Table of Contents

S Corp Tax Savings

How you can save $10,000 or more in taxes as a small business owner (it’s something, your accountant doesn’t tell you)

Many LLC owners strive to optimize their tax strategies. One option to consider is structuring your business as an S corporation, also known as an S Corp. This legal designation offers distinct tax advantages compared to traditional sole proprietorships or Limited Liability Companies (LLCs).

By doing so and taking a reasonable salary you could save $10,000 in taxes and even more each year. That’s a significant saving!

Here's a breakdown of the key benefits:

Limited Liability Protection: Shield Your Personal Assets

An S corporation separates your personal assets (house, car, etc.) from business assets. This means that if your business faces lawsuits or incurs debts, your personal belongings are generally protected from creditors.

Avoid Double Taxation: Keep More of Your Profits

S corporations are considered “pass-through entities” by the IRS. This means the business itself doesn’t pay corporate income tax. Instead, the profits or losses “pass through” to the shareholders’ personal tax returns and are taxed only once at the individual income tax rate.

This avoids double taxation, which occurs in traditional corporations where profits are taxed at the corporate level and again when distributed to owners as dividends.

Let’s See how this Business managed to save in taxes, you can do the same, by electing as an S Corp for your LLC

Mortgage Potential: Invest your money for better returns

Since S corporations allow for a potentially higher after-tax income through pass-through taxation and strategic salary/dividend distribution, this can significantly improve your chances of qualifying for a mortgage and potentially securing a more favorable loan amount.

Important Considerations for S Corporations

While S corporations offer tax advantages, there are also factors to consider:

Entity and Structural Requirements:

● Domestic Corporation: Your business must be incorporated within the United States.

● Ineligible Corporations: Certain businesses like insurance companies, financial institutions, and domestic international sales corporations are not eligible for S Corp status.

● One Class of Stock: You can only have one class of stock with equal rights to distribution and liquidation proceeds, regardless of voting rights.

Shareholder Requirements:

● Number of Shareholders: There can be no more than 100 shareholders.

● Eligible Shareholders: Shareholders must be U.S. citizens or permanent residents, and can only be individuals, certain trusts, or estates. Partnerships and other corporations cannot be shareholders.

Filing Requirements:

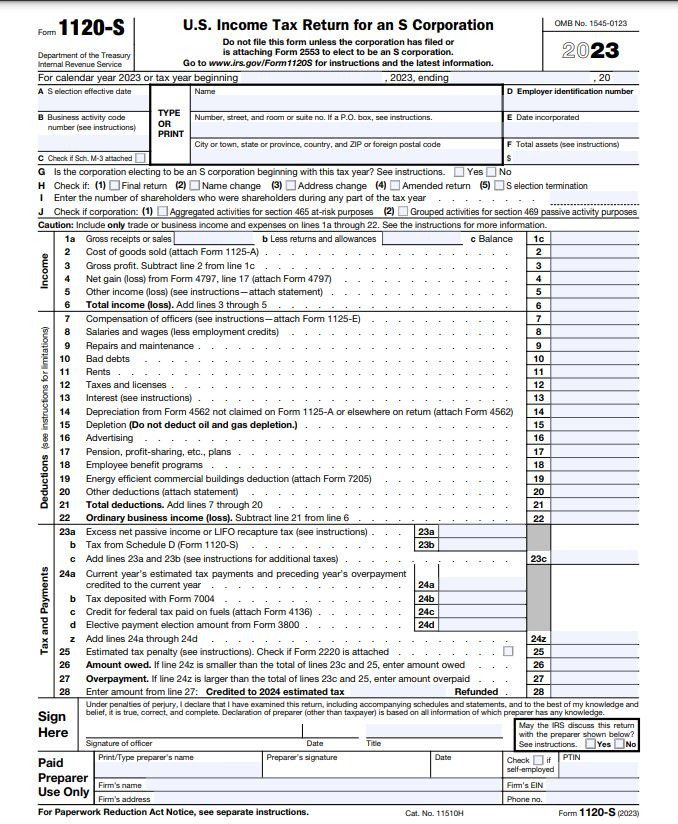

● Form 1120S, U.S. Income Tax Return for an S Corporation: by the 15th day of the 3rd month after the end of the tax year (March 15th for calendar year corporations in 2024). Extensions can be requested using Form 7004, also due on March 15th.

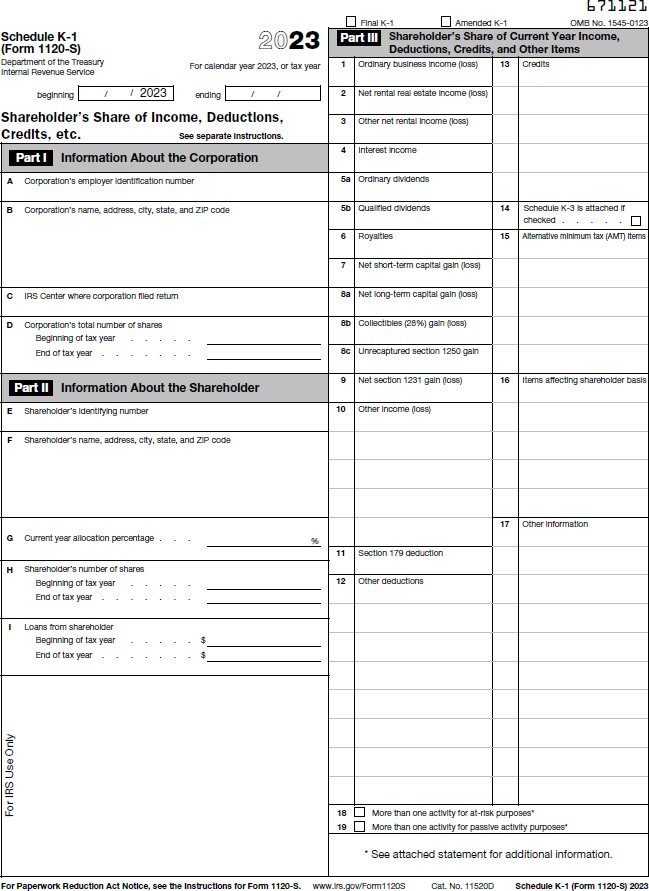

● Schedule K-1: This form is attached to Form 1120S and reports each shareholder’s share of the business’ taxable net income so they can report it on their personal tax returns.

Exploring the Suitability of an S Corp for Your Business

The decision to convert to an S Corp should be made after careful consideration of your specific business circumstances. Factors such as your current tax situation, projected profitability, and long-term growth plans all play a role. Consulting with a tax professional is crucial to determine if an S corporation is the most advantageous structure for your business.

And here's a bonus:

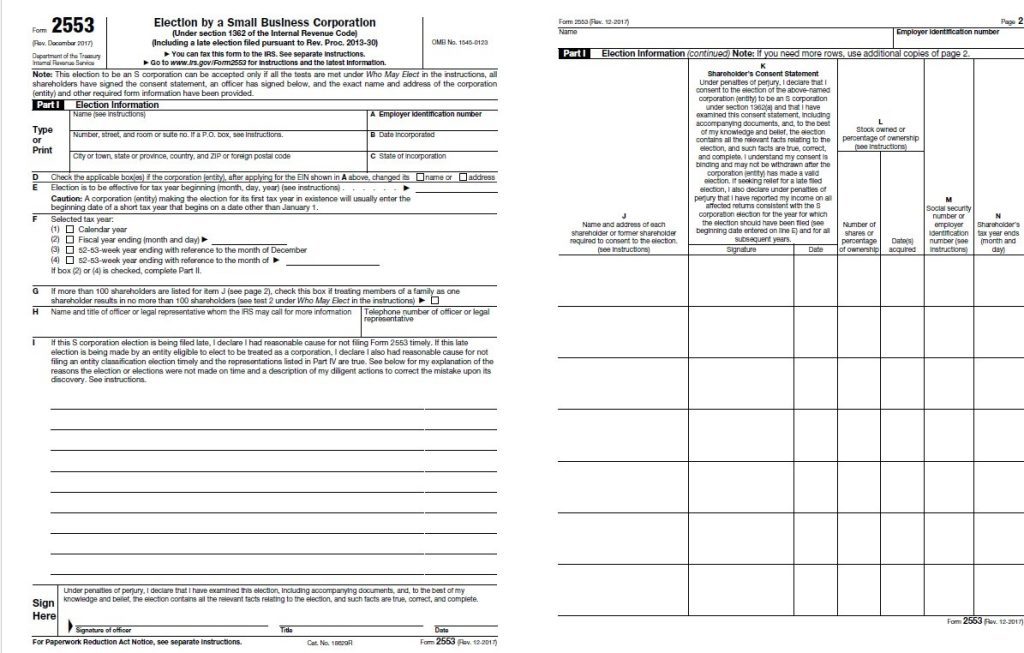

Forms to submit an S Corp election:

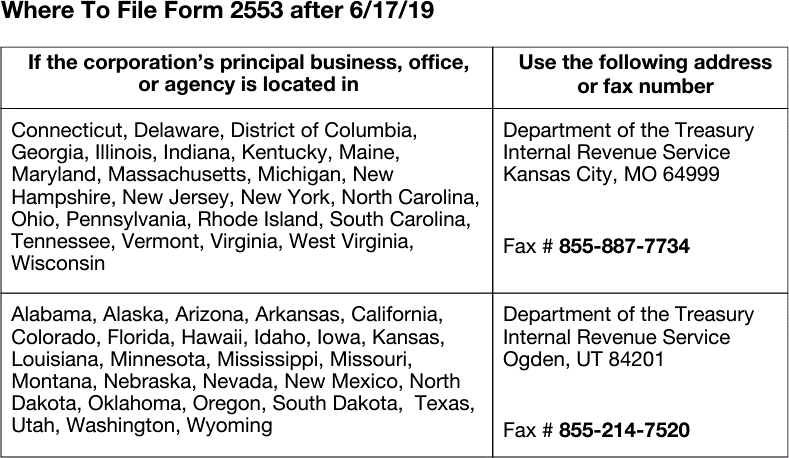

Filing addresses per state:

Forms to file S Corp taxes: 1120S/K-1 schedule.

Sch K-1:

Understanding S Corporation Tax Returns and Schedule K-1

• Informational Tax Return: An S corporation files a tax return on Form 1120S, which is informational and does not involve the payment of taxes at the federal level.

• Role of Schedule K-1: After filing Form 1120S, each shareholder receives a Schedule K-1. This document reports their share of the corporation’s net profits or losses.

• Impact on Personal Taxes: The information from Schedule K-1 flows into Form 1040, where shareholders report their personal income taxes. The net profits or losses from the K-1 are incorporated into their personal tax calculations.

• Taxation Rates: The profits of an S corporation are subject to ordinary income tax rates at the shareholder level.

• Offsetting Losses: Generally, losses reported on the K-1 from an S corporation can offset non-passive income, such as wages from a W-2, on the shareholder’s personal tax return.

The S corporation itself does not pay taxes directly, its shareholders are taxed on their individual portions of the corporate income, which aligns with the entity’s pass-through taxation structure.