Managing taxes can feel overwhelming, especially if your financial situation is complex. A trusted CPA or tax accountant near you can simplify the process, ensuring compliance while maximizing your tax benefits. However, finding the right professional can be challenging. This guide will help you locate a trusted CPA or tax accountant near you and explain how Taxfully can make the process seamless and stress-free.

Why You Need a CPA or Tax Accountant

A CPA does more than just calculate numbers. They are licensed professionals with in-depth knowledge of tax laws and financial planning. Their expertise ensures you stay compliant with tax regulations while maximizing your financial benefits. Here’s how they can help:

- Accurate Tax Filing: They ensure your tax return is complete and free from errors, reducing the risk of audits.

- Maximized Tax Savings: CPAs help identify deductions and credits you might otherwise miss.

- Representation Before the IRS: Should you face an audit or tax dispute, a CPA can represent you and handle the complexities.

- Year-Round Planning: Beyond tax season, CPAs provide strategies to optimize your finances, ensuring long-term savings.

Whether it’s managing personal taxes, handling business finances, or both, working with a CPA allows you to focus on what matters most while leaving tax headaches behind.

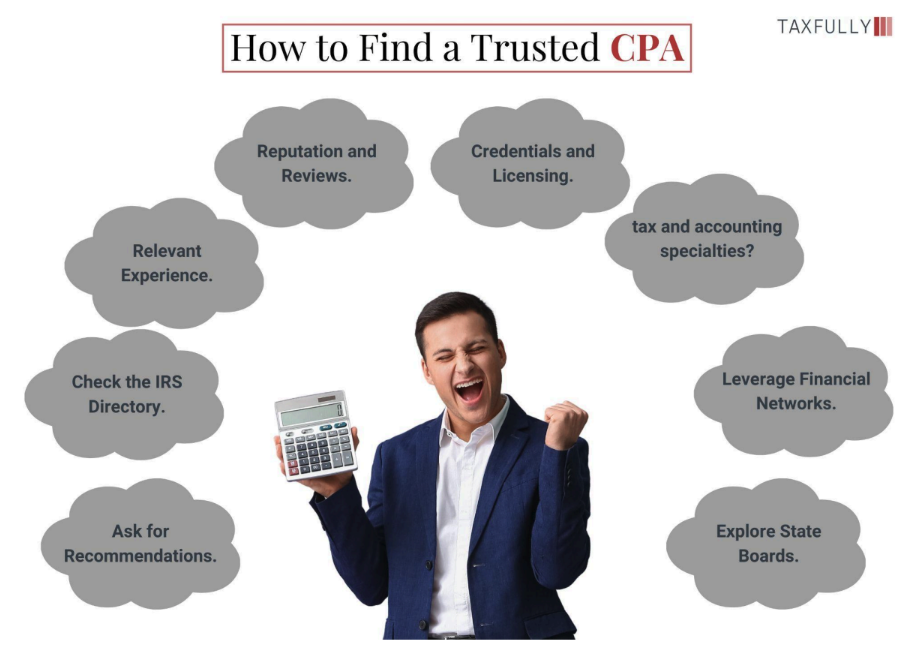

How to Start Your Search

Finding the right CPA requires some effort, but with the right approach, it’s manageable. Here are some steps to kickstart your search:

- Ask for Recommendations:

Friends, family, or colleagues can often point you toward CPAs they’ve had positive experiences with. Personal referrals are an excellent starting point. - Check the IRS Directory:

The IRS offers a searchable database of credentialed tax preparers. Look for CPAs or enrolled agents who have a Preparer Tax Identification Number (PTIN). - Explore State Boards:

State accountancy boards maintain directories of licensed CPAs. These databases also include information about the CPA’s licensing status and any disciplinary actions. - Leverage Financial Networks:

Your bank, financial advisor, or even local business groups might recommend trusted CPAs. - Online Reviews and Directories:

Platforms like Yelp or Google Reviews can offer insights into a CPA’s reputation. Look for professionals with consistently high ratings and positive client feedback.

What to Look for in a CPA

Choosing a CPA goes beyond just finding someone licensed. Here are critical factors to consider:

- Credentials and Licensing:

Confirm they are a licensed CPA with a PTIN. Use tools like CPA Verify to check their standing. - Relevant Experience:

Look for someone who understands your specific needs. For instance, if you’re a small business owner, hire a CPA experienced in business tax filings. - Services Offered:

Ensure they provide the services you require, such as tax planning, financial consulting, or audit representation. - Fee Transparency:

Understand their pricing structure. Some CPAs charge hourly rates, while others work on flat fees or per-form charges. Avoid those who base fees on your tax refund. - Reputation and Reviews:

Online reviews and personal references can help gauge the CPA’s reliability and professionalism. - Communication Style:

Choose someone you feel comfortable with and who explains financial concepts in a way you understand. Open communication ensures smoother collaboration.

You may also like to read:

Why Hiring a CPA Can Transform Your Small Business: Key Benefits and Tax Advantages

Running a small business comes with plenty of challenges—managing finances, ensuring tax compliance, and making sound financial decisions can feel overwhelming. This…

Read More

Questions to Ask Your CPA

Before you hire a CPA, ask questions to ensure they’re the right fit. Here are some key ones:

- What areas of tax and accounting do you specialize in?

This will help you understand if their expertise aligns with your needs. - How do you stay updated on tax law changes?

Tax laws change frequently. Ensure your CPA stays informed to provide the best advice. - Will you represent me in case of an audit?

A good CPA will stand by you if the IRS has questions about your tax return. - What is your fee structure?

Transparency in pricing avoids surprises later. - How will we communicate, and how often?

Establish a clear communication plan that works for both of you.

Their responses will give you confidence in their abilities and help you decide if they’re the right choice.

The Taxfully Advantage

Finding and working with a CPA shouldn’t be stressful, and that’s where Taxfully comes in. We simplify the process by connecting you with vetted, licensed professionals who are experts in tax preparation and financial planning.

Here’s why Taxfully is the smart choice:

- Trusted Professionals: All our CPAs are thoroughly vetted and highly experienced.

- Tailored Services: From personal tax filings to complex business tax strategies, our experts cater to your unique needs.

- Transparent Pricing: With clear fee structures, you’ll always know what to expect.

- Convenience: Skip the guesswork and let us match you with a CPA who fits your specific requirements.

Make Tax Season Stress-Free

Your search for the perfect CPA doesn’t have to be overwhelming. Let Taxfully help you find a professional who will handle your taxes with care, expertise, and efficiency. Ready to make your tax season stress-free?

Visit Taxfully today and start your journey to financial peace of mind!