Your kid can be a millionaire by 18 and save you ~$13,850 every year. Tax savings by hiring your kids in your small business can offer significant benefits while providing them with valuable work experience. This strategy helps reduce your business’s taxable income, shift income to lower tax brackets, and secure future financial stability for your children. Here’s how you can take advantage of the tax savings by hiring your kids.

Tax Savings for the Business

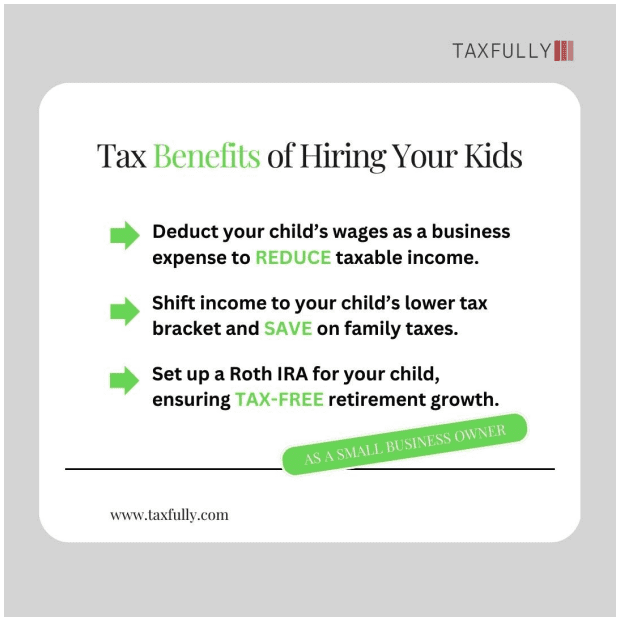

When you hire your children, their wages become a deductible business expense, which reduces your overall taxable income.

- Deductible Wages: Payments made to your children are deductible as a business expense, just like any other employee wages. This reduction in taxable income can lower your overall tax liability.

Example: If you pay your child $13,850 a year, you can deduct that amount from your business income, potentially saving thousands in taxes, depending on your tax bracket.

Income Shifting to Lower Tax Brackets

By paying your children for work performed, you can shift income from your higher tax bracket to your child’s lower tax bracket, reducing the overall family tax burden.

- Standard Deduction for Children: Children can earn up to the standard deduction amount ($13,850 in 2023) without paying any federal income tax.

- Lower Tax Rates: Earnings above the standard deduction are typically taxed at your child’s lower tax rate.

Example: If you are in the 24% tax bracket and shift $13,850 of income to your child, you save $3,324 in federal taxes ($13,850 * 24%).

Retirement Savings Benefits

Hiring your children allows you to set up retirement savings accounts, such as Roth IRAs, in their names, helping to secure their financial future.

- Roth IRA Contributions: Your child can contribute earned income to a Roth IRA. The maximum contribution for 2023 is $6,500. Earnings in a Roth IRA grow tax-free, and qualified withdrawals are also tax-free.

- Long-Term Growth: Starting a Roth IRA at a young age can provide substantial growth over time due to the power of compound interest.

Example: If your child contributes $6,500 annually to a Roth IRA starting at age 16 and continues until age 65, assuming a 7% annual return, the account could grow to over $1.4 million.

Educational and Practical Experience for Children

Beyond the tax benefits, hiring your kids provides them with valuable work experience and teaches them important financial and business skills.

- Work Experience: Your children gain real-world work experience, learning responsibility, and developing a strong work ethic.

- Financial Literacy: Earning their own money and learning to manage it helps your children develop financial literacy skills that will benefit them throughout their lives.

Key Considerations

- Reasonable Compensation: Ensure that the wages you pay your children are reasonable for the work performed. The IRS requires that wages be consistent with what you would pay a non-family member for the same job.

- Age-Appropriate Work: Assign tasks that are appropriate for your child’s age and skills. Younger children can handle simple tasks, while older children can take on more responsibility.

- Proper Documentation: Keep thorough records of hours worked, tasks performed, and wages paid. This documentation is essential if the IRS questions the legitimacy of the employment.

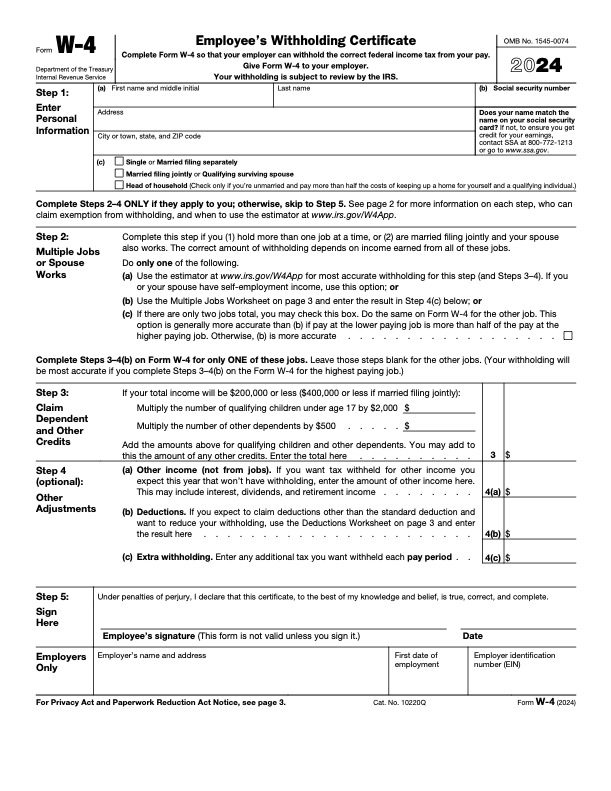

Forms and Resources

- Payroll Records Template: Keep detailed records of the hours your child works and the tasks they perform.

- Roth IRA Contribution Worksheet: Use this to track and manage your child’s retirement contributions.