Why Audits Happen

Nobody enjoys the idea of an IRS audit, especially when you’re busy running a small business. Audits can be stressful, costly, and time-consuming. However, the good news is that IRS audit triggers for small businesses are often predictable and avoidable. Understanding the common “red flags” that attract the IRS’s attention can help you stay audit-free. According to IRS data, businesses earning more than $200,000 annually are more likely to be audited, but that’s not the only factor. In this guide, we’ll cover 10 common IRS audit triggers for small businesses and, most importantly, how you can avoid them to keep your business in the clear.

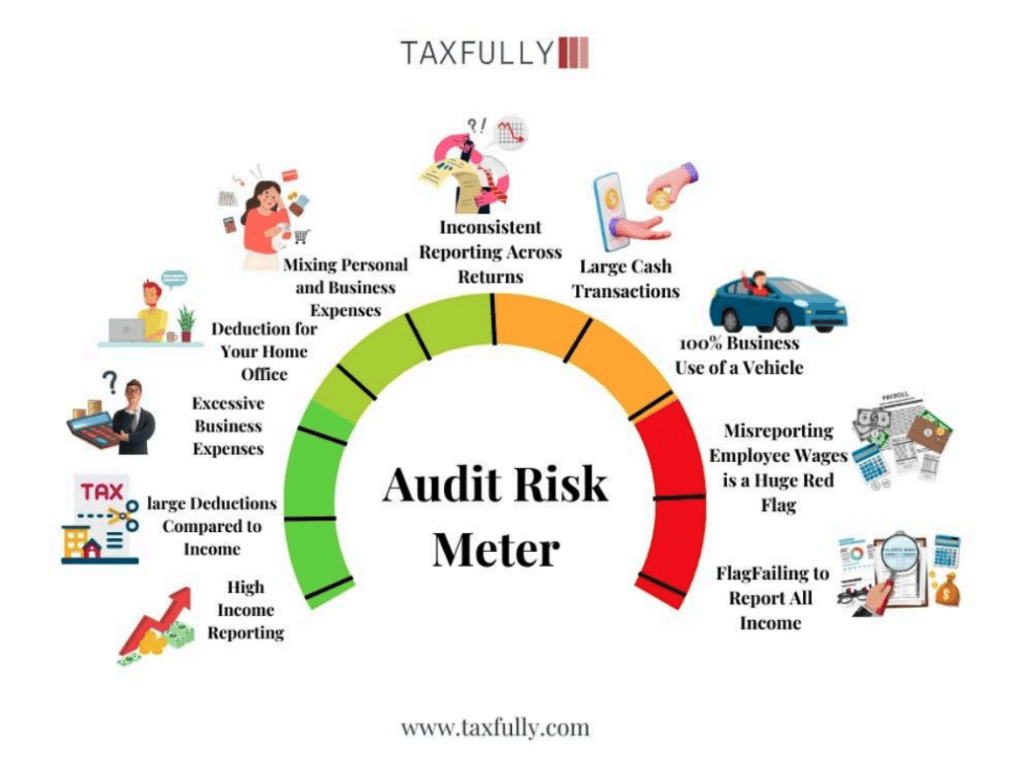

1. High Income Reporting

If your business earns a high income, especially more than $200,000 per year, you’re at a higher risk of being audited. The IRS pays more attention to businesses with higher earnings, as discrepancies here can lead to significant tax recoveries. The more you make, the more scrutiny you face. To avoid unnecessary attention, make sure to report all of your income accurately.

Double-check every 1099 or W-2 form you receive, and ensure everything lines up. Having a solid bookkeeping system in place will help you keep track of your income so nothing slips through the cracks.

2. Significant Deductions Compared to Income

Claiming large deductions that seem disproportionate to your income is a common red flag. For instance, if your business reports $100,000 in income but claims $75,000 in deductions, the IRS may question whether all those deductions are legitimate. To avoid this, make sure that all your deductions are necessary and ordinary business expenses. Keep proper receipts and documentation to back up every deduction you claim. It’s also helpful to ensure your deductions align with your industry norms, making it clear to the IRS that everything is above board.

3. Excessive Business Expenses

Certain business expenses are scrutinized more than others, especially things like meals, travel, and entertainment. If your business claims a large number of expenses in these categories year after year, the IRS might suspect you’re overstating them. To avoid this, be sure that your business expenses are justified. Always keep receipts, invoices, and clear records that explain the business purpose of the expenses. For travel and meals, note who you met with and why the expense was necessary for your business. The more documentation you have, the safer you are in case of an audit.

4. Claiming a Home Office Deduction

The home office deduction is one of the most commonly abused deductions, and because of that, it’s often flagged. The IRS is strict about what qualifies as a home office—it must be a space used exclusively for your business. To avoid any issues here, make sure your home office is a dedicated area, not a shared space like a guest bedroom or living room. Measure the square footage of the office and keep records of the expenses that apply to that part of your home, such as utilities and rent. Having proper documentation shows that you’re using the space appropriately and legally.

5. Mixing Personal and Business Expenses

Mixing personal and business expenses is a surefire way to attract the IRS’s attention. If you’re using your business account to pay for personal expenses, it may look like you’re inflating your business costs to lower your taxes. The solution? Always separate your personal and business finances. Use a dedicated business bank account and business credit card for all your expenses. This keeps your records clean and clear, making it easier for you to file accurate tax returns—and it makes the IRS less likely to investigate.

You may also like to read:

Navigating IRS Penalties: What You Need to Know

If you don’t meet your tax obligations, you might owe a penalty. The IRS charges penalties for various reasons, including if you…

6. Inconsistent Reporting Across Returns

When the information on your various tax returns doesn’t match up, it sends a red flag to the IRS. For example, if your business income reported on your personal return doesn’t match the income reported on your business tax return, the IRS may start looking for inconsistencies. To avoid this, always ensure that all your forms are aligned. Double-check that your personal and business returns match in terms of income and other financial details. Consistency is key in keeping the IRS from probing deeper into your accounts.

7. Large Cash Transactions

If your business handles a lot of cash transactions, like a restaurant or a barbershop, you may be at a higher risk for an audit. Cash transactions are more difficult for the IRS to trace, and businesses that rely heavily on cash often raise concerns about underreporting income. To stay out of trouble, keep detailed records of all your cash transactions and deposit them regularly into your business bank account. A clear paper trail can show the IRS that you’re reporting all income accurately.

8. Claiming 100% Business Use of a Vehicle

Claiming that your vehicle is used solely for business is another audit trigger. The IRS knows that most people use their cars for a mix of business and personal reasons, so claiming 100% business use can seem suspicious—especially if you don’t have another vehicle for personal use. To avoid this, keep a detailed log of your business miles and only claim the portion of vehicle expenses that apply to your business. Accurate records of your vehicle’s use will help you avoid any issues with the IRS.

9. Payroll Issues

Filing payroll taxes late or misreporting employee wages is a huge red flag for the IRS. Payroll taxes fund Social Security and Medicare, so the IRS takes payroll compliance very seriously. To avoid any trouble, make sure to file payroll taxes on time and accurately report employee wages. If you have employees, ensure they are properly classified as full-time, part-time, or contractors. You can also use payroll software to automate the process and avoid missing any deadlines.

10. Failing to Report All Income

Failing to report all your business income, especially cash payments, is one of the quickest ways to trigger an audit. The IRS compares the income you report on your tax return to the 1099s and W-2s it receives from other businesses. If something doesn’t add up, you’re likely to get flagged. The best way to avoid this is to make sure you report all your income, even the small payments. Keep detailed records of every sale or payment you receive to ensure nothing is left out.

Conclusion:

Tax audits are stressful, but many of them can be avoided by understanding these common red flags. The key to avoiding an audit is being prepared—keeping accurate records, reporting all your income, and ensuring your deductions and expenses are reasonable and justified. By staying organized and following best practices, you can lower your chances of an audit and focus on what matters most—growing your business. And remember, if you’re ever unsure about your tax situation, don’t hesitate to reach out to a tax professional for advice.