What is an LLC?

An LLC, or Limited Liability Company, is a popular business structure in the U.S. that protects its owners from personal liability for the company’s debts and obligations. When you start an LLC, you create a legal separation between your personal and business assets, offering a safeguard in case of legal issues or financial troubles.

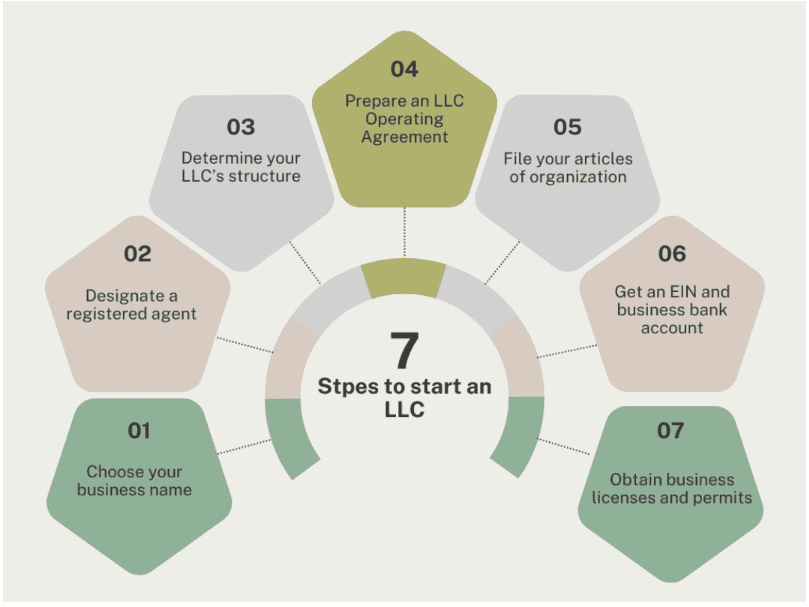

The 7 steps of creating an LLC

Here’s a simple guide to starting an LLC today in seven steps.

1. Choose your business name:

- Your business name is very important for branding and must meet legal rules.

- Make sure it’s unique, includes “LLC” or your business type, and doesn’t use restricted terms.

- Check trademarks and consider reserving your name if you’re not ready to officially start your LLC yet.

2. Designate a registered agent:

- Your registered agent gets legal documents for your LLC.

- This person can be a resident over 18 with a physical address or a registered agent service.

- You can be your own agent or hire one if needed.

3. Determine your LLC’s structure

- Decide if your LLC will be managed by its owners (member-managed) or designated managers (manager-managed).

- ● Choosing the right structure makes operations smoother and clarifies everyone’s roles.

4. Prepare an LLC Operating Agreement

- This agreement outlines how your LLC will operate financially and operationally.

- It helps prevent conflicts, protects you legally, and keeps your business running smoothly.

- For LLCs with multiple owners, it’s wise to get advice from a business lawyer.

5. File your articles of organization

- Submit your LLC formation paperwork, including its name, address, registered agent details, and more.

- You can usually do this online and fees typically range from $50 to $200.

6. Get an EIN and business bank account

- Apply for an Employer Identification Number (EIN) from the IRS.

- You need an EIN to hire employees, file taxes, and open a business bank account.

7. Obtain business licenses and permits

- Depending on your business type and location, you may need licenses and permits.

- Examples include a seller’s permit, general business licenses, or specific licenses for certain industries.

- Check with local and state authorities or a business advisor to find out what you need.

You may also like to read:

Starting a Business: From LLCs to Corporations

Starting on an entrepreneurial journey can be confusing, but it’s important to lay a strong foundation. One of the first decisions…

Read More

What to do after creating your LLC

1. Get Tax Advice for Your LLC

- Learn about how taxes affect your LLC, including penalties, deductions, and legal costs.

- Talk to a tax expert to pick the best tax structure for your business.

2. Stay Compliant and In Good Standing

- File annual reports, pay necessary fees, and keep up with LLC requirements, including any franchise taxes.

3. Register Your LLC in Other States

- If you expand to other states, register as a foreign LLC.

- Get a certificate of good standing, apply for foreign qualification, appoint a registered agent, understand local laws, and file annual reports and fees.

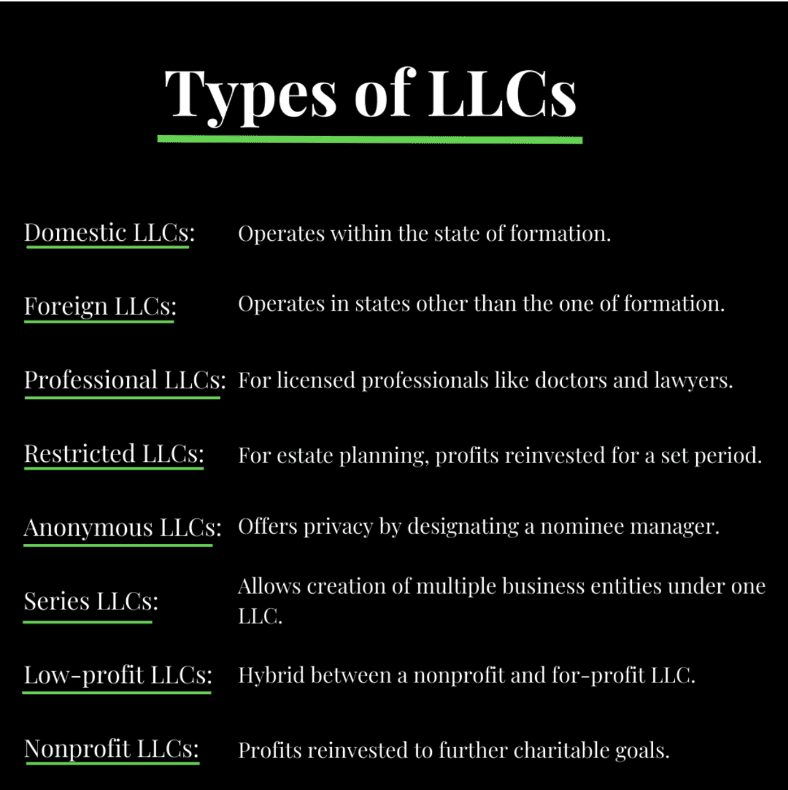

The 8 types of LLCs

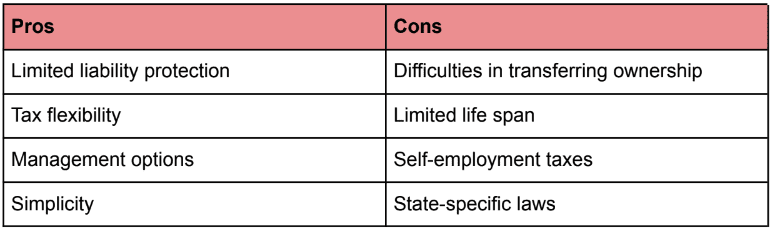

Pros and cons of starting an LLC

Regularly check your LLC status with your state’s Secretary of State (SOS). Use the provided links to ensure your LLC is in good standing and avoid issues.

CLICK HERE TO DOWNLOAD Links for LLC Status

Starting an LLC can offer many benefits, but you can enhance these benefits further by adopting an S Corp strategy. An S Corp status allows you to save on taxes and protect your personal assets.

Considering an S corp strategy?

An LLC offers pass-through taxation, where business profits and losses pass through to the owners’ personal tax returns, avoiding double taxation. This can be beneficial. However, if your LLC is expected to have high profits and you plan to take a salary, an S corporation structure could potentially save you money on taxes in the long run.Why?

S corporations also avoid double taxation, but they allow for a reasonable salary to be paid to owners as employees. This salary is subject to payroll taxes, but any remaining profits are distributed as dividends, which are not subject to payroll taxes. Talk to your tax advisor to see if an S corporation strategy is right for your LLC.LLC fees vary by state and include filing fees and annual costs. Check your state’s fees to stay compliant and budget accordingly.

CLICK HERE TO DOWNLOAD LLC FEES PER STATE

LLC Deadlines

An LLC provides a powerful shield for your personal finances while offering tax advantages through pass-through taxation. It also gives you the flexibility to manage your business however you see fit.

Taxfully can help you navigate the LLC formation process with ease, ensuring your business is set up for success from the start.

Let Taxfully be your partner in building a secure and tax-efficient business. Get started with your LLC formation today!