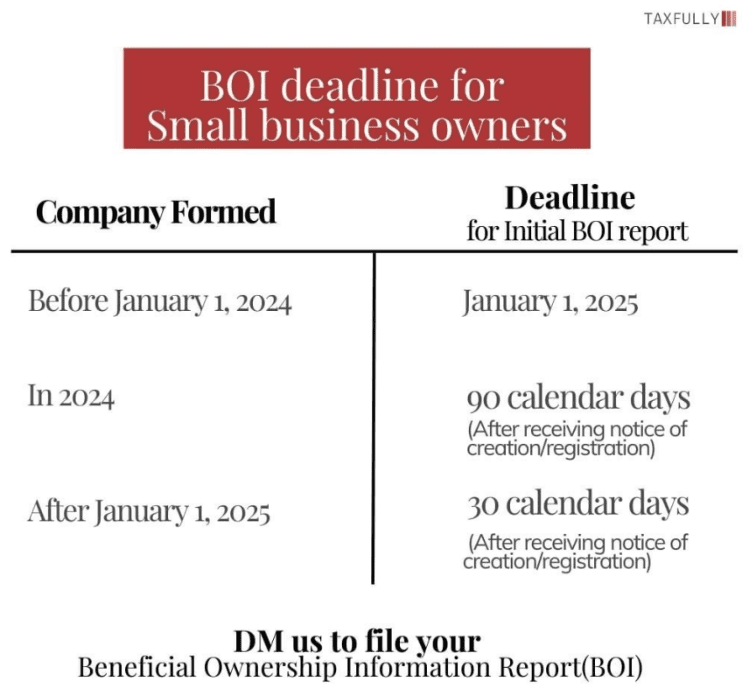

To avoid penalties, understanding the BOI filing deadlines is crucial:

- LLCs Formed Before January 1, 2024: Must submit their initial BOI report by January 1, 2025.

- LLCs Formed On or After January 1, 2024: Must submit the BOI report within 30 to 90 days of formation.

- Ongoing Reporting Requirements: Any changes in beneficial ownership must be reported within 30 days to ensure FinCEN records are up-to-date.

Penalties for failing to file or providing false information include:

- Civil Penalties: Up to $500 per day until compliance is met, with a maximum of $10,000.

- Criminal Penalties: Willful violations can lead to fines up to $10,000 and imprisonment for up to two years.

Tax Deduction Points

Although BOI compliance is not directly tied to the tax code, businesses can potentially deduct expenses related to compliance efforts, such as:

- Legal and Consulting Fees: Costs incurred to ensure correct BOI reporting may be deductible as ordinary and necessary business expenses.

- Administrative Costs: Fees for gathering required information and maintaining accurate records can also be claimed during tax filing.

You may also like to read:

New BOI rules for Business Owners

New BOI rules for Business Owners

Starting January 1, 2024, the latest Beneficial Ownership Informatio…

Read More

Step-by-Step Guide to Filing Your BOI Report

- Gather All Required Information: Ensure you have all the details for your company and its beneficial owners, including names, addresses, and identification numbers.

- Create a FinCEN Account: Access the BOI Reporting Portal through the FinCEN website and set up an account to submit your report.

- Submit Your BOI Report: Complete the report accurately and submit it electronically through the portal. Keep a confirmation of the filing for your records.

- Stay Updated: Monitor for any changes in beneficial ownership and report updates within the required 30-day window.

Conclusion

and timely.