When starting a business, choosing the right structure is crucial. Two popular options are C corporations and S corporations. While they share some similarities, they also have key differences. In this article we explore these structures in detail, along with partnerships, to help you make an informed decision.

Key Takeaways

- Both C corporations and S corporations offer limited liability protection to their owners, meaning personal assets are typically safe from business debts.

- C corporations face double taxation, where both the company’s profits and the shareholders’ dividends are taxed, whereas S corporations benefit from pass-through taxation.

- S corporations have ownership restrictions, including a limit of 100 shareholders and eligibility criteria for who can be a shareholder.

- C corporations provide more flexibility in terms of ownership and stock options, making them a preferred choice for high-growth startups seeking investment.

- Partnerships differ significantly from corporations in terms of taxation and liability, offering unique advantages and challenges.

Understanding C Corporations

What is a C Corporation?

A C Corporation, often called a C Corp, is a type of business structure where the company is a separate legal entity from its owners. This means the owners, or shareholders, are taxed separately from the business itself. Most large companies choose this structure because it allows for unlimited growth through the sale of stock.

Advantages of C Corporations

C Corporations come with several benefits:

- Unlimited growth potential: They can sell stock to raise funds.

- Limited liability: Shareholders are not personally responsible for the company’s debts.

- No ownership restrictions: Anyone, including other businesses and foreign entities, can own shares.

Disadvantages of C Corporations

However, there are some downsides to consider:

- Double taxation: The company pays taxes on its income, and shareholders also pay taxes on dividends.

- Complex regulations: They must follow strict rules and file detailed reports.

- Higher costs: Setting up and maintaining a C Corp can be expensive.

C Corporations are ideal for businesses looking to grow big and attract investors, but they come with more rules and costs.

Understanding S Corporations

What is an S Corporation?

An S Corporation, named after Subchapter S of the Internal Revenue Code, is a special type of corporation. It allows business income, losses, deductions, and credits to pass through to shareholders’ personal tax returns. This setup is popular among small businesses and sole proprietors because it offers tax advantages and liability protection for personal property.

Advantages of S Corporations

S Corporations come with several benefits:

- Tax Benefits: They avoid double taxation since income is passed through to shareholders.

- Liability Protection: Shareholders’ personal assets are protected from business debts and claims.

- Employment Tax Savings: Owners can be W-2 employees, potentially reducing self-employment taxes.

Disadvantages of S Corporations

Despite the benefits, there are some downsides:

- Ownership Restrictions: S Corporations can have no more than 100 shareholders, and all must be U.S. citizens or residents.

- Strict Operational Processes: They must adhere to strict filing and operational processes, including holding regular meetings and maintaining detailed records.

- Limited Stock Options: They can only issue one class of stock, which may limit investment opportunities.

S Corporations are a great choice for small businesses looking for tax benefits and liability protection, but they come with specific rules and limitations.

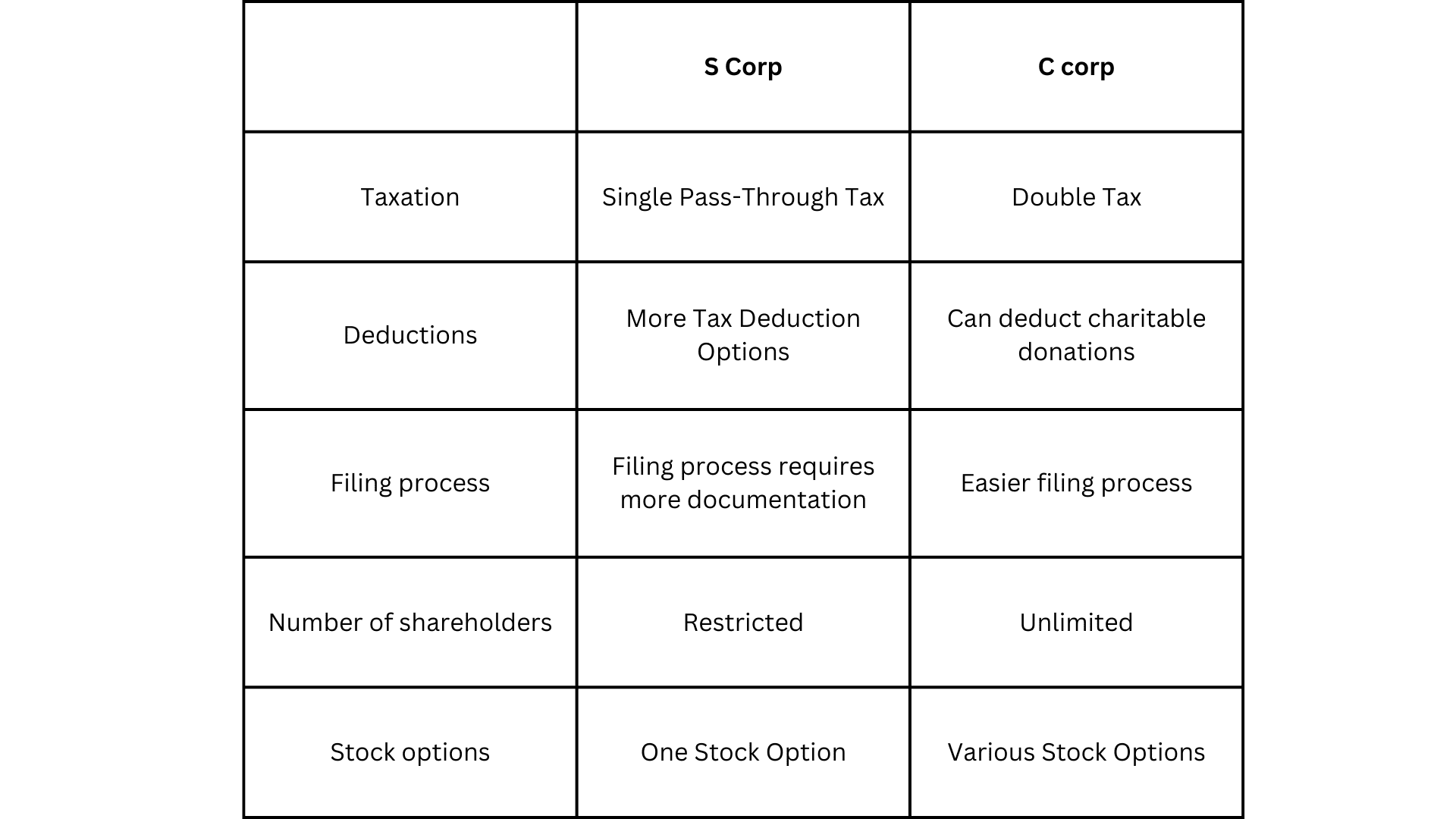

Comparing C Corporations and S Corporations

Taxation Differences

C corporations are taxed under Subchapter C, while S corporations are taxed under Subchapter S. C corporations face double taxation: once at the corporate level and again on dividends. S corporations, however, enjoy pass-through taxation, meaning profits are taxed only at the shareholder level.

Ownership and Stock Options

C corporations can have unlimited shareholders and multiple classes of stock. In contrast, S corporations have strict ownership limits, allowing no more than 100 shareholders and only one class of stock. This makes C corporations more flexible for raising capital.

Compliance Requirements

Both C and S corporations must adhere to corporate governance rules, but C corporations often face more stringent compliance requirements. This includes more detailed reporting and stricter regulations, which can be more time-consuming and costly.

When choosing between a C corporation and an S corporation, consider your business goals and the level of complexity you’re willing to manage.

Limited Liability Protection in Corporations

What is Limited Liability?

Limited liability protection is a key feature of both S and C corporations. It means that the owners’ personal assets are safe from business creditors. In simple terms, shareholders are not personally responsible for corporate debts. This ensures that creditors can’t use personal assets to settle business debts.

How C Corps Provide Protection

C corporations offer strong limited liability protection. Shareholders’ liability is limited to their investment in the business. This means personal assets are not at risk if the business faces financial trouble. However, C corporations must follow certain legal requirements and corporate formalities to maintain this protection.

How S Corps Provide Protection

S corporations also provide limited liability protection. Like C corps, the shareholders’ personal assets are shielded from business debts. This protection extends to potential lawsuits or debt collections aimed at the S corp. It’s a crucial benefit for small business owners.

Limited liability is a major reason why many choose to form corporations. It offers peace of mind knowing personal assets are protected.

Taxation of C Corporations

Corporate Level Taxation

C corporations are taxed as separate entities. They file a corporate tax return, known as Form 1120, and pay taxes on their profits at the corporate level. The current flat rate for corporate income tax is 21%. This means the company itself is responsible for paying taxes on its earnings before any profits are distributed to shareholders.

Shareholder Level Taxation

When a C corporation distributes profits to its shareholders in the form of dividends, those shareholders must pay individual income taxes on the dividends they receive. This is separate from the taxes the corporation pays on its profits. Essentially, the same money is taxed twice: once at the corporate level and again at the individual level.

Double Taxation Explained

Double taxation is a significant drawback of C corporations. The corporation pays taxes on its income, and then shareholders pay taxes on the dividends they receive. This can be a financial burden and is one reason some businesses avoid the C corporation structure. Shareholders cannot deduct corporate losses on their personal income tax returns, which can further complicate the financial landscape for C corporations.

Double taxation means the same income is taxed twice: first at the corporate level and then at the individual level when dividends are paid out.

Taxation of S Corporations

Pass-Through Taxation

S corporations don’t pay income taxes at the corporate level. Instead, the profits and losses are passed through to the shareholders’ personal tax returns. This means the business income is taxed only once, avoiding the double taxation that C corporations face. Shareholders report their share of the income on their individual tax returns.

Self-Employment Taxes

Unlike sole proprietorships or partnerships, S corporation shareholders may save on self-employment taxes. Shareholders who work for the S corp are considered employees and receive salaries. Only these salaries are subject to payroll taxes, while the remaining profits are not.

Tax Benefits for Small Businesses

S corporations offer several tax benefits for small businesses. They can deduct business expenses like salaries, rent, and supplies. Additionally, S corps can provide tax-advantaged retirement plans and health insurance for their employees. This structure can be particularly beneficial for small business owners looking to maximize their tax savings.

By choosing S corporation status, small businesses can enjoy significant tax advantages and avoid the complexities of double taxation.

Ownership Restrictions in S Corporations

Shareholder Limits

S corporations have strict rules about who can own shares. They can have no more than 100 shareholders. This is a big difference from C corporations, which don’t have such limits.

Eligible Shareholders

Only certain people can own shares in an S corporation. Shareholders must be U.S. citizens or residents. Some trusts and estates can also be shareholders, but other corporations and non-resident foreigners cannot.

Impact on Investment

These rules can make it harder for S corporations to get investment money. Venture capital and private equity funds often can’t invest because they don’t meet the shareholder rules. Also, S corporations can’t have different classes of stock, which some investors prefer.

These restrictions are important to understand if you’re thinking about forming an S corporation. They can affect your ability to raise funds and grow your business.

Corporate Governance in C and S Corporations

Corporate governance in both S corps and C corps involves a formal structure for managing and overseeing the company’s operations. Corporate governance typically includes:

Choosing Between a C Corporation and an S Corporation

Factors to Consider

When deciding between a C Corporation and an S Corporation, think about your business’s size, goals, and tax implications. Each structure has its own perks and drawbacks. Your choice should align with your specific needs and objectives.

Business Goals and Structure

Your business goals play a big role in this decision. If you plan to reinvest profits back into the business, a C Corporation might be better. On the other hand, if you want to pass profits directly to shareholders, an S Corporation could be the way to go.

Consulting with Professionals

It’s always a good idea to talk to a tax advisor or a legal expert. They can provide insights on the latest government tax news and help you understand the impact of your choice. This way, you can make an informed decision that best suits your business.

Partnerships vs. Corporations

Key Differences

When starting a business, you might wonder whether to choose a partnership or a corporation. Partnerships are easy to set up and manage, making them a popular choice for new business owners. Corporations, on the other hand, offer more structure and protection but come with more rules.

Taxation of Partnerships

In a partnership, profits pass through to the owners’ personal tax returns. This means the business itself doesn’t pay taxes. However, these profits are generally subject to FICA tax. Corporations, especially C corporations, face double taxation—once at the corporate level and again on shareholders’ dividends.

Liability in Partnerships

One downside of partnerships is that owners’ personal assets are not protected unless the business is a limited partnership or LLC. Corporations provide limited liability protection, meaning owners’ personal assets are usually safe from business debts.

Choosing between a partnership and a corporation depends on your business goals and how much protection you need for your personal assets.

Electing S Corporation Status

How to Elect S Corp Status

To elect S Corporation status, you need to follow a few steps. First, ensure your business meets the eligibility criteria. Then, file IRS Form 2553, signed by all shareholders. This form is crucial for choosing official S corp status. After filing, obtain the necessary state and local business licenses and pay any required fees.

Eligibility Criteria

Before you can elect S Corp status, your business must meet certain requirements:

- Be a domestic corporation

- Have only allowable shareholders, which include individuals, certain trusts, and estates

- Have no more than 100 shareholders

- Have only one class of stock

- Not be an ineligible corporation (e.g., certain financial institutions, insurance companies, and domestic international sales corporations)

Filing Requirements

Once you confirm eligibility, the next step is filing with the IRS. Submit Form 2553, ensuring all shareholders sign it. This form must be filed within two months and 15 days after the beginning of the tax year the election is to take effect. Additionally, keep up with annual filings and fees with the Secretary of State to maintain your S corp status.

Remember, electing S corp status can help you avoid double taxation on corporate income. Always consult a tax or legal professional to ensure it’s the right choice for your business.

Conclusion

Choosing the right business structure can be a game-changer for your company. C corporations, S corporations, and partnerships each have their own perks and downsides. C corporations offer more flexibility with ownership and stock options but come with double taxation. S corporations avoid double taxation and provide some tax benefits but have stricter rules on who can be a shareholder. Partnerships are simpler and offer pass-through taxation but don’t provide the same level of liability protection. Understanding these differences can help you make the best decision for your business. Remember, it’s always a good idea to talk to a tax advisor or lawyer to get advice tailored to your specific situation.

As such, we want to help you choose the option that works best for you and your business, so take advantage of our free consultation system!