Being self-employed gives you freedom, but it also comes with unique challenges, especially during tax season. Fortunately, there are many deductions designed to lighten your tax load and help your business thrive. This guide will walk you through the most common deductions and how to claim them. Let’s save money, step by step.

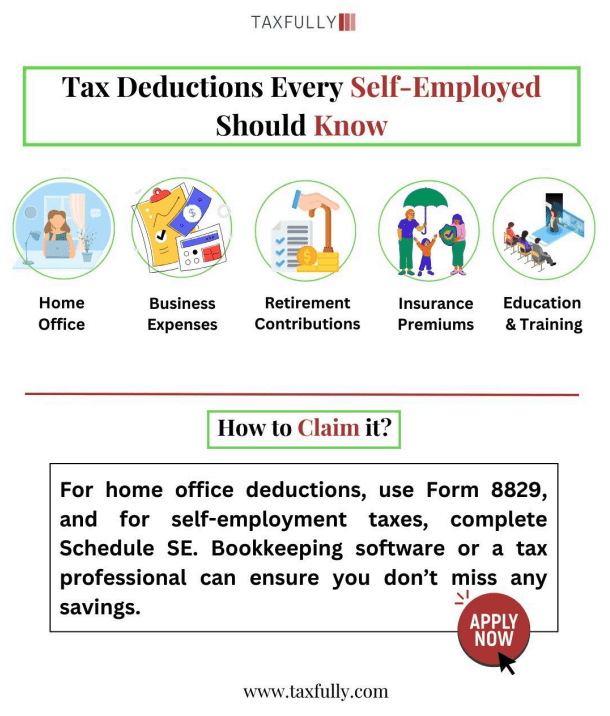

Common Tax Deductions for Self-Employed Individuals

1. Home Office

If you work from home, you can deduct expenses related to the space you use exclusively for business. This includes a percentage of your rent, mortgage, utilities, and property taxes. For a simpler calculation, multiply $5 by your office’s square footage (up to 300 sq. ft.).

2. Business Expenses

Everyday costs like internet, phone bills, office supplies, and software subscriptions are deductible. Larger purchases, such as laptops, cameras, and desks, can also be claimed, but it’s important to keep detailed records and receipts throughout the year to ensure every eligible expense is accounted for.

3. Health Insurance

You can deduct health insurance premiums for yourself, your spouse, and dependents. This deduction applies whether or not you itemize your expenses, but if you or your spouse are eligible for an employer-sponsored plan, the deduction may not apply.

4. Marketing and Advertising

Whether you’re running Facebook ads, sponsoring a local event, or designing business cards, you can fully deduct these expenses. Advertising and marketing costs are essential for growing your business, and the IRS recognizes their importance.

5. Business Travel and Meals

Travel expenses, such as flights, hotels, and car rentals, are deductible if they’re directly related to your business, while meals during work trips or client meetings are 50% deductible.

Documenting the purpose of the trip or meeting is crucial to back up your claim during tax season.

6. Retirement Contributions

Contributions to self-employed retirement plans like a SEP IRA, SIMPLE IRA, or solo 401(k) are deductible, reducing your taxable income while helping you save for the future. For 2024, the maximum contribution for a solo 401(k) is $23,000, with an additional $7,500 catch-up allowance for those over 50.

7. Education and Trainin

Courses, workshops, books, and certifications that improve your skills are deductible. For instance, a graphic designer can claim tuition for a Photoshop masterclass as a business expense that supports their professional growth.

8. Insurance Premiums

Premiums for business-related insurance, including liability, fire, or malpractice coverage, are fully deductible. This includes workers’ compensation and long-term care insurance when tied to your business.

9. Vehicle Use

You can deduct vehicle expenses either by using the standard mileage rate (67¢ per mile for 2024) or by calculating actual expenses like gas, repairs, and insurance. Keep a mileage log or use an app to ensure accurate records.

10. Utilities and Rent

If you rent office space or equipment, those costs are deductible. This includes utilities like electricity, gas, and water for your business space. Even co-working space rentals qualify, making it easier to claim for modern work setups.

You may also like to read:

A Simple Guide to Paying Quarterly Estimated Taxes for Self-Employed Individuals

Being self-employed brings a lot of freedom and flexibility, but it also comes with a few extra responsibilities, like…

Read More

How to Claim These Deductions

Most deductions are claimed on Schedule C (Profit and Loss from Business) when filing your taxes, while home office expenses require Form 8829. For self-employment tax deductions, you’ll need Schedule SE. Consider using bookkeeping software or working with a tax professional to avoid missing out on savings.

Conclusion

Tax deductions can significantly reduce your tax bill and keep your business finances healthy.

By staying organized, maintaining records, and taking advantage of these deductions, you’ll save money and reduce stress during tax season.