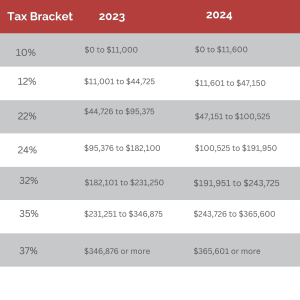

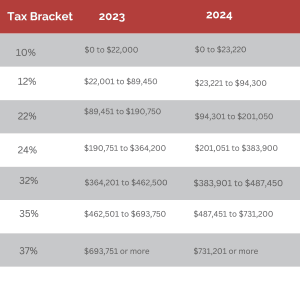

As we have entered the new year of 2024 the last tax quarter is already around the corner. Here are the IRS 2024 tax brackets you need to know to make your tax planning accordingly.

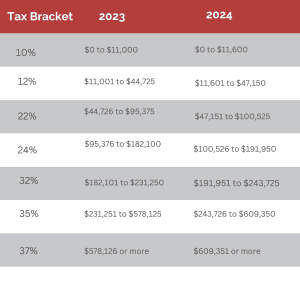

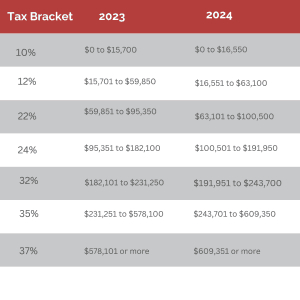

For 2024, the tax brackets have changed slightly. The 10% tax bracket has been expanded to include more taxpayers, and the 22% and 24% tax brackets have been adjusted upwards. This means that some people may pay a little more tax in 2024, while others may pay a little less.

What is a Tax Bracket?

Tax brackets are divisions that decide how much tax you owe based on your income. They split your earnings into sections, each with its own tax rate. If you earn more, you might move into a higher bracket and pay a higher tax rate on that part of your income.

Tax Bracket for Single

Tax Bracket for Household

Tax Bracket for Married Filling Singly

Tax Bracket for Married Filing Jointly

Marginal vs. Effective Tax Rates

The marginal tax rate is the tax rate applied to the highest dollar you earn. The effective tax rate is the total tax you pay divided by your taxable income. The effective tax rate may differ from the marginal rate due to deductions, credits, and other factors that reduce taxable income.

Why Understanding Your Tax Bracket is Important?

Your tax bracket works like a scale for income. The higher it is, the more taxes you pay. Understanding this helps with financial decisions and reducing your tax load. It helps calculate your owed tax based on earnings, similar to knowing costs for different income levels. Knowing your bracket aids in planning and prepares you for tax filing, making organizing easier.

Conclusion:

Understanding the 2024 tax brackets and applying appropriate strategies can help to navigate your taxes effectively. Further, by Staying informed about tax policy changes and consulting with qualified tax professionals, you can maximize tax savings and gain greater control over your financial future.