Unlike individuals who may only fret about taxes once a year, many small businesses must deal with the concept of quarterly estimated taxes. Let’s delve into why this is crucial and how it affects your business operations.

Why Are Quarterly Estimated Taxes Vital for Small Businesses?

Avoiding Penalties: Much like for freelancers, the IRS expects businesses to pay taxes as they earn. Delaying all tax payments until the end of the year might result in penalties for underpayment.

Cash Flow Management: Paying in smaller chunks quarterly can ease the burden of a larger year-end tax bill. This allows businesses to plan their finances better and maintain healthy cash flow.

Predictability and Planning: Regularly assessing your income and expenses can provide valuable insights into your business’s health, helping you make informed decisions throughout the year.

Calculating Estimated Taxes for Small Businesses:

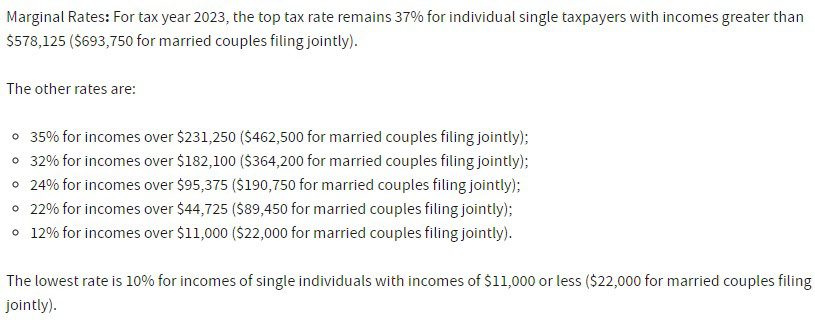

To gauge your quarterly tax, you’ll need to estimate your total expected income for the year, then account for deductible business expenses to determine your net income. Apply your net income to the current tax brackets to approximate your tax for the year. Subsequently, divide this sum by four to get your quarterly obligation.

Example:

Imagine you expect to earn $60,000 this year with $20,000 in business expenses. Your estimated net income is $40,000. If you estimate your tax rate to be 22%, your annual tax would be $8,800. Divide this by four, and you should pay $2,200 each quarter.

Ways to Pay:

You can pay directly on the IRS website. The IRS offers the Electronic Federal Tax Payment System (EFTPS) for corporations for ease of payment. However, if you prefer traditional methods, sending a check or money order is also an option.

Additional Tips for Small Businesses:

Stay Organized: Maintain meticulous records of all your transactions, expenses, and revenues. Consider using accounting software or hiring a bookkeeper to streamline this.

Adjust Accordingly: The business landscape is ever-evolving. If your business has a more profitable quarter than expected, adjust your next estimated tax payment to reflect that. The same goes if you face unexpected downturns.

Consult Professionals: While it’s possible to handle this on your own, working with a tax professional can help you optimize deductions, minimize liabilities, and ensure compliance.

For small businesses, understanding and efficiently managing quarterly estimated taxes can mean the difference between smooth sailing and choppy financial waters. Not only does it prevent unnecessary penalties, but it also equips business owners with insights for better financial planning. When tax matters feel overwhelming, always consider seeking advice from professionals, and remember that a proactive approach now can lead to more predictable and stable financial outcomes in the future.

Schedule a free tax consultation with us at Taxfully to learn more.