So, you’ve hit it big with a sports bet—congrats! But before you start planning how to spend your winnings, let’s talk about taxes. Yep, Uncle Sam wants a piece of the action too. Whether you’re betting at a casino, using an online sportsbook, or making a friendly wager with friends, your winnings count as taxable income.

Do You Have to Pay Taxes on Sports Betting Winnings?

Short answer? Yes. The IRS considers all gambling winnings as taxable income, no matter how small.

If you win $600 or more and the amount is 300 times your wager, the sportsbook or casino might send you a Form W-2G. But even if they don’t, you’re still responsible for reporting it. Ignoring it could mean trouble later, and trust me, no one wants an unexpected letter from the IRS.

How Much Tax Do You Owe?

How much you owe depends on how much you win and your total income for the year. Here’s the breakdown:

- Federal tax: If you win more than $5,000, 24% is automatically withheld for federal taxes.

- State tax: Depending on where you live, your state might take another cut.

- Local tax: Some cities or counties also tax gambling winnings.

For example, let’s say you win $10,000 on a bet. The casino might withhold $2,400 for federal taxes before you even see the money. If your state taxes gambling at 5%, you could owe another $500 when you file your return.

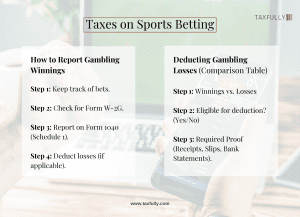

How to Report Your Winnings

So, how do you report your winnings properly? It’s easier than you think.

- Keep track of all your bets – Write down how much you bet, how much you won (or lost), and the date.

- Look for a W-2G form – If you hit a big win, the casino or sportsbook may send you this form.

- File Form 1040 – Report your gambling income under “Other Income” on Schedule 1 of Form 1040.

Even if you don’t get a W-2G form, the IRS can still track your winnings through betting platforms. So, it’s always best to play it safe and report them.

Can You Deduct Gambling Losses?

Good news—you can deduct some of your gambling losses, but there’s a catch.

- You must itemize deductions on Schedule A of Form 1040.

- You can only deduct losses up to the amount of your winnings.

- You must have proof (receipts, betting slips, or bank statements).

For example, if you won $5,000 but lost $3,000, you can deduct the $3,000, meaning you only pay tax on the remaining $2,000.

State Taxes on Sports Betting

Not all states treat gambling winnings the same way. Here’s what you should know:

- High-tax states (like New York and California) could take another 10% or more from your winnings.

- Low-tax states (like Nevada and Florida) have little to no state tax on gambling winnings.

- Some states don’t tax gambling winnings at all!

Before you cash out, check your state’s tax rules so you’re not hit with a surprise tax bill later.

Final Thoughts

Winning money on sports betting is exciting, but taxes can be a buzzkill if you’re not prepared. Keep track of your bets, report your winnings, and deduct your losses when possible.

Also, remember that sports betting platforms report winnings to the IRS. Even if you don’t receive a tax form, your earnings are still traceable. Being honest on your tax return will save you from potential penalties and audits in the future.

If you’re betting regularly, it might be worth consulting a tax professional to ensure you’re handling everything correctly. This can help you maximize deductions and keep more of your winnings in your pocket.

Not sure where to start? Taxfully is here to help. We make tax time easy so you can focus on what really matters—enjoying your winnings!

Need expert tax help? Contact Taxfully today to maximize your tax savings!