Navigating the world of taxes can be daunting, especially when it comes to estate and gift taxes. These taxes often seem complex, but understanding the basics can help you plan better and make informed decisions. In this blog post, we’ll break down estate and gift taxes in simple terms, so you can grasp the essentials without getting lost in jargon.

What Are Estate and Gift Taxes?

Estate and gift taxes are two types of taxes that can impact your wealth and how it is transferred. Here’s a straightforward explanation:

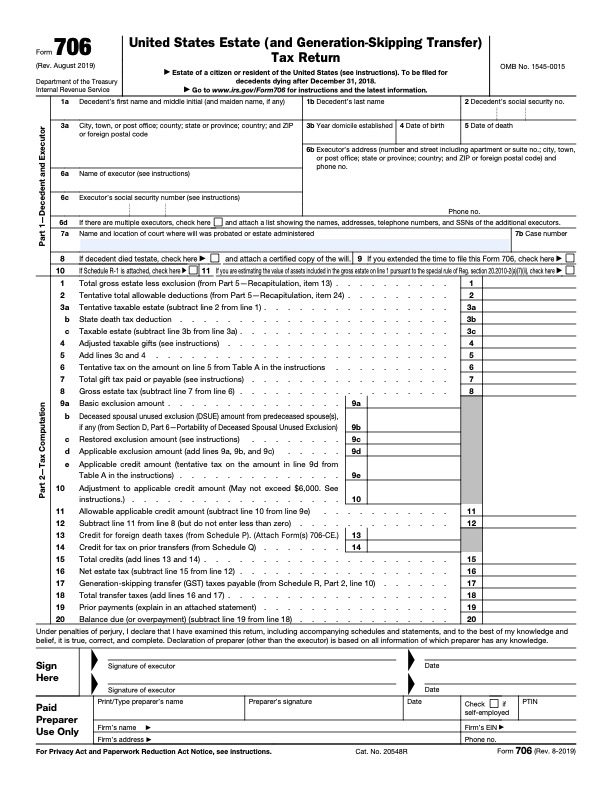

- Estate Tax: This is a tax on the total value of a person’s estate at the time of their death. It applies to the combined value of everything the deceased owned, including property, bank accounts, and investments.

- Gift Tax: This tax is applied to transfers of property or money given as gifts during a person’s lifetime. It’s meant to prevent people from avoiding estate taxes by giving away their assets before they die.

How Estate Taxes Work

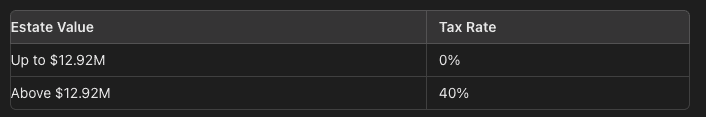

Key Points About Estate Taxes:

- Exemption Limits: The exemption amount can change annually due to inflation adjustments. Check the latest figures from the IRS to ensure you have current information.

- State Estate Taxes: In addition to federal estate taxes, some states impose their own estate taxes with lower exemption thresholds. Be aware of the rules in your state.

- Deductions: Certain deductions, like those for charitable donations or spousal transfers, can reduce the taxable value of an estate.

How Gift Taxes Work

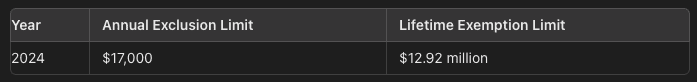

Gift taxes apply when you transfer assets to someone else as a gift. For 2024, you can give up to $17,000 per year per recipient without incurring gift taxes. This amount is known as the annual gift tax exclusion. Gifts above this limit may be subject to gift taxes, although they may also count against your lifetime gift exemption, which is part of the federal estate tax exemption amount.

Key Points About Gift Taxes:

Annual Exclusion Amount: You can give up to $17,000 per person each year without triggering gift taxes. This amount may change periodically.

Lifetime Exemption: Any gifts above the annual exclusion count against your lifetime exemption amount. This lifetime exemption is the same as the estate tax exemption ($12.92 million for 2024).

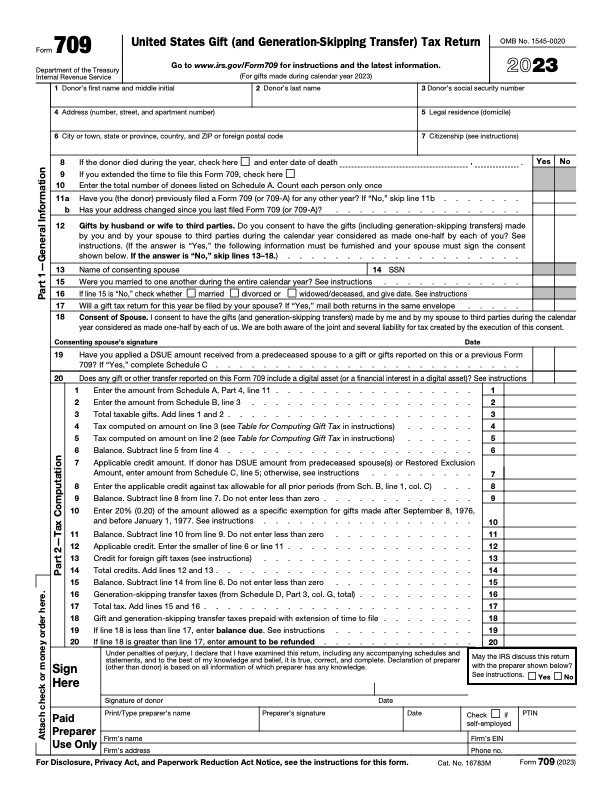

Reporting Gifts: Large gifts must be reported to the IRS using Form 709. Even if no taxes are due, proper reporting is required.

Planning for Estate and Gift Taxes

Proper planning can help minimize the impact of estate and gift taxes. Here are some strategies to consider:

Use of Trusts: Establishing trusts can help manage your estate and potentially reduce taxes. Trusts can provide benefits like avoiding probate and reducing estate taxes.

Gifting Strategies: Regularly gifting assets within the annual exclusion limit can reduce the size of your estate over time, thus minimizing estate taxes.

Consult with Professionals: Estate planning can be complex. Working with an attorney or tax advisor can help ensure your estate plan is effective and compliant with the law.

Common Misconceptions

- Estate Tax Only Affects the Wealthy: While the federal estate tax exemption is high, many states have lower thresholds. Be sure to understand your state’s rules.

- Gifts Are Always Taxed: Not all gifts are taxed. As long as you stay within the annual exclusion limit, you won’t incur gift taxes.

- Estate Taxes Are Only for the Rich: Estate taxes can impact anyone with a sizable estate, particularly in states with lower exemption thresholds.

Conclusion