Choosing the right business structure is a big decision for any entrepreneur. Two popular options are Limited Liability Companies (LLCs) and Professional Limited Liability Companies (PLLCs). Both offer liability protection and have their own benefits and drawbacks. This article will help you understand the key differences between LLCs and PLLCs, so you can make the best choice for your business.

Key Takeaways

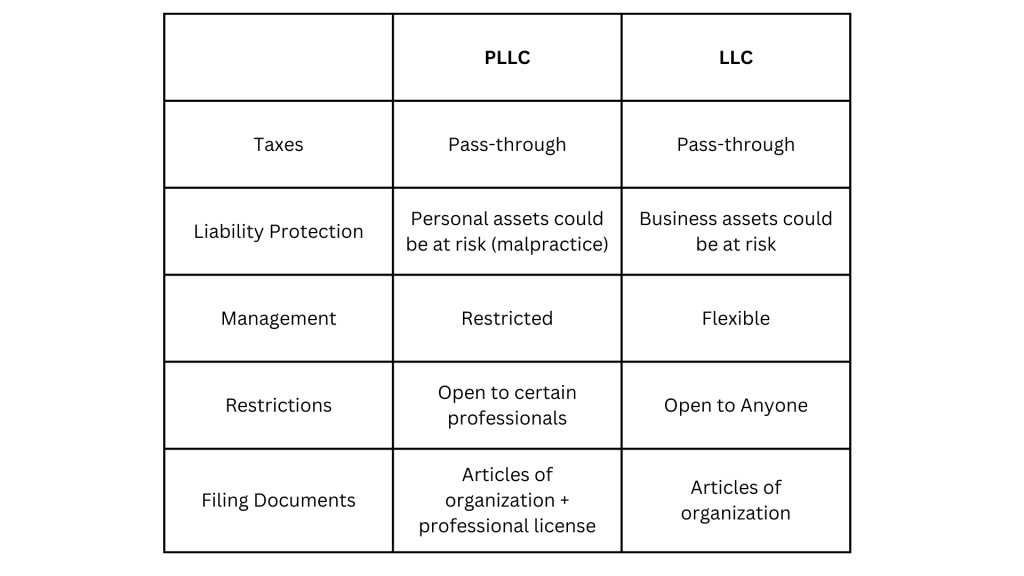

- LLCs and PLLCs both provide liability protection for their owners, but they serve different types of professionals.

- Only licensed professionals, like doctors and lawyers, can form a PLLC.

- Both LLCs and PLLCs offer flexible management structures, but PLLCs may have more restrictions due to state regulations.

- Choosing between an LLC and a PLLC depends on your profession and business needs.

Understanding the Basics of LLCs and PLLCs

What is an LLC?

A Limited Liability Company (LLC) is a popular business structure that combines the benefits of a corporation with those of a partnership or sole proprietorship. LLCs offer protection to their owners from personal liability, meaning your personal assets are generally safe if the business incurs debt or is sued. This makes LLCs a flexible and attractive option for many entrepreneurs.

What is a PLLC?

A Professional Limited Liability Company (PLLC) is similar to an LLC but is designed specifically for licensed professionals like doctors, lawyers, and accountants. To form a PLLC, all members must hold the necessary professional licenses. This structure not only provides personal liability protection but also ensures that the business complies with professional regulations.

Core Similarities Between LLCs and PLLCs

Both LLCs and PLLCs require the filing of “articles of organization” with the state. They offer limited liability protection, meaning the owners are not personally responsible for business debts. Additionally, both structures provide flexibility in management and taxation, making them appealing choices for those starting a business.

When deciding between an LLC and a PLLC, it’s crucial to understand the specific requirements and benefits of each structure. This will help you make the best choice for your business needs.

Eligibility and Formation Requirements

Who Can Form an LLC?

An LLC, or Limited Liability Company, is open to almost anyone. There are no professional restrictions, meaning you don’t need a special license to start one. This makes it a popular choice for many small business owners. Ownership is open to anyone, which provides a lot of flexibility in terms of who can be a member.

Who Can Form a PLLC?

A PLLC, or Professional Limited Liability Company, is a bit different. To form a PLLC, all members must hold a professional license in the field of business. This means that only certain professionals, like doctors, lawyers, or accountants, can form a PLLC. This requirement ensures that all members are qualified to provide the professional services the PLLC offers.

State-Specific Regulations

Both LLCs and PLLCs must register with the Secretary of State in the state where they are formed. However, a PLLC may also need additional documentation and certifications. For example, you might need to submit articles of organization, an application, and an affidavit to a state licensing board. The board will verify that all members have licenses in good standing. This process can take a few weeks to a few months.

It’s important to check your state’s specific requirements, as they can vary significantly. Some states have more stringent rules for PLLCs, while others may have additional steps for forming an LLC.

Liability Protection: LLC vs PLLC

Personal Liability Protection

Both LLCs and PLLCs offer limited liability protection, which means they can shield a member’s personal assets from business debts and legal liabilities. This is a primary benefit of LLCs and PLLCs. However, there are some differences in how each structure handles personal liability. LLCs protect owners from personal liability for business debts and liabilities. On the other hand, PLLC members are responsible for their own malpractice insurance and any claims that arise from their professional services.

Professional Liability Protection

PLLCs provide an additional layer of protection for licensed professionals. This means that while an LLC offers general liability protection, a PLLC can limit personal liability for suits arising from the professional services rendered. For example, if a doctor in a PLLC is sued for malpractice, the other members of the PLLC are not personally liable for that claim. This added protection is a key difference when considering PLLC vs LLC.

Examples of Liability Scenarios

To better understand the differences, let’s look at some examples:

- LLC Scenario: A customer sues a bakery LLC for a breach of contract. The owner’s personal assets are protected, and only the business assets are at risk.

- PLLC Scenario: A patient sues a dentist in a PLLC for malpractice. The dentist’s personal assets are at risk, but the other members of the PLLC are not personally liable.

When choosing between an LLC vs PLLC, it’s crucial to consider the specific liability protections each structure offers, especially if you are a licensed professional.

Management Structure and Flexibility

Management in an LLC

An LLC offers a flexible management structure that can be tailored to fit the needs of its members. You can choose between a member-managed or manager-managed setup. In a member-managed LLC, all members participate in the day-to-day operations. In a manager-managed LLC, you can appoint one or more managers to handle the business operations, allowing other members to take a more passive role.

Management in a PLLC

A PLLC also provides flexibility but with some restrictions. Professionals forming a PLLC, such as doctors or lawyers, must maintain control and ownership of the business. This means you can’t easily delegate responsibilities or share ownership with non-professionals. Despite these restrictions, you still have the freedom to choose between a member-managed or manager-managed structure.

Decision-Making Processes

In both LLCs and PLLCs, decision-making processes can be customized to suit the needs of the business. You can outline these processes in your operating agreement, specifying how decisions are made and who has the authority to make them. This allows for a tailored approach that can adapt as your business grows.

The flexibility in management structure and decision-making processes makes both LLCs and PLLCs attractive options for many business owners.

Tax Considerations for LLCs and PLLCs

Tax Benefits of an LLC

One of the main advantages of an LLC is its tax flexibility. LLCs can choose to be taxed as a sole proprietorship, partnership, S-corporation, or C-corporation. This flexibility allows business owners to select the tax treatment that best suits their financial situation. Most LLCs opt for pass-through taxation, where the business income is reported on the owners’ personal tax returns, avoiding double taxation.

Tax Benefits of a PLLC

PLLCs enjoy similar tax benefits to LLCs. They are also considered pass-through entities, meaning the business income and losses pass through to the owners’ personal tax returns. This can simplify tax filing and potentially reduce the overall tax burden. However, PLLC owners must recognize profits immediately, which can sometimes complicate tax management.

Potential Tax Drawbacks

While the pass-through taxation model is beneficial, it can also present challenges. For instance, PLLC owners might face taxes on unrealized profits, making tax return management more complex. Additionally, choosing the wrong tax classification can lead to higher taxes and penalties. It’s crucial to seek professional advice to navigate these complexities effectively.

Understanding the tax implications of your business structure is essential for making informed decisions and optimizing your tax situation.

Pros and Cons of Choosing an LLC

Advantages of an LLC

When it comes to the benefits of an LLC, flexibility is the name of the game. As an LLC member, you have the freedom to structure your business in a way that best suits your needs. This can include deciding how profits are distributed amongst members and setting up the company’s management structure. Another significant advantage is the limited liability protection it offers, shielding your personal assets from any business debts or liabilities.

Disadvantages of an LLC

However, an LLC isn’t without its drawbacks. One such downside is the potential for self-employment taxes. Because profits from the LLC pass through to individual members, these profits are subject to self-employment taxes, which can be quite hefty. Additionally, while an LLC provides personal liability protection, it doesn’t shield members from malpractice claims. This is where a PLLC might come into play.

Ideal Scenarios for an LLC

If you’re looking to start a business—whether it’s a consulting firm, a marketing agency, or a product development company—an LLC can be a solid choice. But as with any business decision, it’s crucial to weigh the pros and cons.

Pros and Cons of Choosing a PLLC

Choosing a PLLC for your business structure has its own set of benefits and challenges. A significant benefit of a PLLC is that it offers both limited liability protection and protection against malpractice claims made against other members. This can be crucial for professionals in fields where malpractice suits are common.

Conclusion

Choosing between an LLC and a PLLC can seem tricky, but it all comes down to what your business needs. If you’re a professional like a doctor or lawyer, a PLLC might be the better choice because it offers special protections for your profession. On the other hand, an LLC is more flexible and can be a great fit for many types of businesses. Remember, the right choice depends on your specific situation. Ready to file or still unsure which option is best for you?