E-2 visa: launching your US business, increase you visa approval chances by organizing your LLC, Bookkeeping and Tax strategies.

Thinking of investing in a US business? The E-2 Visa might be your golden ticket!

This visa allows citizens of treaty countries to invest and run a business in the United States.

Here’s a breakdown of the key points:

Who qualifies?

- You must be a citizen of a country with a trade treaty with the US (check the Department of State website for the list).

You need to invest a substantial amount of money in a real, operational US business (not stocks or undeveloped land).

- The investment must be “at risk,” meaning you could lose it if the business fails.

- You must be actively involved in running the business and have control over the invested funds.

- You plan to return to your home country when your E-2 visa expires (though renewals are possible).

What kind of businesses qualify?

How much do I need to invest?

What’s the application process like?

Can I bring employees?

business.

Bookkeeping: building a strong financial foundation

- Visa application: a well-maintained set of books demonstrates the legitimacy and financial viability of your business. This strengthens your E-2 visa application by showcasing a responsible and organized operation.

- Future success: accurate and up-to-date bookkeeping helps you track income, expenses, and profitability. This empowers you to make informed financial decisions, manage cash flow effectively, and optimize your tax strategy.

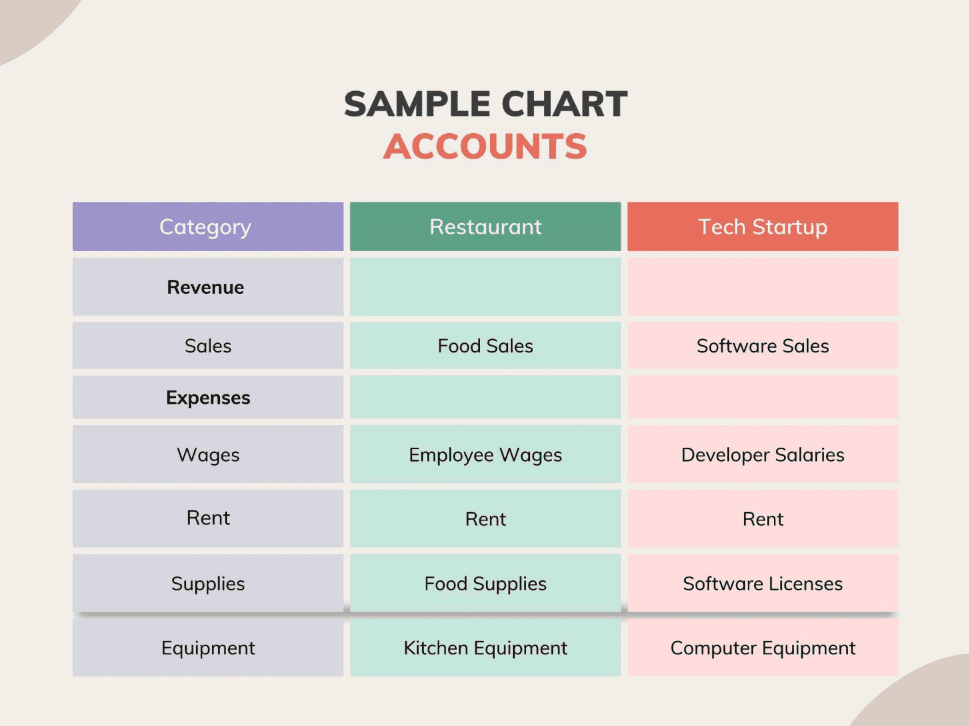

Developing your chart of accounts

You may also like to read:

E-2 and O-1 Visa holders: Navigating Tax Filing, Accounting, and Business Entities

Immigrating to the U.S. on an E2 (Treaty Investor) or O-1 (Extraordinary Ability) visa brings forth a realm of opportunities…

Read More

Establishing payroll: employees and contractors

As your business grows, you might need to hire employees or contractors. Setting up payroll ensures you comply with tax regulations and demonstrate financial responsibility to potential investors and future visa applications.

- Hiring employees brings additional responsibilities, including withholding income taxes and Social Security payments. Research US payroll regulations or consider using a payroll service to ensure compliance.

- Even with contractors, you might need to issue 1099 forms to report the income you paid them.

LLC formation/EIN Setup: setting up your business entity:

While not mandatory for the E-2 visa application, forming a Limited Liability Company (LLC) offers several benefits:

- Limited Liability Protection: an LLC shields your personal assets from business debts and lawsuits. This provides valuable financial security for entrepreneurs.

- Pass-through taxation: profits from your LLC “pass through” to your personal tax return, avoiding double taxation.

- Obtaining an EIN number: Steps to Obtain an EIN as a Foreigner:

- Determine Eligibility:

- Ensure you need an EIN for your business activities in the U.S. EINs are required

for opening a U.S. bank account, hiring employees, and filing certain tax returns.

- Ensure you need an EIN for your business activities in the U.S. EINs are required

- Prepare the Necessary Information:

- You will need the legal name and address of the business, the type of entity

(LLC, corporation, partnership, etc.), and the reason for applying for an EIN. - If you don’t have a Social Security Number (SSN) or Individual Taxpayer

Identification Number (ITIN), you can still apply for an EIN.

- You will need the legal name and address of the business, the type of entity

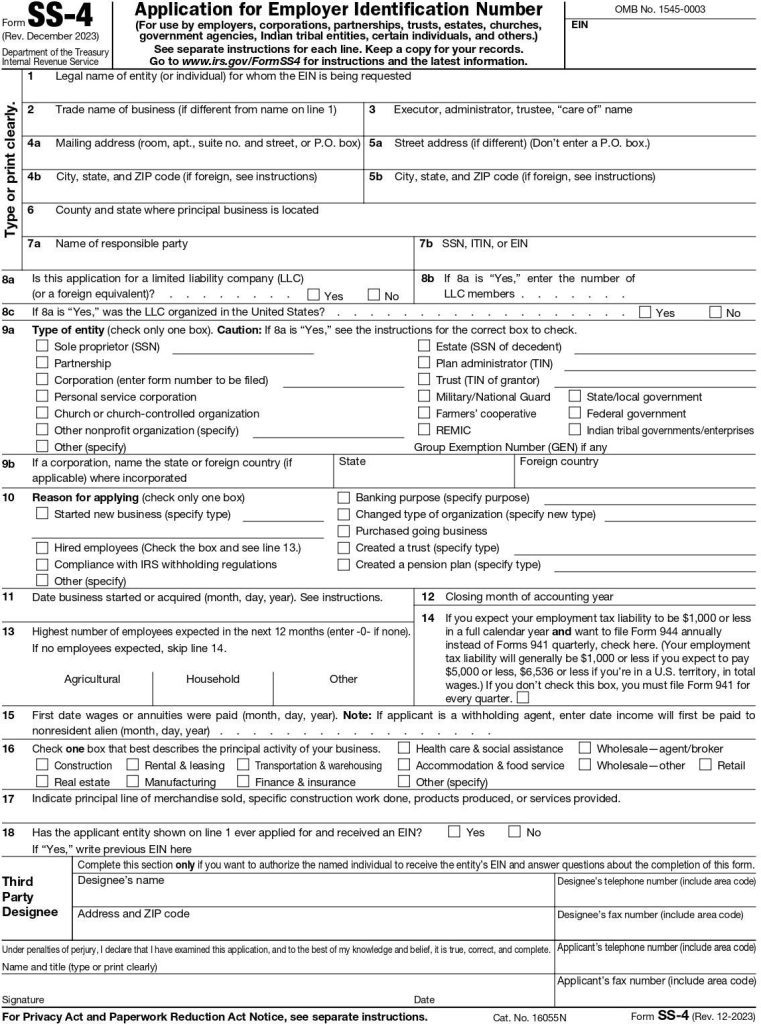

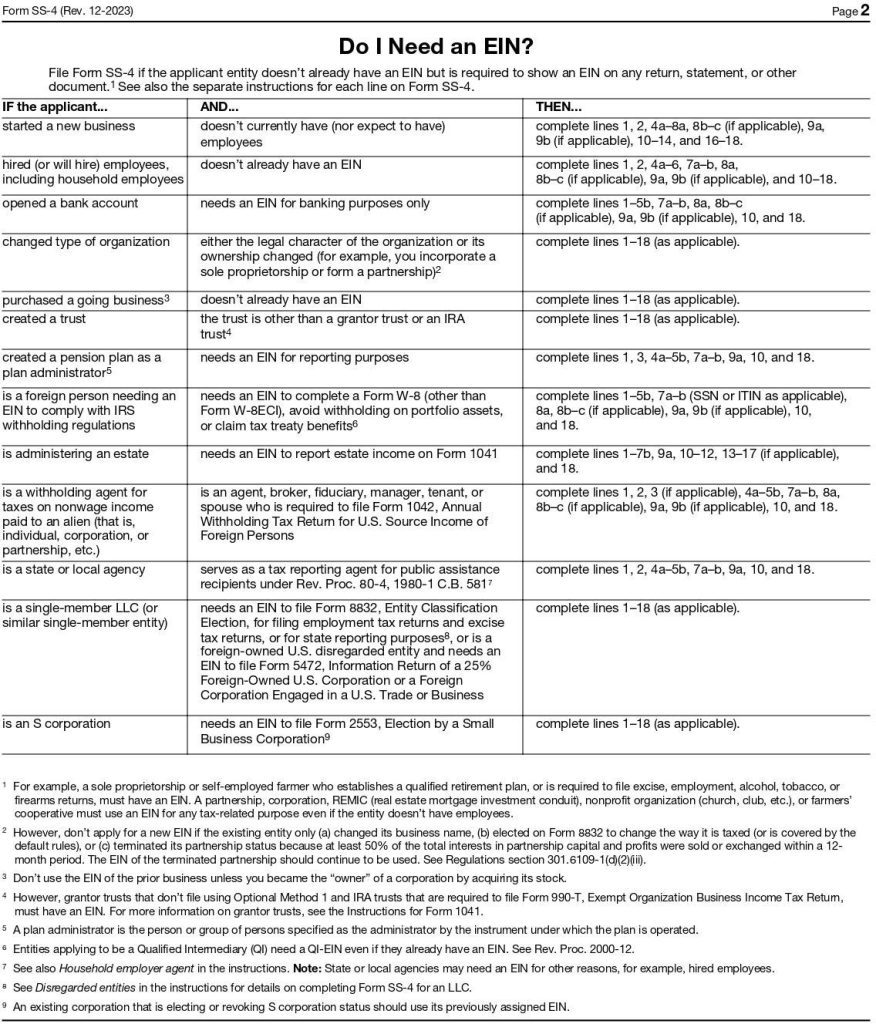

- Complete Form SS-4:

- You can download Form SS-4 from the IRS website. This form is used to apply

for an EIN. - Complete the form with all necessary information. In line 7b, if you do not have

an SSN or ITIN, write “Foreign/None”.

- You can download Form SS-4 from the IRS website. This form is used to apply

- Submit the Application:

- By Fax: You can fax the completed Form SS-4 to the IRS at (855) 215-1627. If

you are outside the U.S., use (304) 707-9471. The IRS will fax back the EIN

within four business days. - By Mail: Mail the completed form to Internal Revenue Service, Attn: EIN

Operation, Cincinnati, OH 45999. Processing time for mail applications is about

four weeks. - By Phone: You can apply by calling the IRS at (267) 941-1099 (not a toll-free

number). This option is available from 6 a.m. to 11 p.m. (Eastern Time) Monday

through Friday.

- By Fax: You can fax the completed Form SS-4 to the IRS at (855) 215-1627. If

- Receive Your EIN:

- Once your application is processed, you will receive your EIN. Keep this number

secure as it is essential for tax filings and other business activities in the U.S.

- Once your application is processed, you will receive your EIN. Keep this number

- Determine Eligibility:

- Additional Tips

- Time Zone Awareness: When calling from abroad, be mindful of the time difference to call during IRS business hours.

- Language: Ensure you or someone assisting you is comfortable communicating in English, as the IRS services are primarily in English.