8 Major IRS changes in 2024

For the tax year 2024, the Internal Revenue Service (IRS) released the annual inflation adjustments for over 60 tax provisions, which included changes to the tax rate schedules and other tax provisions.

In 2024, the IRS will make major changes for both individuals and small businesses. Knowing these changes will help you plan your taxes ahead of time.

1. Tax brackets

The federal income tax brackets indicate the amount owed on each segment of your taxable income. In 2024, there will be seven federal income tax rates and brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The top tax rate for individual single taxpayers with incomes over $609,350 ($731,200 for married couples filing jointly) stays at 37% for the 2024 tax year. For single people making $11,600 or less per year ($23,200 for married couples filing jointly), the lowest rate is 10%.

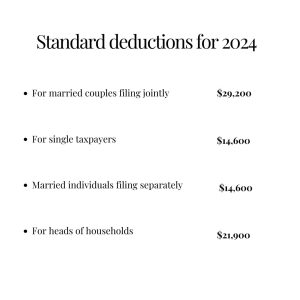

2. Standard deductions increased

Most taxpayers use the standard deduction, which reduces taxable income. According to the IRS, approximately 90% of tax filers opt for the standard deduction.

These are the standard tax deductions for 2024.

3. 1099-K reporting

The 1099-K is a tax document utilized for disclosing payments received for goods or services within a business context from third-party payment organizations (TPPOs) such as payment apps, online marketplaces, and payment processors. It assists the IRS in monitoring income and ensuring accurate tax reporting.

In 2024, payment processors will disclose transactions of $5,000 or higher on Form 1099-K. In the previous tax year (2023 for the 2024 filing season), platforms must issue Form 1099-K if your payments exceeded $20,000 and involved over 200 transactions during 2023.

4. Earned income tax credit increased

For the tax year 2024, the highest Earned Income Tax Credit (EITC) amount is $7,830 for eligible taxpayers with three or more qualifying children, up from $7,430 in 2023. The revenue procedure includes a table detailing the maximum EITC amount for different categories, income thresholds, and phase-outs.

5. The annual exclusion for gifts increased

For the calendar year 2024, the gift annual exclusion rises to $18,000, up from $17,000 in the calendar year 2023

6. Higher standard mileage Rate

The IRS raised the mileage rate for businesses in 2024 to 67 cents per mile, which is 1.5 cents more than the previous year’s rate of 65.5 cents per mile.

Charities mileage in 2023 and 2024 remains the same at 14 cents per mile. For medical, the mileage is 21 cents per mile in 2024, which was 22 cents per mile in 2023.

7. The foreign earned income Boosted

The foreign earned income exclusion (FEIE) provided by the IRS permits specific U.S. citizens and resident aliens residing overseas to exclude a portion of their foreign earned income from U.S. federal income tax. In tax year 2024, the foreign earned income exclusion stands at $126,500, up from $120,000 in tax year 2023.

8. Medical saving account coverage

For tax year 2024, these are coverage in a Medical Savings Account.

- For self-only coverage in a medical savings account, the annual deductible must range from $2,800 to $4,150.

- The maximum out-of-pocket expense for self-only coverage is $5,550.

- For family coverage, the annual deductible ranges from $5,550 to $8,350.

- The out-of-pocket expense limit for family coverage is $10,200.

Other provisions under the IRS for the 2024 tax season.

- In tax year 2024, the monthly limitation for the qualified transportation fringe benefit and qualified parking increases to $315, rising by $15 from the limit in 2023.

- Estates of decedents who pass away in 2024 are granted a basic exclusion amount of $13,610,000, up from $12,920,000 for estates of decedents who died in 2023.

- For tax year 2024, the maximum credit permitted for adoptions is the total of qualified adoption expenses, up to $16,810, which has risen from $15,950 in 2023.

Bottom Line

Keeping up with all the tax updates is hard for small businesses but crucial as well. Know your tax obligations to make informed decisions on money matters, as 2024 tax updates will be applicable in 2024 tax returns.

To get personalized tax guidance, consult our experts today for a FREE consultation.