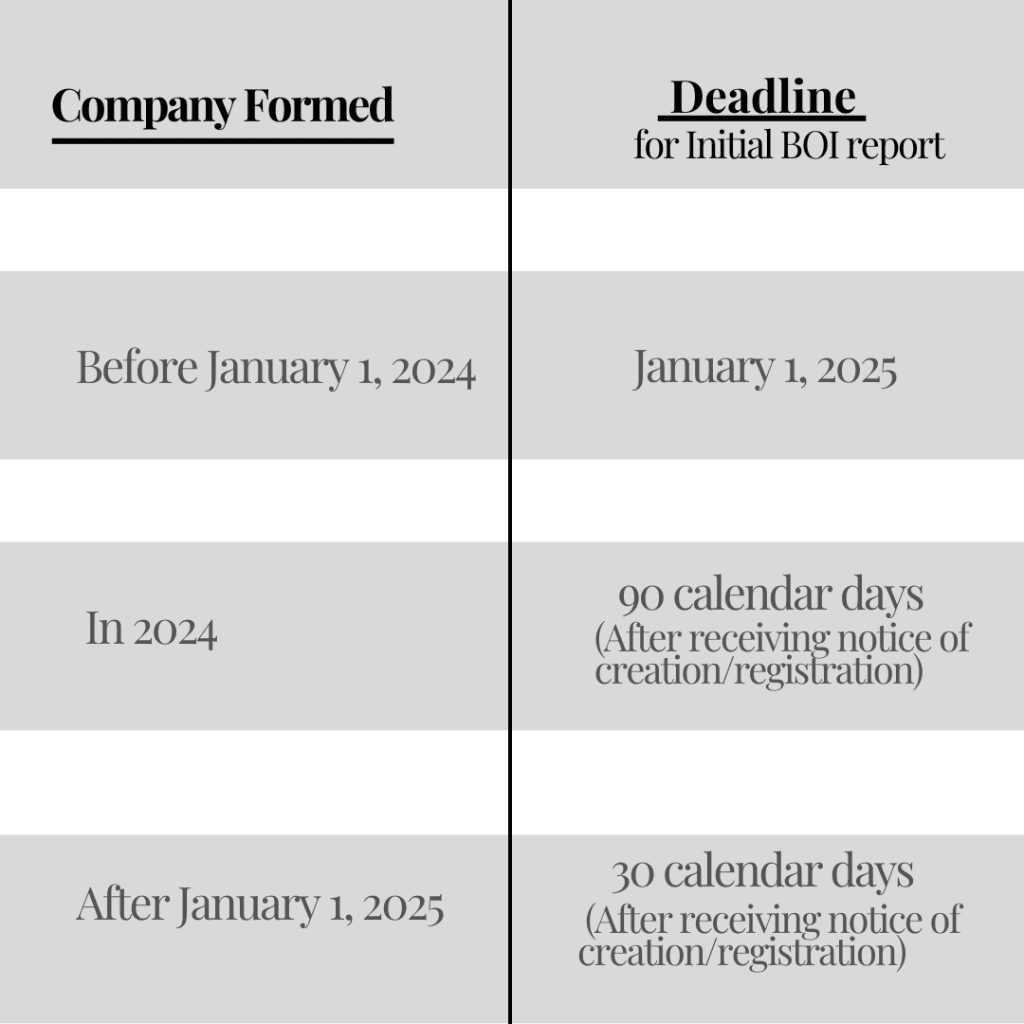

Deadline for BOI Report

Who needs to file a BOI report?

BOI reports require most newly formed or registered companies in the US to report their beneficial owners to FinCEN. Focusing on smaller companies, which are especially at risk of being used as shell companies.

There is an exemption for 23 categories of entities that are NOT required to report BOI.

Check your Eligibility now

Reporting companies

Take a Look what our clients have to share

Excellent experience! From obtaining our USDOT to finalizing the last compliance document, they even suggested truck options for our operations. Our books are organized, the LLC is compliant, and the S corp election is in place.

Highly recommended

DOUZ TRUCKING LLC

CEO

Taxfully has been a game-changer for my NY based gym! Taxfully takes care of our tax filing every year and helps us plan for the year after. I highly recommend going to them if you're a first timer or just want better faster results.

Glory Martial Arts Center

CEO

Taxfully totally had my back – they set up my LLC, sorted my EIN, got the S Corp paperwork filed. Now we are all set with our business and tax compliant. Thanks

Kabbani Tailor LLC

CEO

Taxfully handled our business tax returns and bookkeeping, also took care of our S corp election, and clearly explained its benefits. We're satisfied with the quality and communication. Highly recommended!

ZAK TECH LLC

CEO

To file your BOI with us

Featured In

Contact us today to schedule

your free initial consultation

To ensure that the tax process is seamless we offer tax consultation services that help our clients make informed decisions about their taxes.

Contact Details

- Phone: 212-287-9529

- Email: [email protected]

- Fax: 646-859-1029

-

800 Third Avenue

New York, NY 10022

United States