What are Grouping Activities?

Grouping activities involve consolidating multiple business operations or rental activities into one entity for tax purposes. This strategy is especially useful for meeting IRS material participation requirements and maximizing tax benefits.

Benefits of Grouping Activities

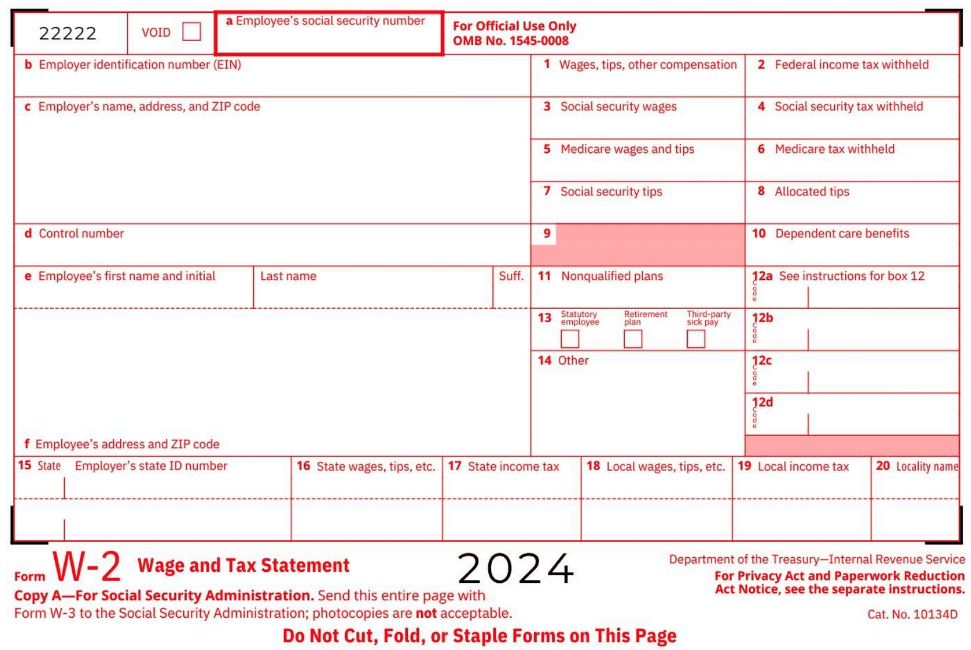

(W-2 + Grouping activities = big tax refund)

Meet Material Participation Requirements

By grouping activities, you can more easily satisfy IRS rules on material participation, ensuring your business activities are considered non-passive.

Offset Passive Losses

Transform passive losses into non-passive losses, allowing you to deduct them against other income types and potentially save significant taxes.

W-2 + Grouping activities = big tax refund

Simplify Record-Keeping

Consolidating activities simplifies tax preparation and record-keeping, reducing administrative burdens and making financial management more efficient.

How to Group Activities

To implement grouping activities effectively, follow these steps:

Identify Related Activities

Identify business or rental activities that share operational similarities, location, control, and interdependence.

Make the Election

Formally declare your grouping decision when filing taxes by attaching a statement that justifies why these activities form an economic unit.

Maintain Detailed Records

Keep thorough documentation supporting your grouping decision, including time logs, business interdependencies, and ownership details.

Example Statement for Grouping Election

“I, [Taxpayer Name], am electing under Section 469 of the Internal Revenue Code to group the following activities as a single activity: [Description of Activities]. These activities are grouped because they constitute an appropriate economic unit due to [Reasons for Grouping].”

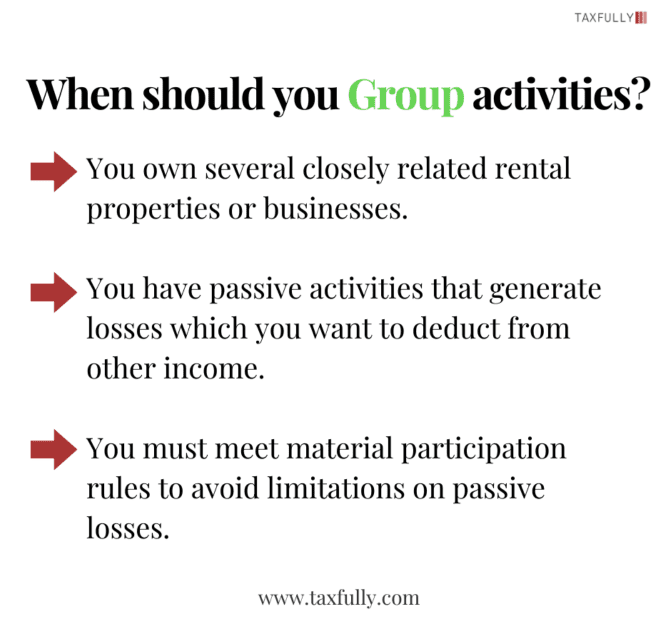

When Should You Consider Grouping Activities?

Grouping activities can provide significant benefits if:

- You own multiple closely related rental properties or businesses.

- You have passive activities generating losses that you want to offset against other income.

- You need to meet material participation requirements to avoid passive loss limitations.

You may also like to read:

Maximizing Savings: Short-Term Rentals Cut Taxes by $9,400!

A short–term rental refers to a rental of any residential home unit or accessory building for a short period of time. This…

Read More

Important Considerations and Risks

IRS Scrutiny

Anticipate IRS scrutiny and ensure your grouping decision is well-documented to withstand audits.

Changing Grouping Elections

Changing your grouping election requires IRS approval, so choose wisely initially.

Impact on Passive Activity Loss Rules

Understand how grouping affects your ability to deduct passive losses and plan accordingly.

Conclusion

Grouping activities is a powerful strategy for reducing taxes, simplifying tax reporting, and meeting IRS requirements. Consult a tax professional to determine if grouping is right for your situation and to properly execute the election.