Starting a nonprofit is an exciting step toward making a positive impact. But before you can fully operate as a tax-exempt organization, you need to apply for that status with the IRS. To do so, you’ll need to choose between two forms: IRS Form 1023 and IRS Form 1023-EZ. This guide will explain what each form is, the eligibility requirements, and which one is best for your nonprofit.

What Is IRS Form 1023?

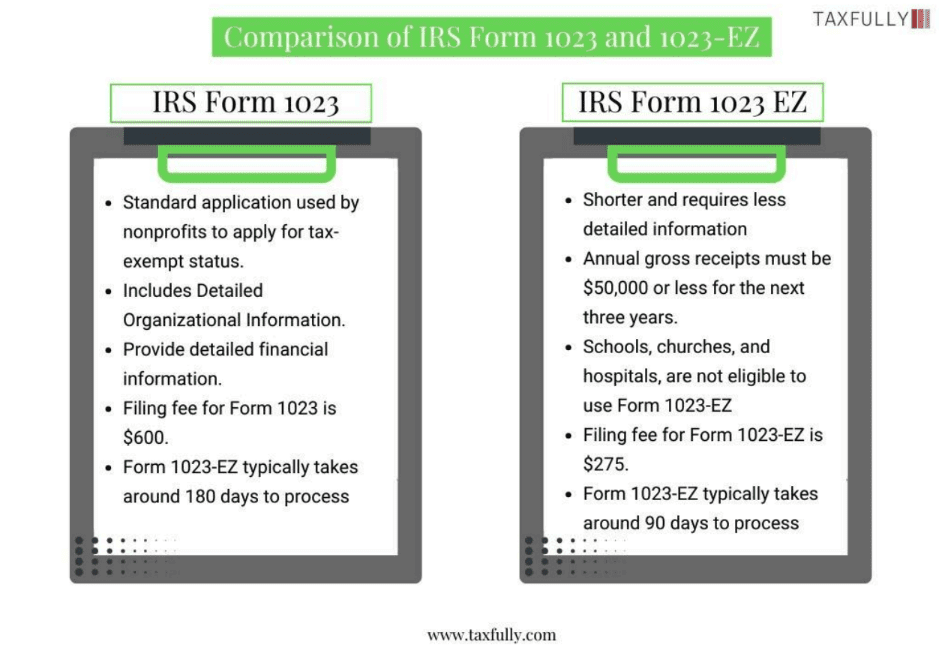

IRS Form 1023, also called the “Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code,” is the standard application used by nonprofits to apply for tax-exempt status. It’s a more detailed and comprehensive form, requiring specific information about your nonprofit’s structure, finances, and operations.What Is IRS Form 1023?

IRS Form 1023, also called the “Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code,” is the standard application used by nonprofits to apply for tax-exempt status. It’s a more detailed and comprehensive form, requiring specific information about your nonprofit’s structure, finances, and operations.

Key Features of Form 1023:

- Detailed Organizational Information: Includes bylaws, articles of incorporation, and a description of your nonprofit’s activities.

- Financial Projections: You’ll need to provide detailed financial information, including past budgets or projections for the next three years.

- Narrative of Activities: A section where you explain the goals and mission of your nonprofit in detail.

Who Should Use Form 1023?

What Is IRS Form 1023-EZ?

IRS Form 1023-EZ is a simplified version of the standard application designed for smaller nonprofits. It’s shorter and requires less detailed information, making the application process faster and easier for organizations that meet the specific eligibility criteria.

Eligibility for Form 1023-EZ:

- Your organization’s projected annual gross receipts must be $50,000 or less for the next three years.

- The total value of your nonprofit’s assets must be $250,000 or less.

- Some organizations, such as schools, churches, and hospitals, are not eligible to use Form 1023-EZ.

Benefits of Form 1023-EZ:

- Lower Cost: The filing fee for Form 1023-EZ is $275, compared to $600 for the full Form 1023.

- Faster Processing Time: Form 1023-EZ typically takes around 90 days to process, while Form 1023 can take up to 180 days.

Comparing Form 1023 and Form 1023-EZ

Cost, Process, and Review Time

- Cost: Form 1023 is $600; Form 1023-EZ is $275.

- Length: Form 1023 is 12 pages long, with additional schedules and attachments; Form 1023-EZ is only 3 pages.

- Processing Time: Form 1023 takes 6 months on average, while Form 1023-EZ takes about 3 months.

Which Form Is Right for Your Nonprofit?

If your nonprofit is small and unlikely to grow quickly, Form 1023-EZ is a faster and more affordable option. However, if you anticipate growth or more complex operations, Form 1023 may provide better long-term security and less IRS scrutiny down the road.

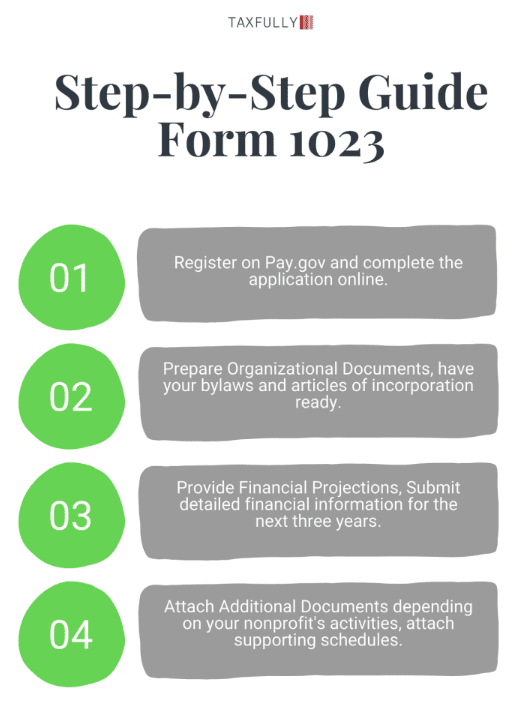

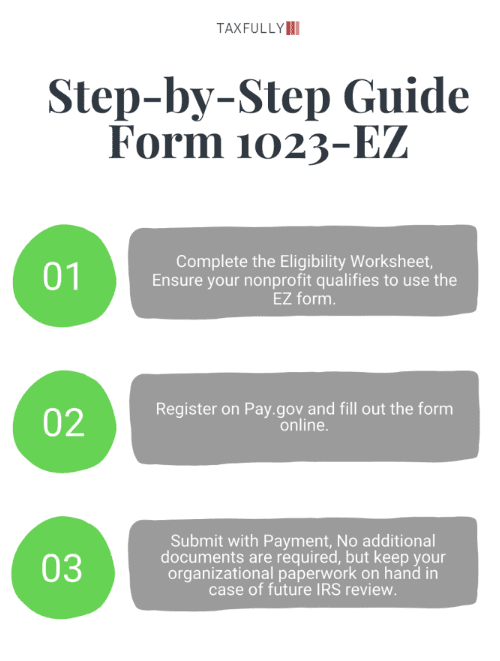

How to Apply Using Form 1023 and 1023-EZ

Step-by-Step Guide for Each Form:

You may also like to read:

What Is a 1023 Form: Tax-exempt Status for Non-profits

Navigating the world of tax-exempt status for non-profits can be tricky, especially when it comes to understanding IRS…

Read More

Key Documents You’ll Need:

- Articles of Incorporation

- Bylaws

- Financial Projections (for Form 1023)

- Narrative of Activities (for Form 1023)