Are you buying or selling a business? If so, you’ll need to know about Form 8594. This guide will help you understand this important document. Form 8594 is used to report the sale and purchase of business assets. Both the buyer and seller must fill it out. This guide will explain what this Form is, why it’s important, and how to complete it correctly.

Key Takeaways

- Form 8594 is crucial for reporting business asset sales and purchases.

- Both buyers and sellers need to fill it out during a transaction.

- The form helps in allocating the sales price among different asset classes.

- Proper completion of Form 8594 can impact tax outcomes.

- There are resources and professional services available to help you fill out the form accurately.

What is the 8594 Form?

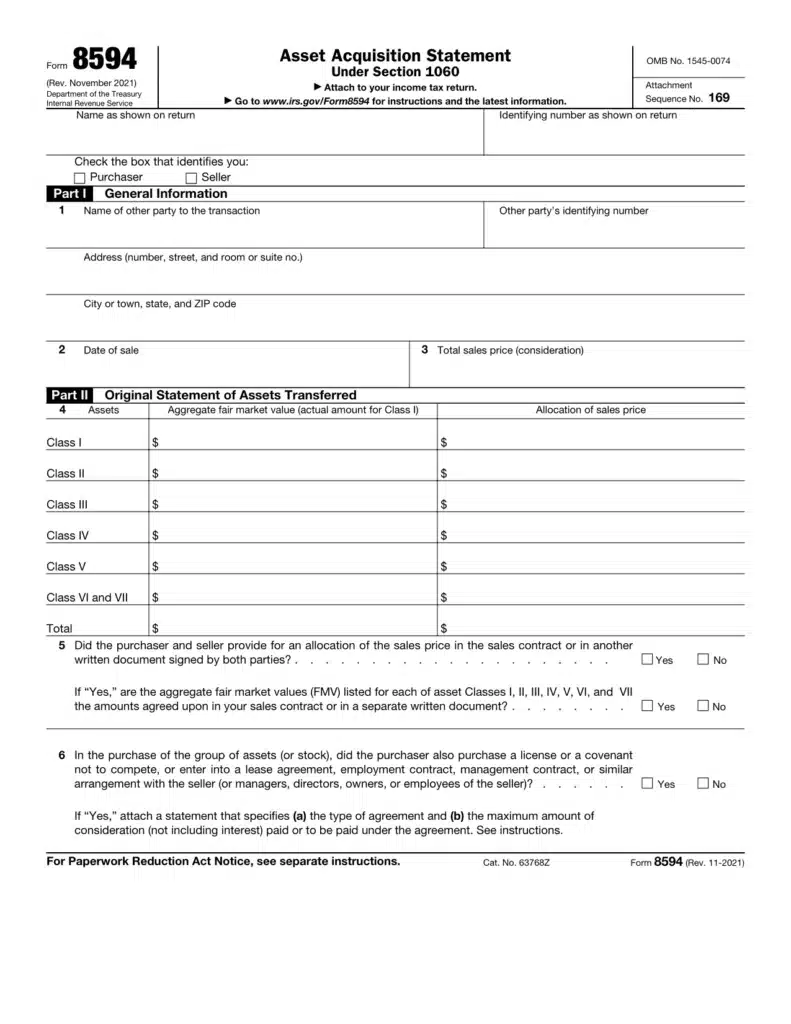

The 8594 form is a crucial document used in business transactions, especially when buying or selling assets. It helps both the buyer and the seller allocate the assets among different categories based on their fair market value. This allocation is essential for tax purposes and ensures that both parties report the transaction accurately to the IRS.

Key Sections of the 8594 Form

The 8594 Form is divided into several key sections, each serving a specific purpose in the process of reporting an asset acquisition. Understanding these sections is crucial for both buyers and sellers to ensure accurate reporting and compliance with IRS regulations.

How to Fill Out the 8594 Form

Filling out the form 8594 might seem tricky, but with the right steps, you can do it easily. Here’s a simple guide to help you through the process.

Importance of the 8594 Form in Business Transactions

The 8594 Form plays a crucial role in business transactions, especially when it comes to buying or selling assets. Both the buyer and seller must complete IRS Form 8594 during the sale to report the sale and purchase of business assets. This form helps ensure that both parties are on the same page regarding the allocation of the sales price to different asset classes.

Impact on Buyers

For buyers, the 8594 is essential because it helps them determine the basis of the assets they are purchasing. This basis is important for future depreciation and amortization calculations. Without accurate filing, buyers might face issues with their tax returns down the line.

Impact on Sellers

Sellers also benefit from it, as it helps them report the sale correctly on their tax returns. The form ensures that the sales price is allocated properly among the different asset classes, which can affect the amount of taxable gain or loss they report.

Tax Implications

The tax implications of the 8594 Form are significant. Proper allocation of the sales price can impact the amount of taxes owed by both the buyer and the seller. Incorrect filing can lead to disputes with the IRS and potential penalties. Therefore, it’s crucial to understand the importance of accurate filing emphasized in the form’s instructions.

The 8594 Form is not just a formality; it’s a vital document that can have lasting effects on your business’s financial health.

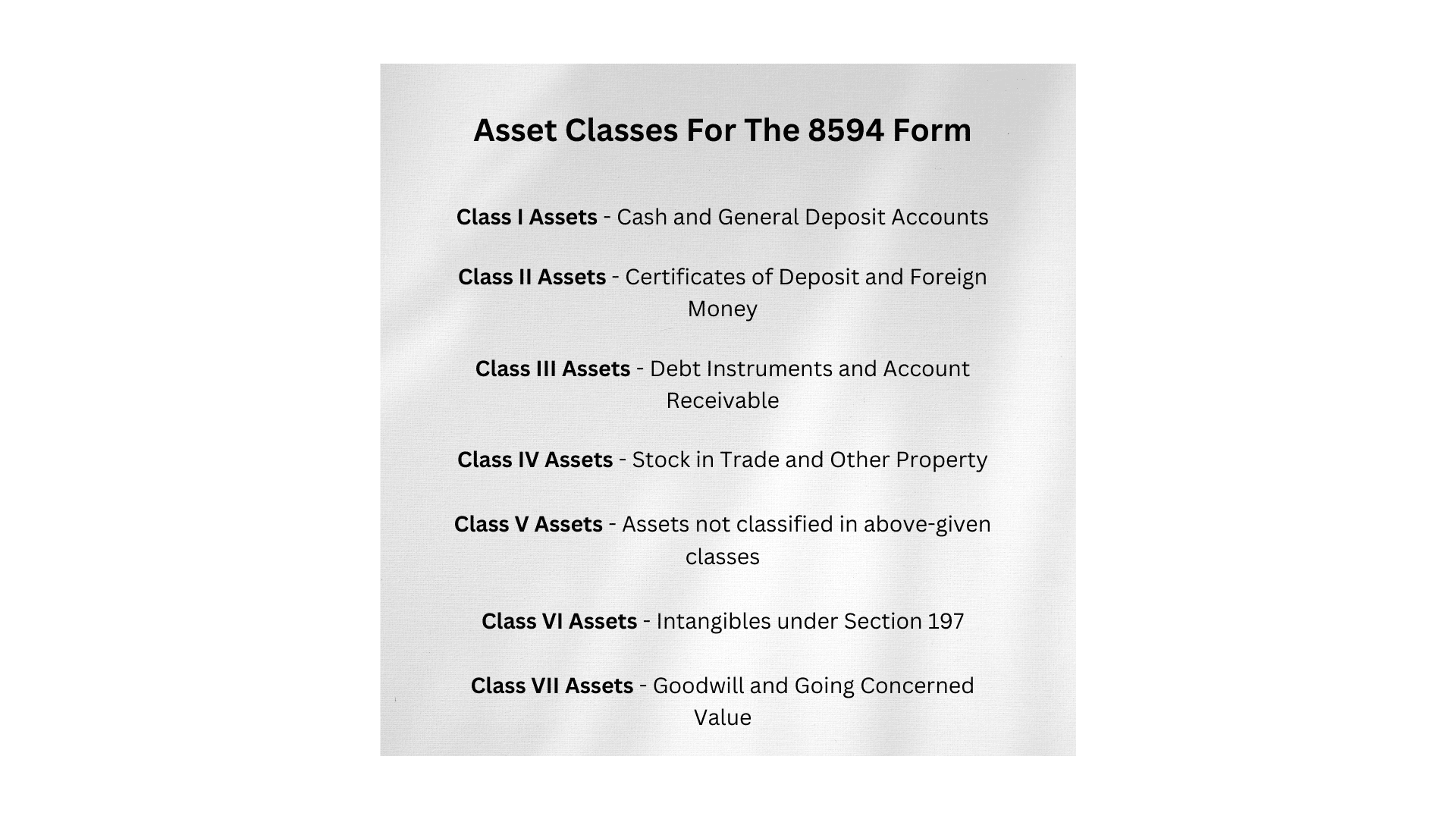

Asset Classes and Valuation Methods

Understanding Asset Classes

When dealing with business transactions, it’s crucial to understand the different asset classes. The main asset classes include equities, fixed income, cash or marketable securities, and commodities. Each of these asset classes is treated differently for tax purposes, which is why it’s important to categorize them correctly.

Valuation Methods Explained

Valuing assets accurately is key to completing Form 8594. There are several methods to determine the value of an asset:

- Market Approach: This method looks at the prices of similar assets in the market.

- Income Approach: This method calculates the present value of future income generated by the asset.

- Cost Approach: This method considers the cost to replace the asset with a similar one.

Best Practices for Valuation

To ensure accurate valuation, follow these best practices:

- Use multiple valuation methods: Don’t rely on just one method; compare results from different approaches.

- Keep detailed records: Document how you arrived at each valuation to support your figures if questioned.

- Consult professionals: When in doubt, seek advice from valuation experts or accountants.

Proper valuation of assets can significantly impact the tax outcomes for both buyers and sellers. Make sure to approach this step with care and diligence.

Common Scenarios for Using the 8594 Form

Business Acquisitions

When a business is bought, the 8594 Form is essential. It helps both the buyer and seller agree on how the purchase price is split among the different assets. This is important because it affects how much tax each party will pay. Using the form correctly can save you money and avoid problems with the IRS.

Asset Sales

If you’re selling parts of your business, like equipment or inventory, you’ll need to fill out the 8594 Form. This form helps you and the buyer agree on the value of each item sold. This is crucial for tax reasons and ensures both parties are on the same page.

Mergers and Acquisitions

In mergers and acquisitions, the 8594 Form is used to allocate the purchase price among the acquired assets. This helps in determining the tax basis for the new owners and ensures compliance with IRS rules. Filling out this form correctly is vital for a smooth transaction.

The 8594 Form is your guide to 1099s and W9s for independent contractors. It clarifies tax misconceptions, differences between forms, importance of timely collection, potential penalties, and recent updates.

IRS Instructions and Publications

The IRS has resources that can help you navigate this. On this page, you’ll find more instructions for accurately completing Form 8594. These guides are designed to make the process easier and ensure you don’t miss any important steps.

Professional Services

Sometimes, it’s best to get help from the pros. Services like Taxfully can clarify the purpose of Form 8594 and guide you through its key sections. We can also help you avoid common mistakes and ensure everything is filled out correctly.

If you’re selling your business, using these resources can make the process much smoother and less stressful.

Wrapping It Up

Alright, we’ve covered a lot about Form 8594! Whether you’re buying or selling a business, this form is your go-to for reporting asset sales to the IRS. It’s not just paperwork; it’s a crucial part of making sure everything is above board and clear. Remember, both buyers and sellers need to fill it out, and getting it right can save you from headaches down the road. So, keep this guide handy, follow the steps, and you’ll be in good shape.