Running a photography business involves various expenses. The IRS offers tax deductions that can help reduce your taxable income, saving you money. Here’s a simple guide to help you understand key deductions for your photography business.

Common Deductions for Photographers

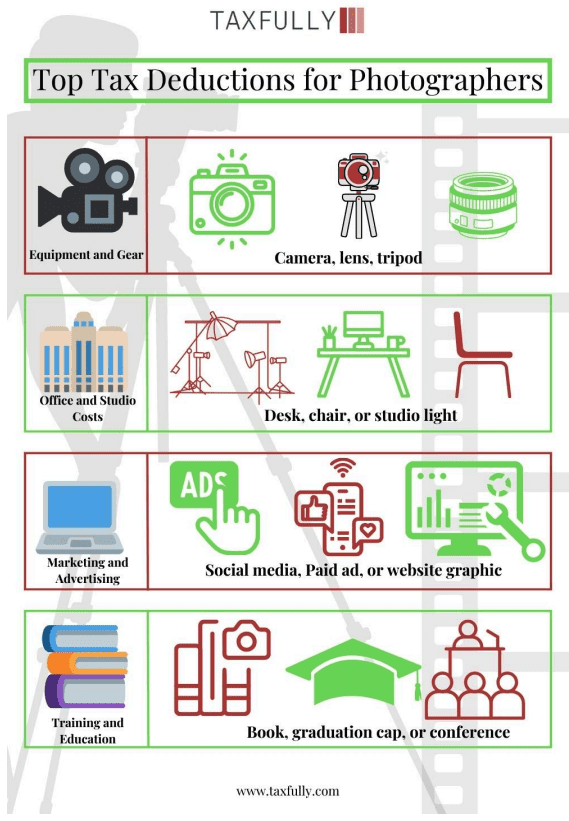

1. Equipment and Gear

- Cameras, lenses, lights, and other equipment are essential tools and are tax-deductible.

- If your equipment is used for more than a year, you can use “depreciation” or a one-time deduction called “Section 179.”

2. Office and Studio Costs

- If you rent a studio, you can deduct rent, utilities, and maintenance costs.

- Working from home? Deduct a percentage of your home expenses (like internet, utilities, and mortgage interest) based on the space used for business.

3. Travel Expenses

- If you drive to photo shoots, you can deduct mileage, tolls, gas, and car maintenance.

- For out-of-town shoots or conferences, airfare, hotels, and 50% of meal costs are deductible if they’re directly related to your work.

You may also like to read:

New BOI update for Small business owners

Failing to report or update BOI may result in significant penalties, starting from $500 per day up to $10,000….

Read More

Additional Deductible Expenses

4. Insurance

- Business insurance to protect your equipment and liability is deductible.

5. Marketing and Advertising

- Expenses for business cards, online ads, and website costs can be written off as business expenses.

6. Training and Education

- Courses, seminars, and workshops that improve your skills are deductible.

- You can also deduct travel costs associated with training.

7. Professional Fees

- Fees for accountants, legal services, and membership dues for photography organizations are deductible.

8. Keeping Track

- Keep all receipts and document each expense.

- Consider using expense-tracking software to make tax season easier.

Conclusion

Tax deductions are a powerful tool to help photographers manage business expenses and lower tax bills. By keeping track of your expenses year-round, you can maximize the benefits available and put more of your earnings back into growing your business. Remember to consult a tax professional for personalized advice that fits your unique situation. With careful planning and organization, you can make tax season a smoother experience, letting you focus on what you love—capturing moments through your lens.