Cryptocurrency investing can be exciting, but it also comes with challenges, especially when market conditions are unstable. One strategy that can help manage your tax liability and potentially save you money is tax-loss harvesting. This guide will explain what tax-loss harvesting is, how it works with cryptocurrencies, and how you can use it effectively.

What is Tax Loss Harvesting?

Tax-loss harvesting is a method where you sell assets that have decreased in value to reduce your taxable gains. By realizing these losses, you can lower the amount of taxes you owe on your investment profits.

Key Points:

- Realize Losses: Sell investments at a loss.

- Offset Gains: Use these losses to reduce the taxable gains from other investments.

- Deduct from Income: You can also use up to $3,000 of these losses to lower your taxable income from wages.

Here is your complete guide for Cryptocurrency Tax Reporting:

https://taxfully.com/cryptocurrency-taxes/

How Tax Loss Harvesting Works for Crypto

Step-by-Step Guide:

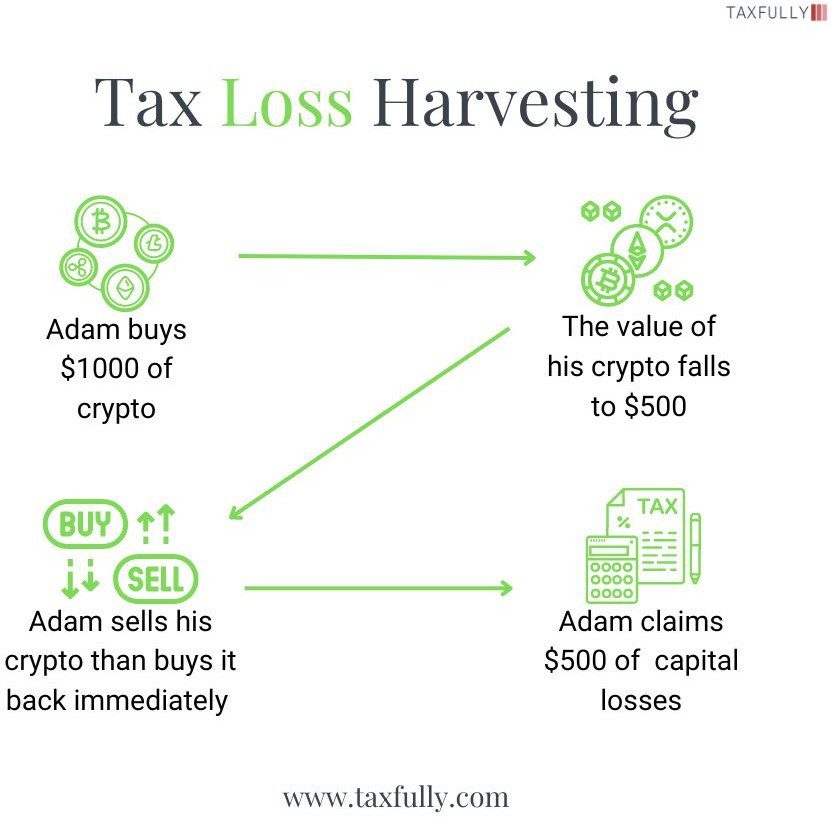

- Identify Crypto Assets with Losses: Look at your cryptocurrency portfolio to find assets that are worth less than what you paid for them.

- Sell the Underperforming Assets: Sell these cryptocurrencies to realize the losses.

- Rebuy the Same or Similar Assets: Unlike stocks, cryptocurrencies are not affected by the “wash sale rule,” so you can buy back the same assets right away if you wish.

- Report the Losses on Your Tax Return: Use the losses to offset gains from other investments. If your losses are more than your gains, you can use up to $3,000 to reduce other types of income and carry forward any remaining losses to future years.

You may also like to read:

Buying and Selling Cryptocurrency Through an LLC

Hey crypto Traders! If you’re trading or planning to, great move. But hold up…

Read More

Example of Tax Loss Harvesting:

Imagine you bought 1 Bitcoin at $50,000, and its value drops to $30,000. If you sell it at $30,000, you incur a $20,000 loss. You can use this $20,000 loss to offset gains from other investments. You can also rebuy Bitcoin at $30,000 to maintain your position in the market.

Benefits of Tax Loss Harvesting

- Reduce Taxable Income: Lower the taxes on gains from other investments.

- Flexibility: You can harvest losses anytime during the year.

- Carry Forward Losses: Unused losses can be applied to future years’ gains.

Key Considerations

- Wash Sale Rule: This rule, which prevents claiming a loss if you buy back the same or similar asset within 30 days, does not currently apply to cryptocurrencies. However, keep an eye on any changes in tax regulations.

- Market Timing: Be mindful of market conditions when selling and buying back cryptocurrencies.

- Transaction Fees: Consider the fees associated with selling and repurchasing assets, as they might affect your overall savings.

Potential Risks

- Market Volatility: Cryptocurrency prices can change quickly, and you might end up repurchasing at a higher price.

- Regulatory Changes: Tax laws can change, so it’s important to stay informed about any updates that may impact your strategy.

Conclusion

Tax-loss harvesting can be a useful tool for cryptocurrency investors to manage their tax liabilities. By strategically selling and repurchasing assets, you can offset capital gains and potentially lower your tax burden. Always consult a tax professional to ensure you are using this strategy effectively and in compliance with current laws.