Gift tax is an important concept for anyone looking to transfer wealth, whether as a one-time gift or as part of an ongoing estate planning strategy. As of 2024, individuals can take advantage of a federal estate and lifetime gift tax exemption of $13.61 million, allowing significant tax-free transfers. This guide will help you understand what gift tax is, when it applies, and how to manage your gift giving to stay within the law while optimizing your tax benefits.

What is a Gift?

A gift, as defined by the IRS, occurs when you transfer money, property, or other assets to

another person without expecting something of equivalent value in return. This includes cash

gifts, real estate, and personal items like vehicles. Understanding what qualifies as a gift is

crucial, as certain transfers may have tax implications.

- A gift is any transfer of property, money, or assets where the giver doesn’t expect anything in return.

- Gifts can include cash, real estate, vehicles, and other valuable items.

*you may owe gift tax only If the gift amount is over $13.61 million

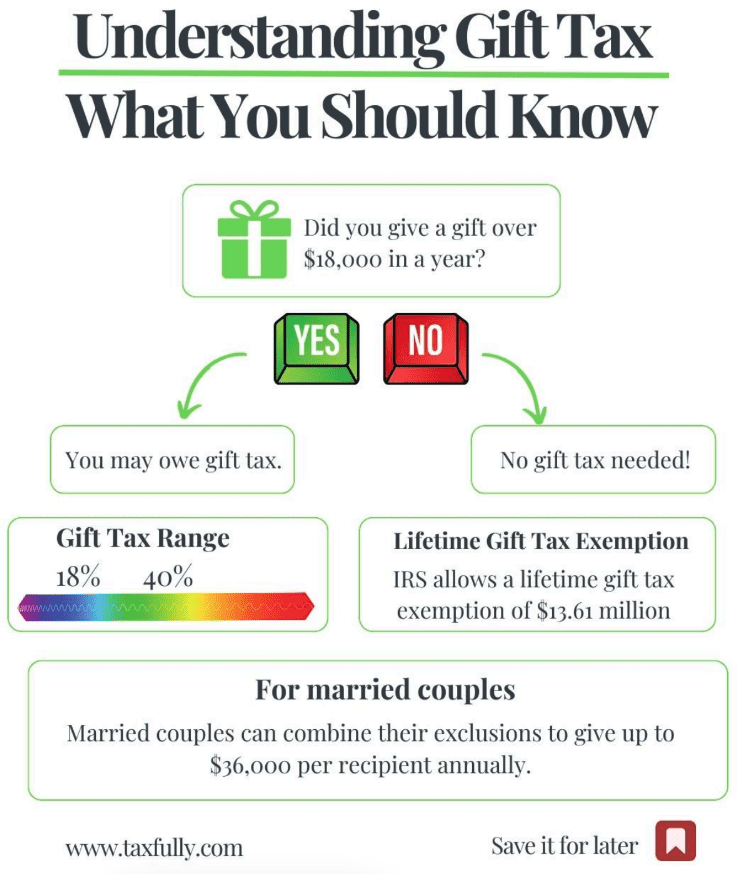

Annual Gift Tax Exclusion

Each year, the IRS allows you to give up to a specified amount to as many individuals as you like without triggering the gift tax. For 2024, this amount is $18,000 per recipient. This exclusion is a key tool in minimizing your tax obligations while still being generous. For married couples, this amount doubles to $36,000 per recipient when gifts are split between spouses.

- In 2024, you can give up to $18,000 per recipient per year without incurring gift tax.

- Married couples can combine their exclusions to give up to $36,000 per recipient annually.

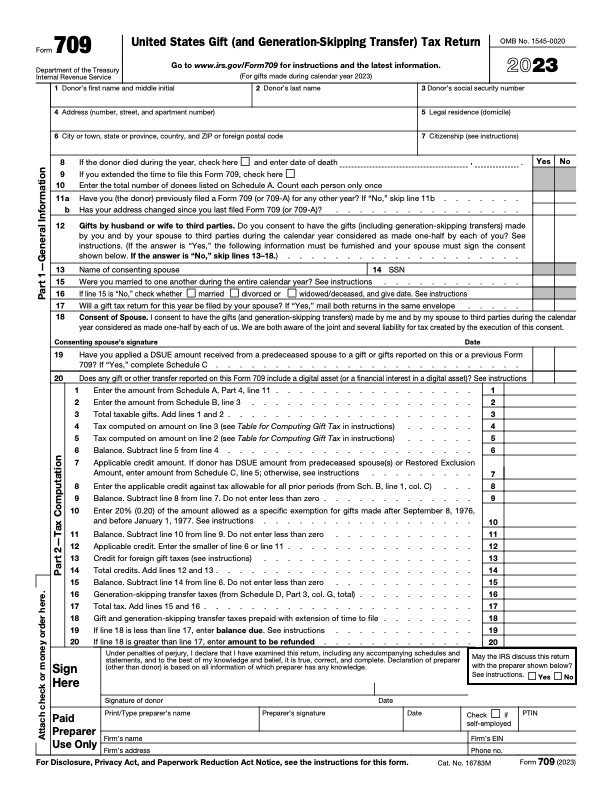

When Do You Need to Report a Gift?

If you give more than the annual exclusion amount to any individual in a given year, you must report the excess on Form 709, the gift tax return. However, reporting does not necessarily mean you will owe taxes. The excess amount is simply deducted from your lifetime gift tax exemption, which is $13.61 million in 2024.

- If you exceed the annual exclusion of $18,000 per recipient, you must report the excess on Form 709.

- Reporting doesn’t necessarily mean you owe taxes; it reduces your lifetime gift tax exemption.

Lifetime Gift Tax Exemption

In addition to the annual exclusion, the IRS allows a lifetime gift tax exemption of $13.61 million. This means that over your lifetime, you can give away up to this amount in gifts without incurring gift tax. The exemption is cumulative, so it includes all reportable gifts made during your lifetime. If your total gifts exceed this exemption, you will be required to pay gift tax on the excess.

- As of 2024, the lifetime gift tax exemption is $13.61 million.

- This exemption is cumulative, covering all reportable gifts made during your lifetime.

- If your total gifts exceed the exemption, you will owe gift tax on the amount over $13.61 million.

You may also like to read:

Estate and Gift Taxes: What You Need to Know

Navigating the world of taxes can be daunting, especially when it comes to estate and gift taxes. These taxes often seem complex, …

Read More

How Gift Tax Works

If your total gifts exceed both the annual exclusion and the lifetime exemption, you may be subject to gift tax. The tax rate on gifts can vary, generally ranging from 18% to 40%, depending on the amount by which your gifts exceed the exemption. It’s important to remember that the gift tax is paid by the giver, not the recipient.

- Gifts exceeding both the annual and lifetime exemptions may be subject to gift tax.

- Gift tax rates typically range from 18% to 40%.

- The giver is responsible for paying any applicable gift tax, not the recipient.

Common Misconceptions

One common misconception is that the recipient of a gift must report it or pay taxes on it. In reality, the responsibility for reporting and potentially paying gift tax lies with the giver. Recipients do not need to include gifts on their tax returns, and the act of receiving a gift does not typically create a tax liability for them.

- The recipient of a gift does not need to report it or pay taxes on it.

- Only the giver is responsible for reporting and potentially paying gift tax. (If your total gifts exceed the exemption, you will owe gift tax on the amount over $13.61 million, at the same time, if your annual gift is over the annual gift limit (18k in 2024) then a gift tax return is required and filing form 709 with the IRS is required, however, gift tax does not apply still unless the 13.61 annual gift tax exclusion has been met).

Conclusion

Understanding gift tax rules is essential for anyone considering making significant gifts, whether for estate planning or personal reasons. By taking full advantage of the annual exclusion and being aware of the lifetime exemption, you can ensure that your generosity does not lead to unintended tax consequences. Always consider consulting a tax professional to ensure you are maximizing your benefits while staying compliant with IRS regulations.

For more detailed information on reporting gifts, you can refer to IRS Form 709, which provides guidelines on filing a gift tax return