Life gets busy, and missing the tax deadline happens more often than you think. Whether you forgot, faced unexpected hurdles, or just didn’t know where to start, you’re not alone. The good news? It’s never too late to file your taxes and get back on track. Here’s a straightforward guide to help you tackle late tax returns step by step.

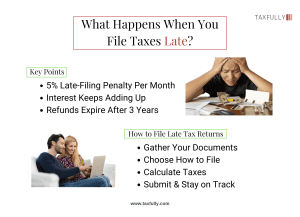

Why Filing Late Is a Big Deal

When you miss the tax deadline, a few things can happen:

- Penalties Pile Up: The IRS charges a late-filing penalty (5% of unpaid taxes per month) and interest.

- Refunds Can Expire: If the IRS owes you a refund, you have just three years to claim it.

- It Gets Harder to Catch Up: The longer you wait, the more intimidating it feels, but remember—you can always file.

Steps to File Late Tax Returns

Step 1: Gather Your Documents

Start with the basics:

- W-2 Forms: From employers, showing your income.

- 1099 Forms: For freelance work, investments, or other earnings.

- Receipts and Records: For deductions like charitable donations or medical expenses.

Can’t find everything? Don’t worry. You can request copies from employers, banks, or the IRS directly.

Step 2: Choose How to File

Pick a method that works for you:

- Do-It-Yourself: Use IRS-approved tax software for easy e-filing.

- Work with a Professional: A CPA can handle the details and save you time.

- Mail Your Forms: If you prefer paper, mail your completed tax forms to the IRS.

Pro Tip: If you’re filing for a previous year, use the correct year’s tax forms—rules and deductions change annually.

Step 3: Calculate What You Owe (or What You’re Owed)

- If you owe taxes: Filing stops the hefty late-filing penalty (5% per month). Even partial payments reduce your overall debt.

- If you’re owed a refund: File ASAP to get your money! Refunds can expire after three years, so don’t wait too long.

Step 4: Submit Your Tax Return

File your return electronically for the fastest processing. If you’re mailing it, double-check the IRS mailing address for your region.

What to Do If You Can’t Pay

Option 1: Apply for a Payment Plan

The IRS offers options:

- Short-Term Plan: Pay within 180 days.

- Long-Term Installments: Spread payments over months or years.

Option 2: Explore Relief Programs

If you missed filing due to circumstances like illness or natural disasters, you might qualify for penalty waivers.

What If You’re Due a Refund?

Here’s the best part: If the IRS owes you money, there’s no penalty for filing late. However, you must file within three years to claim it. The longer you wait, the longer it takes to receive your refund.

Avoid Future Late Filing

- Set Reminders: Mark key tax deadlines on your calendar.

- Use Extensions: File Form 4868 to extend your deadline by six months.

- Stay Organized: Keep receipts, W-2s, and other documents in one place year-round.

- Work with Tax Professionals: They’ll make sure you stay on top of deadlines and maximize refunds.

Why Trust Taxfully?

Filing late taxes can feel overwhelming, but Taxfully makes it simple:

- Expert Support: Our team of CPAs ensures your taxes are filed accurately and on time.

- Flexible Solutions: Whether you owe money, need a refund, or have multiple years of returns, we’ve got you covered.

- No Surprises: Transparent pricing and personalized guidance every step of the way.

Don’t let late taxes weigh you down. Whether you owe money or are owed a refund, the best time to file is now. Visit Taxfully to connect with our experts and take the first step toward financial peace.

Start today—it’s easier than you think!