What is the SALT Deduction?

The SALT deduction allows taxpayers to deduct up to $10,000 of certain state and local taxes from their federal taxable income. If you’re married and filing separately, the limit is $5,000.

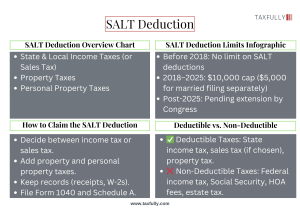

This deduction covers three types of taxes:

- State and Local Income Taxes (or Sales Tax if you choose)

- Property Taxes

- Personal Property Taxes (like taxes on vehicles or boats)

Who Can Claim the SALT Deduction?

You can only claim the SALT deduction if you itemize your deductions using Form 1040 Schedule A. Most people take the standard deduction, which in 2024 is $14,600 for single filers and $29,200 for married couples filing jointly. If your itemized deductions—including SALT—are higher than the standard deduction, itemizing might save you money.

How to Claim the SALT Deduction

Decide Between Income Tax or Sales Tax

- If you live in a state without income tax, deducting sales tax might be a better option.

- If your state has high income tax, deducting state income tax is likely better.

- You cannot deduct both income tax and sales tax—you must choose one.

Add Property Taxes

- If you own a home, you can deduct real estate taxes you paid to your state or county.

- If you have a vehicle or boat, you may also deduct personal property taxes—but only if they are based on the item’s value and charged annually.

Keep Records

- Save receipts for property taxes, state tax payments, and major purchases (if deducting sales tax).

- Check your W-2 form for state and local tax withholdings.

File Form 1040 and Schedule A

- Use Schedule A to list all deductions.

- Make sure your total itemized deductions are higher than the standard deduction before filing.

SALT Deduction Limits

Before 2018, there was no limit on SALT deductions. But the Tax Cuts and Jobs Act set a cap of $10,000 (or $5,000 for married couples filing separately). This cap is set to expire in 2025, unless Congress extends it.

This cap mainly affects taxpayers in high-tax states like New York, California, and New Jersey, where property taxes and state income taxes are high.

Taxes That Are NOT Deductible

Some taxes and fees do not qualify for the SALT deduction, including:

- Federal income taxes

- Social Security and Medicare taxes

- Estate and inheritance taxes

- Homeowners Association (HOA) fees

- Service fees (like water, sewer, or trash collection)

Is Itemizing Worth It?

Itemizing only makes sense if your total deductions are higher than the standard deduction. If you:

- Own a home and pay high property taxes

- Live in a state with high income taxes

- Have large medical expenses or charitable contributions

…then itemizing might save you more money.

If your total itemized deductions are below the standard deduction, it’s better to take the standard deduction instead.

Final Thoughts

The SALT deduction is a great way to reduce your tax bill—if you qualify. Make sure to keep track of your taxes and choose the right deductions. If you need help, Taxfully is here to guide you through the process!

Need expert tax advice? Contact Taxfully today and maximize your tax savings!