The W-4 form, also known as the Employee’s Withholding Certificate, is a simple but essential document you fill out when starting a job. It helps your employer determine how much federal income tax to withhold from your paycheck. If filled out correctly, it ensures you don’t owe a large tax bill or miss out on a refund when filing your taxes.

1. What Is a W-4 Form?

A W-4 form is an IRS document that tells your employer how much federal income tax to deduct from your paycheck. The form considers your filing status, number of dependents, and other factors that affect your tax liability.

- Key Point: The more accurately you fill it out, the better you can manage your tax payments throughout the year.

- Example: If you claim dependents or other deductions, less money will be withheld from your paycheck.

2. Why Is the W-4 Form Important?

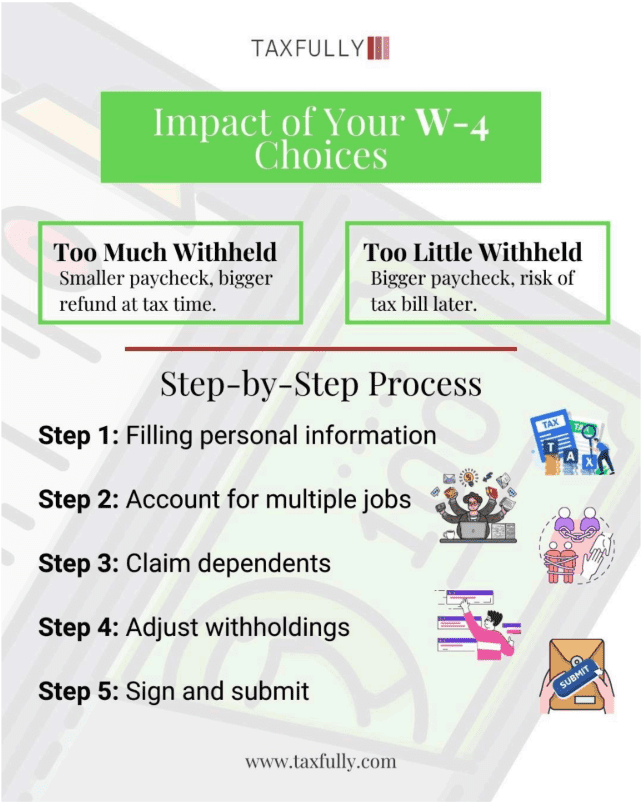

The W-4 directly impacts your paycheck and tax filing:

- Too much withheld: You’ll get a refund at tax time, but your monthly budget will be tighter.

- Too little withheld: You’ll have more take-home pay, but you might owe taxes later.

- Tip: Review your W-4 if you got a large refund or owed taxes last year to make adjustments.

4. Step-by-Step Guide to Filling Out the W-4

Step 1: Enter Personal Information

Provide your name, address, Social Security number, and filing status (single, married, head of household, etc.).

- Tip: Your filing status affects the tax credits and deductions you qualify for.

Step 2: Account for Multiple Jobs

If you or your spouse have more than one job, follow the instructions:

- Use the IRS’s online Tax Withholding Estimator for accuracy.

- Check the box in Step 2(c) if you and your spouse have two jobs with similar pay.

- Example: A couple with similar incomes can simplify withholding by checking the box for both employers.

Step 3: Claim Dependents

If your income is under $200,000 ($400,000 if married filing jointly), claim dependents here:

- Multiply the number of children under 17 by $2,000.

- Multiply other dependents by $500.

- Tip: If you want to withhold more taxes, you can choose not to claim dependents.

You may also like to read:

20 Essential Tax Deductions for Doctors and Psychologists

For self-employed physicians, other medical professionals, and mental health professionals…

Read More

Step 4: Adjust Withholdings

This step is optional and allows you to refine your withholdings:

- Enter extra income (like dividends or gig work) on Line 4(a).

- Enter additional deductions if you plan to itemize deductions.

- Use Line 4(c) to withhold an extra amount if needed.

- Example: If you earn side income, adding extra withholding prevents a big tax bill.

Step 5: Sign and Submit

Sign and date the form and submit it to your employer.

- Tip: If your employer offers an online payroll system, you can often complete the form digitally.

5. Tips for Accurate Completion

- Use Online Tools: The IRS Withholding Estimator can help ensure accuracy.

- Double-Check Details: Ensure your name, Social Security number, and deductions are correct.

- Review Regularly: Major life events or income changes are good reasons to update your W-4.

- Seek Help: If you’re unsure, consult a tax professional.

Conclusion

Filling out a W-4 form is straightforward if you break it into simple steps. By providing accurate information, you can avoid surprises at tax time and better manage your finances throughout the year. Take a few minutes to review your W-4 today, especially if you’ve had any major life changes recently. Accurate withholding means fewer headaches and more control over your money!