Receiving a letter from the IRS can feel overwhelming, especially for small business owners who already have a lot on their plate. However, these letters are often routine and can be dealt with efficiently if you know what to do. Whether it’s a reminder, a clarification request, or a more serious notice like a penalty or audit, it’s essential to handle it promptly.

This guide will walk you through what to expect, how to respond, and how to avoid penalties that could harm your business.

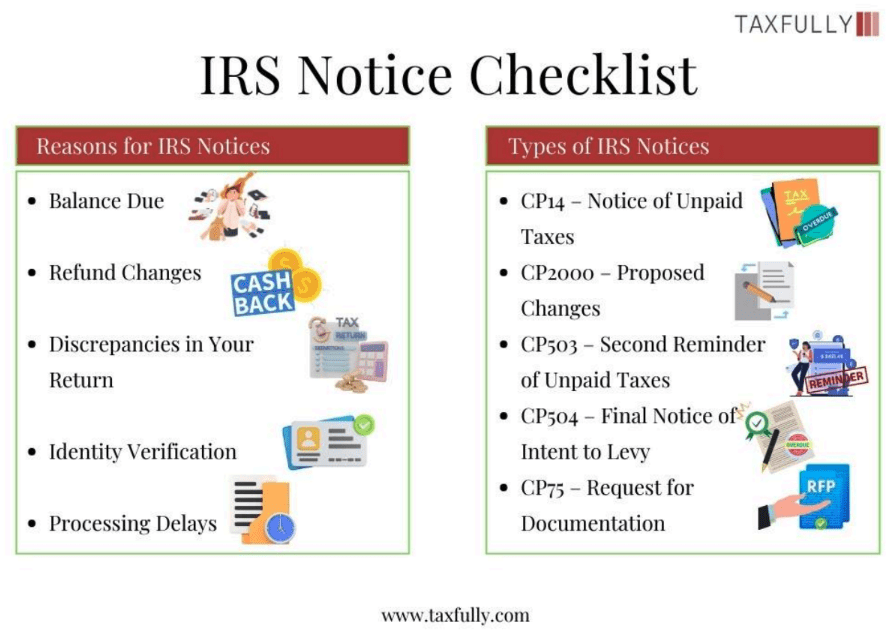

Common Reasons for IRS Notices

IRS letters or notices can arrive for many reasons. Here are some common examples:

- Balance Due: You owe taxes that haven’t been paid yet.

- Refund Changes: The IRS adjusted your refund amount.

- Discrepancies in Your Return: Information in your tax return doesn’t match IRS records.

- Identity Verification: The IRS needs to confirm your identity.

- Processing Delays: Your tax return is delayed, and the IRS is updating you on its status.

The key to handling these letters is not to panic. Many are simply informational, but it’s still essential to read them carefully.

Types of IRS Notices

The IRS sends out different types of notices depending on the situation. Some common ones include:

- CP14 – Notice of Unpaid Taxes: Sent when there’s an outstanding tax balance. You will be given instructions on how to pay.

- CP2000 – Proposed Changes: The IRS finds discrepancies between your return and the information it has from third parties like employers or banks.

- CP503 – Second Reminder of Unpaid Taxes: If you’ve missed the initial notice, this second reminder will urge you to act.

- CP504 – Final Notice of Intent to Levy: This is a more serious notice where the IRS warns of a levy on assets if taxes remain unpaid.

- CP75 – Request for Documentation: The IRS asks for more documents to verify specific credits or deductions on your tax return.

Each notice will include a deadline and instructions on how to respond. Pay close attention to these, as missing the deadlines could lead to penalties.

Steps to Responding to IRS Notices

1. Read the Notice Carefully

Don’t just glance at the letter. Read through it entirely to understand the issue at hand. Every IRS notice will explain the problem and provide instructions on how to respond.

2. Verify the Information

Compare the notice with your tax return or business records. If you believe the IRS made an error, gather all relevant documents to prove your case. If you agree with the notice, follow the instructions to take action.

3. Respond Promptly

Most notices will include a deadline. Make sure to respond within the timeframe provided to avoid additional penalties or interest. Ignoring these deadlines will only make things worse.

4. Make a Payment if Required

If the notice states that you owe money, try to pay the full amount by the due date. If you can’t, consider setting up a payment plan with the IRS to avoid further interest and penalties.

5. Keep a Copy of Everything

Always keep copies of the notice, your response, and any documentation you provide. This will help if the IRS asks for further information or if you need to refer back to it later.

6. Contact the IRS if You Have Questions

If something in the notice is unclear, call the IRS directly at the number provided on the letter. Be sure to have your notice number and tax return information handy.

Common Penalties and How to Avoid Them

- Failure-to-File Penalty: This happens if you don’t file your tax return on time. Avoid it by setting calendar reminders or hiring a tax professional to ensure your return is filed by the deadline.

- Failure-to-Pay Penalty: This occurs when you don’t pay your taxes by the due date. If you can’t pay the full amount, set up an installment plan with the IRS to avoid extra charges.

- Accuracy-Related Penalty: This penalty is charged if there are major errors in your return. Double-check your information or hire a professional to review your taxes to ensure accuracy.

By addressing these issues before they become serious, you can save your business money and avoid unwanted stress.

You may also like to read:

20 Essential Tax Deductions for Doctors and Psychologists10 Common Red Flags That Trigger Small Business Tax Audits

Nobody enjoys the idea of an IRS audit, especially when you’re busy running a small business. Audits can be stressful…

Read More

How Taxfully Can Help

At Taxfully, we understand how stressful receiving an IRS notice can be. Our team specializes in helping small business owners handle these situations, including resolving issues and helping reduce or eliminate penalties.

Here’s How We Help:

- Penalty Abatement: If you’re facing penalties, we can help you request a reduction or elimination of those penalties through a process called penalty abatement. Whether due to a one-time error or an unforeseen event, we’ll work with the IRS to explain your situation and negotiate the best outcome.

- Documentation Assistance: If you need to provide extra documents or clarification to the IRS, we’ll ensure you have everything organized and submitted correctly.

- IRS Representation: If you’re unsure how to navigate the IRS process, our experts can represent you and deal directly with the IRS on your behalf.

When to Seek Professional Help

Some situations require professional assistance, especially if:

- You’re Facing a Large Penalty: A tax professional can help negotiate with the IRS and possibly reduce what you owe.

- You’ve Received Multiple Notices: If you’ve received more than one notice and are unsure how to proceed, a professional can ensure the issues are handled properly.

- You’re Dealing with Complex Issues: Certain IRS matters, such as audits or wage levies, are best handled with professional guidance.

Don’t wait until it’s too late—getting professional help can save you from costly mistakes.

Conclusion

Handling IRS letters and notices may seem intimidating, but it’s manageable if you approach it calmly and methodically. Always respond promptly, verify the information, and keep detailed records of every interaction with the IRS. If things get complicated or you’re unsure of how to proceed, don’t hesitate to seek professional help.