No matter how much you love driving a truck, tax season can be stressful. But don’t worry, you can save money with tax deductions for truck drivers. This guide is designed to help you understand two key tax strategies that can significantly reduce your tax bill: Section 179 and Per Diem Rates. By utilizing these strategies, you could potentially save an average of $15,300 on your taxes.

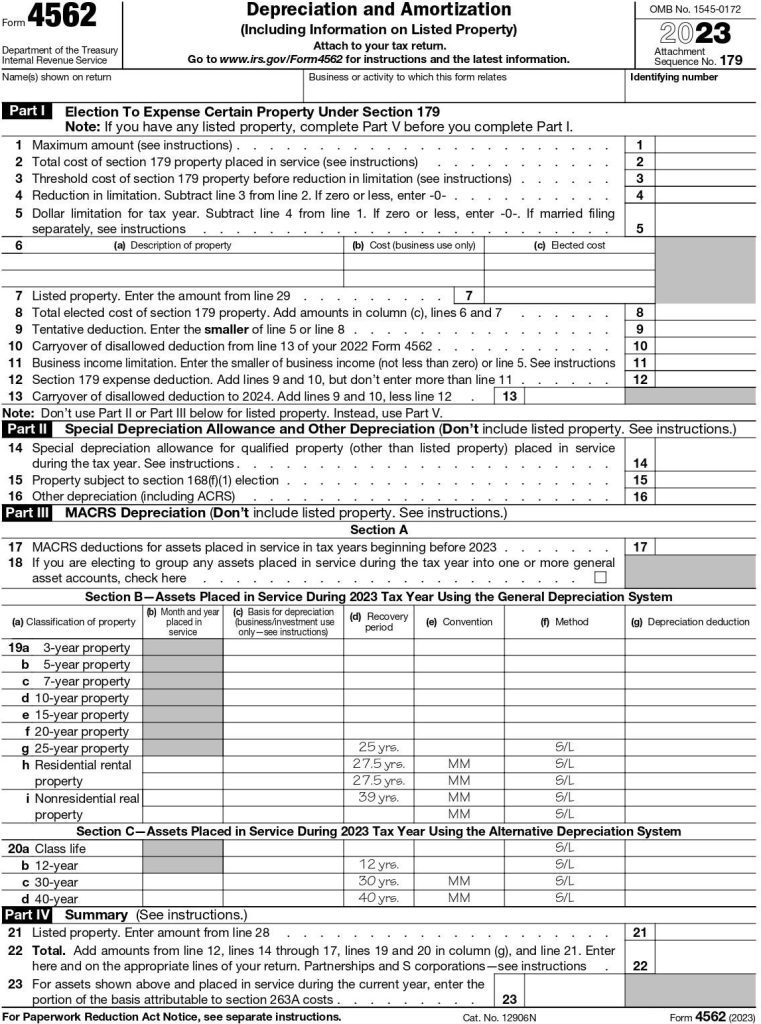

What is Section 179?

Section 179 offers big tax savings for businesses when they buy vehicles. Sometimes called the “Hummer tax loophole,” it lets businesses deduct the cost of certain vehicles.

Understanding Business Vehicle Deductions

Which Vehicles Qualify?

Full Deduction Vehicles:

✅ Shuttle vans seating more than nine passengers✅ Classic cargo vans with no rear seats

✅ Over-the-road tractor trailers

✅ Vehicles used only for business, like ambulances and hearses

Partial Deduction Vehicles:

✅ Trucks and SUVs over 6,000 lbs. GVWR (Gross Vehicle Weight Rating) if used more than 50% for business✅ Pickup trucks with an 8-foot cargo bed

✅ Heavy SUVs, with a deduction cap of $30,500 for 2024

Important Things to Know

✅ The vehicle can be new or used (“new to you”).✅ It must be acquired through an arm’s-length transaction.

✅ The vehicle should be titled in the company’s name.

✅ It must be used for business at least 50% of the time.

✅ The deduction is claimed in the tax year the vehicle is placed in service.

Facts About Section 179 Deductions You Need to Know

✅ Section 179 allows businesses to deduct the full purchase cost of qualifying vehicles bought or leased during the tax year.✅ Qualifying vehicles include shuttle vans, enclosed cargo vans, and heavy vehicles over 6,000 lbs. GVWR.

✅ Both new and used vehicles qualify, and deductions can be claimed in the year the vehicle is placed in service.

✅ Leased vehicles used at least 50% for business also qualify.

✅ Mixed-use vehicles must be used at least 50% for business, and the deduction is based on the business use percentage.

✅ The vehicle should be used for business at least 50% of the time over its class life (typically 5 years), or some of the deduction might need to be recaptured.

Per diem

Carriers aren’t required to offer per diem to company drivers, but many do with certain conditions.

2024 per diem rates

Calculating your per diem

This is a rather cut-and-dry process that’s relatively simple, but does require absolute attention to detail. Generally, here’s how it’s done:

- Identify travel days: determine the number of days you’re on the Be sure to include both full and partial days in your calculation.

- Apply the correct daily rate: for 2024, use $69 per day within the continental S. and $74 per day for travel outside.

- Consider partial days: if you’re not on the road for a full 24 hours, you can still calculate a partial day rate (typically 75% of the full-day rate).

Tax implications

Per diem deductions reduce taxable income, potentially increase refunds, and impact future benefits. The deduction is now 80% under current law. Consulting a tax professional is recommended to maximize benefits and ensure compliance.

Tips for using your per diem

To manage per diem effectively, budget wisely for intended expenses, save receipts to track spending, understand your company’s policy, plan for off-days, and keep detailed records of travel days and expenses.

Maximizing Your Per Diem Deductions:

✅Track Your Travel: Maintain a logbook or use a trucking app to document your travel dates and locations. This will help you determine eligibility for per diem deductions.

✅Choose the Right Method: Evaluate whether it’s more beneficial to track your actual meal expenses or use the per diem rates. If you tend to eat frugally on the road, tracking actual expenses might be better.

Not all truck drivers qualify for per diem. Eligibility depends on trip length, employment status, and company policies. OTR drivers who spend nights away from home are more likely to qualify. Owner-operators and company drivers may have different criteria and options to opt-in or out of per diem based on their needs.

Tax Saving Trick for Truck Drivers

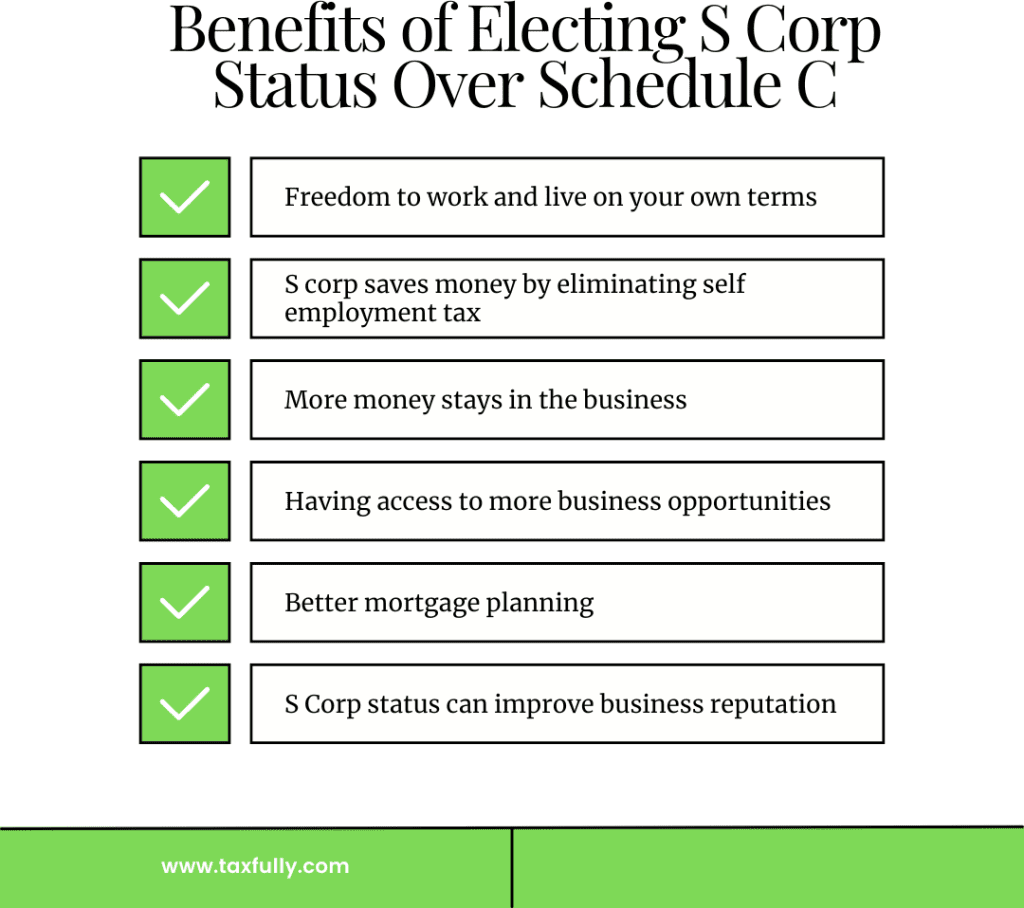

Why S Corp Over Schedule C?

Schedule C (Sch C): Typically used by sole proprietors, leading to higher self-employment taxes.

S Corp: Offers a strategic advantage in tax savings and liability protection for truck drivers and other small business owners.

Who qualifies for tax deductions?

Self-employed drivers, like owner-operators and independent contractors, can deduct business expenses. However, company drivers cannot deduct job-related expenses; they just file a W-2 form.

Requirements for claiming deductions

Company drivers file a W-2 and cannot deduct job-related expenses. Owner-operators use 1099-NECs from clients, fill out Schedule C for expenses and Schedule SE for self-employment tax, and submit these with form 1040.

Common deductions for truck drivers

✅ Vehicle expenses, including fuel, repairs, maintenance, and equipment depreciation, are deductible, but you must keep receipts and documentation.

✅ Travel expenses like mileage, tolls, accommodation, and parking can also be deducted.

✅ Office expenses for software, stationery, and postage are deductible as long as they are for business use.

✅ Business-related insurance premiums, including liability and health insurance, can be deducted.

✅ Communication expenses for business-related devices and services are deductible.

✅ Membership fees for trucker unions or associations can also be deducted.

Non-deductible expenses

You cannot deduct reimbursed expenses from business partners. If you use your home or personal cell phone for both personal and business use, you can only deduct the portion used for business. Everyday clothing that can be worn outside of work, like work boots, is not deductible.

Form 4562