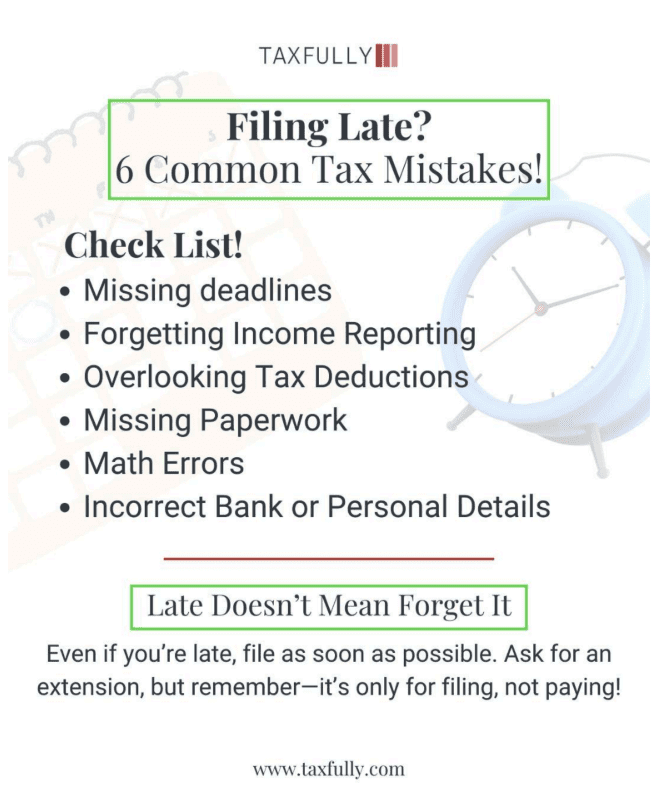

Filing taxes late can be intimidating, but it doesn’t have to be. Many people make mistakes to avoid when filing taxes late that end up costing them money and causing issues with the IRS. This guide highlights six common mistakes and how to steer clear of them. From missing deadlines to overlooking important paperwork, you’ll discover how to file late taxes correctly and hold on to more of your hard-earned money.

1. Missing Deadlines Completely

If you are late, ignoring the deadline can cost you big. The IRS charges a 5% penalty on unpaid taxes for every month you’re late, up to 25%. If you know you can’t file on time, ask for an extension. But remember, an extension only gives you more time to file, not to pay. Try to pay as much as you can before the deadline to reduce the penalties.

2. Forgetting to Report All Income

Make sure to include every dollar you earned in your tax return. This includes your job, side gigs, freelancing, or any investment income. Missing income can get you in trouble with the IRS. Gather all the forms you get, like 1099s or W-2s. If you don’t have a form, contact the company or person who paid you to get it before filing.

3. Overlooking Tax Deductions and Credits

Rushing can make you miss tax benefits that could save you money. Some examples are the Child and Dependent Care Credit, education credits, or deductions for a home office if you qualify. These credits and deductions lower the amount of taxes you owe or increase your refund. Double-check to see what you’re eligible for so you don’t miss out on savings.

You may also like to read:

Ultimate Tax Filing Checklist for Small Businesses: Don’t Miss These Essential Steps

unning a small business is exciting, but when tax season rolls around, it can also feel overwhelming. Staying organized and ensuring that you follow …

Read More

4. Skipping Essential Paperwork

Filing without all the right documents can cause mistakes or delays. If your return is incomplete, you might have to fix it later, which is a hassle. Before filing, collect all your forms, like 1099s, W-2s, mortgage interest statements, and receipts for donations. Having everything ready will make the process much smoother./

5. Making Math Errors

Even small math mistakes, like adding or subtracting wrong, can cause problems. These errors might delay your refund or lead to notices from the IRS. To avoid this, use tax software or file electronically. These tools do the math for you and reduce errors. If your taxes are complicated, you might want to ask a professional for help.

6. Entering Incorrect Bank or Personal Details

If you enter the wrong bank account number, your refund could go to the wrong place. Mistakes with your Social Security number or name can also delay your return. Double-check all your details before you submit your taxes to avoid these problems.

Conclusion

Filing late doesn’t have to be stressful. Avoid these mistakes, and you can save money and reduce headaches. If you feel unsure, ask a tax professional or use a trusted filing service. Stay organized, take your time, and you’ll get through it without trouble.