Are you a construction, remodeling, or renovation LLC owner? Taxes can be a heavy burden, but with the right deductions, you can lighten the load significantly. Many business owners in these industries miss out on crucial deductions, resulting in overpayment. Let’s dive into eight essential tax deductions that can help you save an average of $19,200 annually.

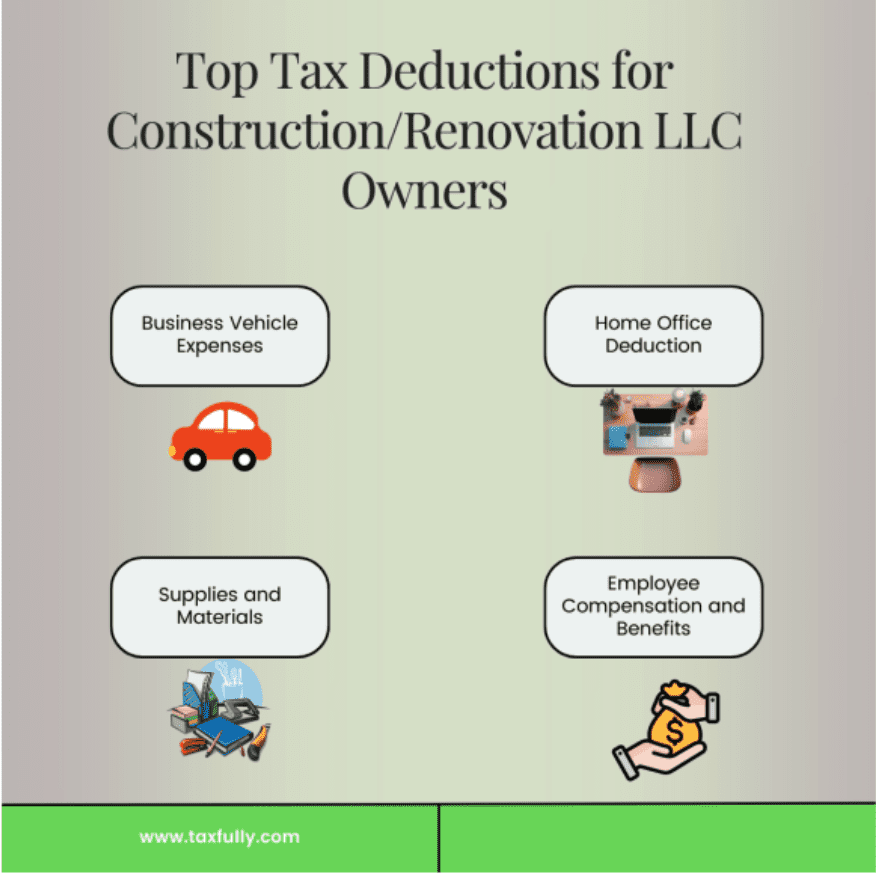

1. Business Vehicle Expenses

If your business relies on vehicles for transporting tools, materials, or meeting clients, you can deduct the associated costs. This includes expenses like mileage, fuel, repairs, and maintenance. Keeping a thorough record of your business-related mileage will help ensure you maximize this deduction.

2. Home Office Deduction

If you dedicate a part of your home exclusively for business purposes, you may qualify for the home office deduction. This can cover a portion of your mortgage or rent, utilities, insurance, and maintenance expenses. To qualify, the space must be used regularly and exclusively for business activities. You can deduct $5 for each square foot, with a maximum of $1,500 or 300 square feet per year for your dedicated home office area – but only if it’s used for the entire year.

3. Supplies and Materials

The cost of materials and supplies necessary for your business operations is fully deductible. This includes tools, equipment, safety gear, and any other items essential for your work. Make sure to keep all receipts and document that these purchases are for business use.

4. Employee Compensation and Benefits

Wages, benefits, and training costs for your employees and contractors are deductible. Proper documentation of all payments and keeping detailed records of their work is essential to claim these deductions.

You may also like to read:

20 Essential Tax Deductions for Doctors and Psychologists

For self-employed physicians, other medical professionals, and mental health professionals…

Read More

5. Marketing and Advertising

Expenses related to marketing and promoting your business, such as online ads, business cards, flyers, and sponsoring events, are deductible. Investing in advertising is crucial for business growth, and the costs are fully tax-deductible.

6. Insurance Premiums

Insurance costs, including liability, workers’ compensation, and health insurance premiums for yourself and employees, are deductible expenses in the construction industry. This includes liability insurance, workers’ compensation, and health insurance premiums for you and your employees.

7. Professional and Legal Fees

Fees paid for legal advice, accounting, and other professional services are deductible. This allows you to get the expert help you need without bearing the full financial burden.

8. Business Travel Expenses

Travel expenses related to business purposes, such as attending conferences or meeting clients, are deductible. This includes airfare, lodging, meals, and other travel-related costs. Keep detailed records and receipts to support these deductions.

Bonus Tip: Consider S Corporation Election

LLC owners can potentially save even more by electing to be taxed as an S Corporation. This eliminates self-employment taxes, providing significant savings. Consult with a tax professional to determine if this strategy aligns with your business goals. By leveraging these eight tax deductions, construction, remodeling, and renovation LLC owners can save an average of $19,200 annually. Proper documentation and planning are crucial, so consider working with a tax professional who understands the unique needs of your industry. Maximizing your deductions can significantly lower your tax burden, allowing you to reinvest in your business and drive growth.