Charitable contributions are a powerful way to support causes you care about while potentially lowering your tax bill. However, specific rules and limits determine how much you can deduct. Knowing how these apply—and the benefits available in your state—can help you maximize your savings.

What Counts as a Charitable Contribution?

A charitable contribution is any donation of cash or property made to a qualified nonprofit

organization, such as a charity, religious group, or educational institution. For a donation to be

deductible, the recipient must be a qualified organization under IRS rules. These organizations

work for religious, educational, scientific, literary, or charitable purposes.

Key Steps to Deducting Charitable Contributions:

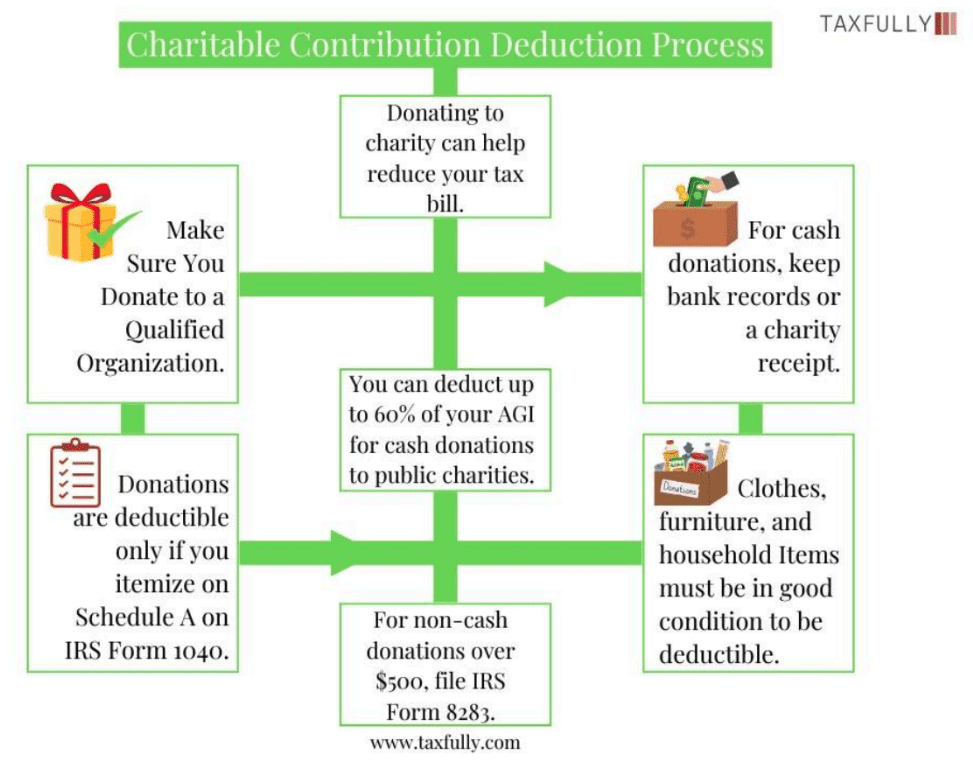

- Make Sure You Donate to a Qualified Organization To claim a tax deduction, you need to give to an organization recognized by the IRS as tax-exempt. Donations to individuals, political groups, or candidates do not count.

- Itemize Your Deductions You can only deduct charitable donations if you itemize your deductions on your tax return using Schedule A of IRS Form 1040. The standard deduction might be higher than your total itemized deductions, so it’s essential to compare both options.

- Keep Good Records For cash contributions, you’ll need to keep bank records, payroll deductions, or written communication from the charity to prove your donation. For non-cash donations worth over $500, you must file IRS Form 8283.

How Much Can You Deduct?

- Cash Contributions: You can deduct up to 60% of your adjusted gross income (AGI) for cash contributions to public charities.

- Non-Cash Contributions: For non-cash donations like goods or stocks, the limit is generally 30% of your AGI.

- Appreciated Assets: If you donate assets such as stocks, you might be able to eliminate paying capital gains taxes, while still claiming the fair market value of the donation.

You may also like to read:

Estate and Gift Taxes: What You Need to Know

Navigating the world of taxes can be daunting, especially when it comes to estate and gift taxes. These taxes often…

Read More

State-by-State Breakdown

While federal deductions for charitable giving are important, states also offer their own incentives. Let’s look at how some states provide tax benefits for charitable donations.

- Minnesota: Non-Itemizer Charitable Deduction In Minnesota, you can reduce your taxable income by 50% of your charitable donations that exceed $500, even if you don’t itemize your federal return. This is called the “non-itemizer charitable deduction,” and it allows more taxpayers to benefit from charitable giving.

- Arizona: Enhanced Standard Deduction Arizona allows taxpayers to increase their state standard deduction by 25% of the value of their charitable contributions, even if they do not itemize on their federal return. This makes charitable giving more attractive for non-itemizers.

- Colorado: Subtraction for Charitable Contributions Colorado lets residents subtract charitable donations that exceed $500 from their taxable income, even if they take the federal standard deduction. The state caps the allowable deduction at 50% of your AGI.

- Massachusetts: Deductions for Part B Income Starting in 2023, Massachusetts allows a charitable deduction to reduce Part B income (which includes wages and other taxable income). The deduction is limited to 50% of your Part B income.

- New York: Income-Based Deduction Adjustments In New York, charitable deductions are adjusted based on income levels. High earners may face limits on how much of their charitable contributions they can deduct, but there are still benefits for taxpayers who fall below these thresholds.

- Utah: Charitable Contribution Tax Credit Utah provides a 6% tax credit for charitable contributions. This credit is applied to your taxable income, making charitable giving even more beneficial in the state.

- Wisconsin: 5% Tax Credit for Charitable Giving Wisconsin offers a 5% tax credit for charitable donations that exceed the state’s standard deduction. This means you can get a direct reduction in your state tax bill for your contributions.

Non-Cash Donations

Donating clothes, furniture, or other household items? These must be in good condition or better to be deductible. If you donate a vehicle, the deduction depends on how much the charity sells he car for, unless they use it for their operations.

Tips to Maximize Your Charitable Tax Deductions:

- Donate Appreciated Securities: Donating stocks or bonds that have increased in value allows you to avoid capital gains taxes while claiming the full market value as a deduction.

- Bunching Strategy: If your total deductions don’t exceed the standard deduction, consider bunching multiple years of donations into one year to qualify for itemizing.

- Track All Donations: Even small donations add up. Keep receipts or written proof of every donation you make throughout the year.

Conclusion

Charitable donations are a wonderful way to give back while potentially lowering your tax bill. By understanding the rules and keeping good records, you can make sure your generosity pays off come tax season. Whether you’re donating cash, goods, or appreciated assets, taking advantage of these tax benefits helps you give smarter.

Make sure to consult with a tax professional or financial advisor to maximize your tax benefits and ensure you’re following all IRS and state regulations.