Managing a business is no small feat, especially when it comes to handling finances. This is where CFO services come in handy. They offer expert guidance to help you understand your financial health and create a clear plan for the future. Whether you’re scaling up or maintaining your current operations, CFO services can be the partner you need to make well-informed financial decisions.

Key Takeaways

- CFO services provide expert financial guidance to help decode complex financial data.

- They assist in creating a clear financial path for your business.

- These services can boost profitability and improve cash flow.

- Outsourcing CFO services can be a cost-effective solution with access to specialized expertise.

- CFO services help in strategic financial planning and risk management.

The Responsibilities of a CFO

Strategic Financial Planning

A Chief Financial Officer (CFO) is crucial in shaping a company’s financial future. They develop and implement financial strategies that align with the company’s goals. This includes making significant investment and financing decisions. A CFO’s role is vital for the long-term success of the business.

Risk Management

Managing risk is another key responsibility of a CFO. They oversee risks related to cash flow, capital, and compliance. By identifying potential financial threats, they help the company avoid pitfalls and stay on a stable financial path. This involves working closely with other departments to ensure all financial risks are managed effectively.

Investor Relations

CFOs also play a significant role in communicating with investors and the board of directors. They build credibility for the company’s strategic direction and ensure that investors are well-informed about the company’s financial health. This includes preparing detailed financial projections and reports to keep stakeholders updated.

In short, a CFO oversees all the company’s finances. This includes everything from accounting to budgeting to tax planning.

The Difference Between a CFO, a Bookkeeper and a Controller

Bookkeepers play a crucial role in maintaining the financial health of a business. They are responsible for entering data into the books and keeping records up to date. Bookkeeping is essential for business success. It involves tracking all income and expenses, paying bills, invoicing, and managing payroll. They handle the day-to-day financial activities of a business and record all income and expenses.

A controller is like the quarterback of the accounting team, overseeing all accounting operations. They make sure that the company’s financial data is accurate and up-to-date. A controller oversees the accounting operations of a company. This senior position generally requires years of proven experience in various levels of accounting and finance.

Lastly, the CFO analyzes all these pieces of information and strategizes the best way for the company to achieve its financial goals and make sound financial decisions. They are doing all the financial planning for both short and long-term, managing operations, assets and financial risks.

How CFO Services Improve Profitability and Cash Flow

CFO services play a crucial role in enhancing a business’s profitability and cash flow. By providing expert financial guidance, they help business owners make informed decisions that drive growth and efficiency. CFO services scrutinize your company’s expenses to identify areas where cost-cutting and budgeting can increase cash flow. This ensures that funds are available for immediate needs while also investing in future opportunities.

Boosting Profit Margins

One of the primary ways CFO services improve profitability is by boosting profit margins. They analyze financial data to find inefficiencies and recommend strategies to reduce costs. This might include renegotiating supplier contracts, optimizing pricing strategies, or streamlining operations. By focusing on these areas, CFOs help businesses increase their bottom line.

Optimizing Cash Flow

Cash flow management is more than just increasing revenue. CFO services track spending and identify areas for improvement. They help businesses maintain a balance between covering immediate expenses and investing in growth opportunities. This delicate balancing act ensures that the company remains financially healthy and can seize new opportunities as they arise.

Strategic Financial Planning

Strategic financial planning is another key area where CFO services add value. They work with business owners to create long-term financial plans that align with the company’s goals. This includes setting financial targets, forecasting future performance, and developing strategies to achieve these objectives. With a clear financial path, businesses can navigate challenges and capitalize on growth opportunities more effectively.

CFO services offer expertise, customized solutions, and a technology-driven approach to help businesses manage finances efficiently and make informed decisions.

Examples: Why a Good CFO is Important

Case Studies

Let’s take for example how the CFO played a pivotal role for Walmart and Alibaba.

The CFO of Walmart led an innovative digital initiative. Through the acquisition of thriving e-commerce platforms and substantial investments in their online infrastructure, Walmart sought to provide a smooth shopping experience. By integrating online shopping with the strengths of their physical stores, they developed an omnichannel retail experience that blended the advantages of both.

In Alibaba’s case, acknowledging the opportunities presented by global capital markets, Alibaba’s CFO orchestrated one of the most significant Initial Public Offerings (IPOs) in history. The 2014 IPO on the New York Stock Exchange not only raised the required capital but also established Alibaba as a powerful global e-commerce entity, enhancing its international reputation.

We see how a CFO can make or break a company’s financial future.

The Benefits of Outsourcing CFO Services

Outsourcing CFO services is a smart move, especially for small or medium-sized businesses. It offers many advantages that can help your business thrive.

Cost-Effective Solutions

One of the biggest benefits of outsourcing CFO services is the cost savings. You get expert financial advice at a fraction of the cost of hiring a full-time, in-house CFO. This means you can allocate your resources more efficiently and focus on growing your business.

Access to Expertise

Outsourced CFO services give you access to financial experts with a wide range of experiences. These professionals stay updated with the best practices in the field, ensuring that your business benefits from the latest financial strategies. This access to expertise can lead to more business productivity and better outcomes.

Flexibility and Scalability

With outsourced CFO services, you have the flexibility to engage financial experts for specific projects or part-time work. This means you can scale the services up or down based on your business needs. This flexibility is particularly beneficial for businesses that experience seasonal fluctuations or are in the growth phase.

Outsourcing CFO services allows business owners to access top-notch financial expertise without the commitment of a full-time hire. This can lead to more efficient operations and peace of mind.

In summary, outsourcing CFO services can streamline your operations, ensure accuracy, and provide peace of mind, helping you avoid the pitfalls of DIY financial management.

Navigating Financial Complexities with CFO Services

Financial Analysis and Strategy

Chief financial services offer expert financial guidance, helping you decode the numbers and make sense of your business’s financial health. They analyze current and projected finances to understand your strengths and weaknesses. Then, they advise you on resource allocation that aligns with your business goals.

Budgeting and Forecasting

If you are a business owner juggling sales, marketing, and operations while trying to make sense of your financial reports, you can easily understand what this situation is all about. It’s overwhelming. Hence, you need a trusted partner who can handle the finances and help you develop a clear path forward. CFO services can be that partner. They go beyond managing budgets and compliance.

Compliance and Reporting

You shouldn’t need to worry about the complexities of finances on top of running your company. Fractional CFO services give you access to several finance services that you may otherwise not have access to. These services will help your business grow and be a leader in the industry, while helping you get access to what your business needs, whether that is financial planning, making sure you are tax compliant, analyze risks or help increase the efficiency of your operations!

CFO Services for Small to Medium-Sized Enterprises

Tailored Financial Solutions

For small to medium-sized enterprises (SMEs), having access to CFO services can be a game-changer. These services offer customized financial solutions that fit the unique needs of each business. Whether it’s a small business accountant or a part-time CFO, the goal is to provide expert financial guidance that aligns with the company’s objectives.

Growth Opportunities

CFO services help SMEs identify and seize growth opportunities. By analyzing market trends and financial data, a CFO can pinpoint areas where the business can expand. This strategic insight is invaluable for companies looking to scale up and compete in larger markets.

Protecting Against Risks

Risk management is another critical area where CFO services excel. They help businesses identify potential risks and develop strategies to mitigate them. This proactive approach ensures that SMEs are better prepared to handle financial uncertainties and challenges. They also make sure the business achieves tax compliance.

With the right CFO services, small to medium-sized enterprises can navigate the complexities of financial management with confidence and ease.

How CFO Services Help in Resource Optimization

Cost Reduction

CFO services can help your business by reducing costs and fixed overheads. They might renegotiate vendor or client contracts to ensure your pricing is in line with industry standards. Effective cost-cutting strategies can make a big difference in your bottom line. Additionally, CFOs can analyze your supply chain management to find more ways to save money.

Efficiency Improvement

By reorganizing the finance function, CFO services can improve efficiency. This means less time spent on financial and management report preparation. They provide management with up-to-date reports for decision-making, which helps in running the business smoothly. Streamlining processes can lead to significant time and cost savings.

Capital Management

CFO services assist in raising capital, which is often the most stressful part of running a business. With access to a network of financiers, they can help you secure the funds needed for growth. They also optimize working capital management, ensuring that your business has the cash flow it needs to operate effectively.

CFO services can be a game-changer for businesses looking to optimize their resources and improve overall efficiency.

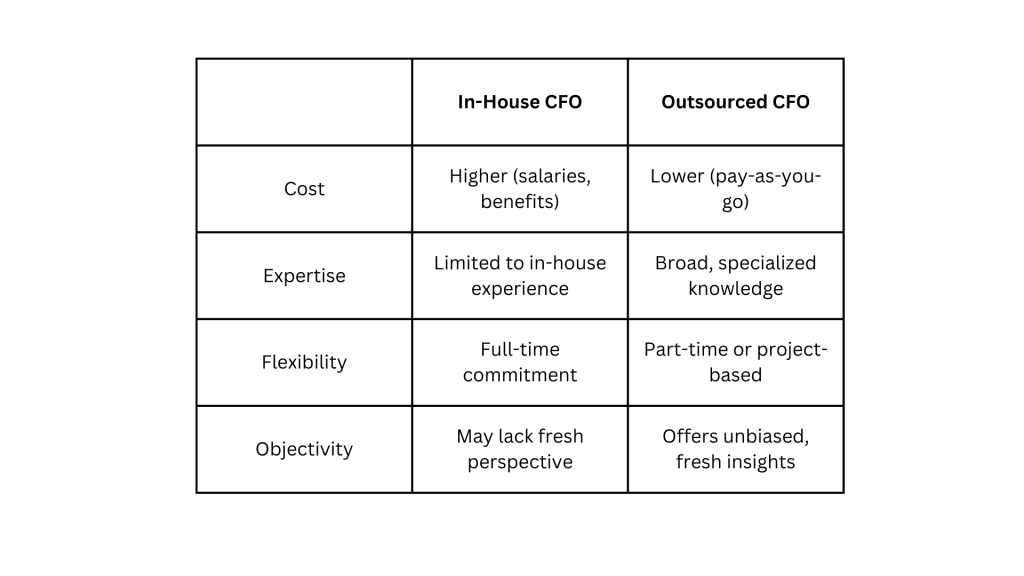

Choosing Between In-House and Outsourced CFO Services

When deciding between in-house and outsourced CFO services, it’s important to weigh the pros and cons of each option. Both have unique benefits that can significantly impact your business’s financial health.

Pros and Cons

In-house CFOs offer the advantage of being fully integrated into your company. They understand the business’s day-to-day operations and can provide immediate support. However, they come with higher costs, including salaries, benefits, and other overheads.

Outsourced CFOs, on the other hand, bring specialized knowledge and experience that may not be available in-house. They can offer insights into financial strategy, risk management, and financial reporting, tailored to your company’s specific needs. Flexibility is a key benefit, as you can engage an outsourced CFO for specific projects or part-time work.

Making the Right Choice

To make the right choice, consider your business’s specific needs and financial situation. If you need constant, hands-on financial management, an in-house CFO might be the best fit. However, if you require specialized expertise and flexibility, while on a budget, an outsourced CFO could be more beneficial.

Aligning with Business Goals

Ultimately, the decision should align with your business goals. Whether you choose an in-house or outsourced CFO, the key is to ensure they can help you understand your business’s financial landscape, maximize profits, and grow with confidence.

An external CFO offers a fresh perspective, helping you identify financial blind spots and navigate complex financial challenges with ease.

Conclusion

In the end, CFO services can be a game-changer for business owners. They provide the financial expertise and strategic insight needed to navigate the complex world of business finance. Whether you’re looking to grow, stabilize, or simply make more informed decisions, a CFO can be your trusted partner. By taking the financial reins, they allow you to focus on what you do best—running your business. So, if you’re feeling overwhelmed by financial tasks, consider bringing a CFO on board. It might just be the best investment you make for your business’s future.