Losing someone close to us is a deeply emotional experience, and amidst the grief, there are practical matters to handle, such as managing their estate. You might inherit money, property, or other valuable assets. A common question that arises is, “Does inheritance count as income?” In most cases, inherited cash isn’t subject to tax. However, if you invest this cash or place it in an interest-bearing account, the income it generates may be taxable. This guide will help you navigate these concerns and understand the importance of inheritance tax planning. Our goal is to help you safeguard what you’ve worked hard for and ensure it reaches the right people with minimal stress.

Understanding Inheritance and Taxation

Inheritance can include many different things—money, property, stocks, or even personal items like jewelry. Most of the time, the assets you inherit are not considered income. This means you don’t have to report them on your federal income tax return.

However, there are some exceptions. For example, if you inherit a retirement account or certain types of stocks, the income they generate might be taxable. This is known as “Income in Respect of a Decedent” (IRD). It’s important to know about these exceptions so that you can avoid any surprises later on.

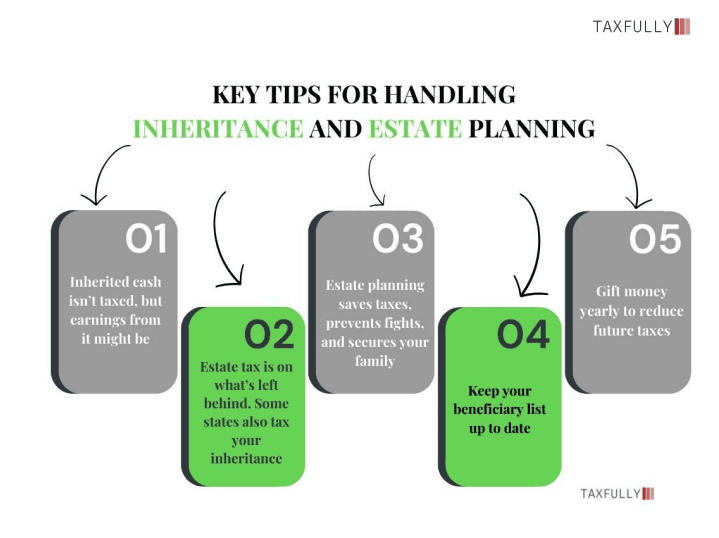

Here are some key points:

- Cash Inheritance: Generally, inherited cash isn’t taxable by the IRS.

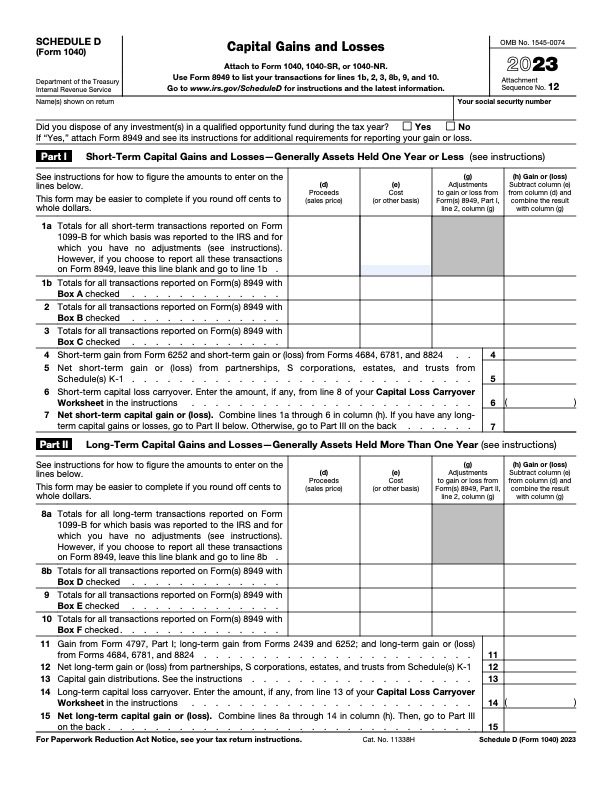

- Taxable Income: If you invest your inheritance or put it in an interest-bearing account, the income it generates may be taxable.

- Tax-Free Source: Whether the income is taxable depends on whether it comes from a tax-free source.

There are also two important taxes to know about:

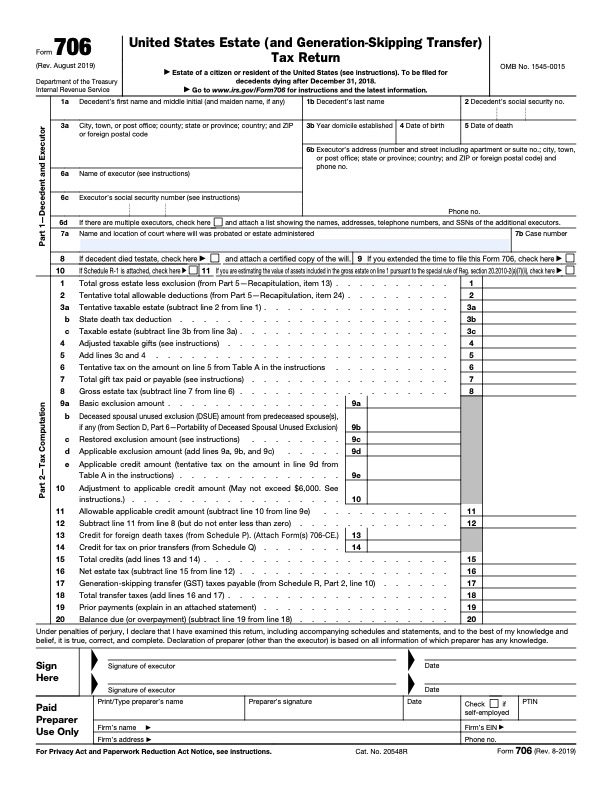

- Estate Tax: This tax applies to the total value of the deceased person’s estate before it is given to the heirs. As of 2023, estates worth over $12.92 million may face federal estate taxes.

- Inheritance Tax: Some states impose a tax on the value of the assets you inherit. The amount you pay depends on the value of the inheritance and your relationship to the deceased. Close relatives often pay less or no inheritance tax.

The Importance of Estate Planning

Estate planning is important for everyone, not just the wealthy. It ensures your assets are protected and go to the right people. Here’s why it matters:

- Preserving Wealth: Without proper planning, taxes can take a large portion of your estate. Estate planning helps reduce these taxes and ensures more of your assets go to your loved ones.

- Avoiding Family Disputes: Clear instructions in your estate plan can prevent conflicts and misunderstandings among your family members.

- Ensuring Financial Security: Proper planning helps ensure that your spouse, children, or other dependents are financially secure even after you’re gone.

Planning ahead gives you peace of mind. It also protects your family from financial hardship.

You may also like to read:

Real Estate Taxes: Schedule E, C, and D

Real estate can be a smart investment, but when tax season rolls around, knowing how to report your real estate taxes…

Read More

Practical Steps for Effective Tax and Estate Planning

If you haven’t started planning your estate yet, now is a great time to begin. Here are some practical

steps you can take:

- Create a Will: A will is the foundation of any estate plan. It outlines how you want your assets to be distributed and who will be responsible for carrying out your wishes.

- Establish Trusts: Trusts can help reduce estate taxes and provide more control over how your assets are distributed. For instance, you can set up a trust to manage your child’s inheritance until they reach a certain age.

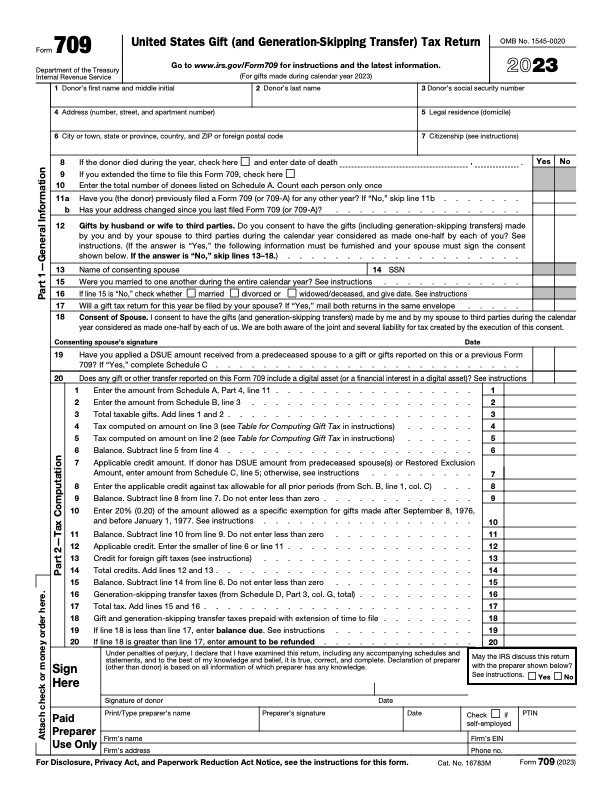

- Consider Gifting: You can give a certain amount of money or assets to your heirs each year without paying a gift tax. This helps reduce the size of your estate and the potential estate tax.

- Review Beneficiary Designations: Make sure the beneficiaries on your retirement accounts, life insurance, and other financial assets are up to date. This ensures that the right people inherit your assets.

- Consult a Tax Professional: Tax laws can be complex and vary by state. A tax professional can help you navigate these laws and find the best strategies to minimize taxes on your estate.

Conclusion

Inheritance can be a blessing, but it comes with responsibilities, especially when it comes to taxes. Understanding how inheritance is taxed and taking the time to plan your estate can save your loved ones from financial and emotional stress.

Remember, estate planning isn’t just about money; it’s about caring for your family’s future. By planning now, you can ensure that your loved ones are protected and that your legacy is preserved.

You may want to check the IRS Forms that can help you with getting this done or contact us to help you with it