Navigating the world of tax-exempt status for non-profits can be tricky, especially when it comes to understanding IRS Form 1023. This form is essential for organizations seeking to be recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. In this guide, we’ll break down what Form 1023 is, why it’s important, and everything you need to know to complete it successfully.

Key Takeaways

- Form 1023 is used by non-profits to apply for tax-exempt status under Section 501(c)(3).

- Form 1023 only grants federal tax exemption; state tax exemption requires separate registration.

- Organizations must provide detailed information about their activities and beneficiaries on Form 1023.

- Non-profits should avoid common mistakes like incomplete information, missing deadlines, and incorrect fees when filing.

What is a 1023 Form and Why It’s Important

Definition of Form 1023

Form 1023 is a detailed document that non-profits must fill out to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. All applicants must complete the first 12 pages, which include sections one through eleven. Additionally, there are eight extra forms, known as Schedules A through H, that organizations must submit if they apply to them. Some organizations can use a shorter version called Form 1023-EZ.

Importance of Tax-Exempt Status

Having tax-exempt status means your non-profit doesn’t have to pay federal income taxes. This can save your organization a lot of money, allowing you to put more resources into your mission. It also makes your non-profit more attractive to donors, as they can claim tax deductions for their contributions.

Who Needs to File

Any organization that wants to be recognized as tax-exempt under Section 501(c)(3) needs to file Form 1023. This includes charities, educational institutions, and religious organizations. If your organization meets the criteria, you should definitely consider filing to gain the benefits of tax-exempt status.

Filing Form 1023 is a crucial step for any non-profit aiming to maximize its impact and resources.

Steps to Complete IRS Form 1023

Filing for tax-exempt status can seem like a big task, but breaking it down into steps makes it easier. Follow these steps to complete IRS Form 1023 and get your non-profit on the right track.

Gathering Required Information

Before you start, gather all the necessary information. This includes your organization’s basic details, financial data, and a description of your activities. Having everything ready will make the process smoother.

Filling Out the Form

Form 1023 is a long document. All applicants must complete the first 12 pages, or sections one through 11. Form 1023 also has eight additional forms (Schedules A through H). Organizations must submit any of the schedules that apply to them. Certain types of organizations can complete a shorter version of the form known as Form 1023-EZ. To find out whether you can submit the streamlined form, you’ll need to read the instructions for Form 1023-EZ.

Submitting the Form

Once you’ve filled out the form, it’s time to submit it. Make sure to follow the checklist for Form 1023, which tells you what to include in your application packet. The checklist goes first, followed by optional forms you may need depending on your circumstances (i.e. Form 2848 and Form 8821). After submitting, you’ll need to wait until the IRS approves your application.

Remember, the IRS may reject your application or return it if you don’t follow its directions. But luckily, there’s an interactive version of Form 1023 that can guide you through the application process.

Eligibility Criteria for Filing Form 1023

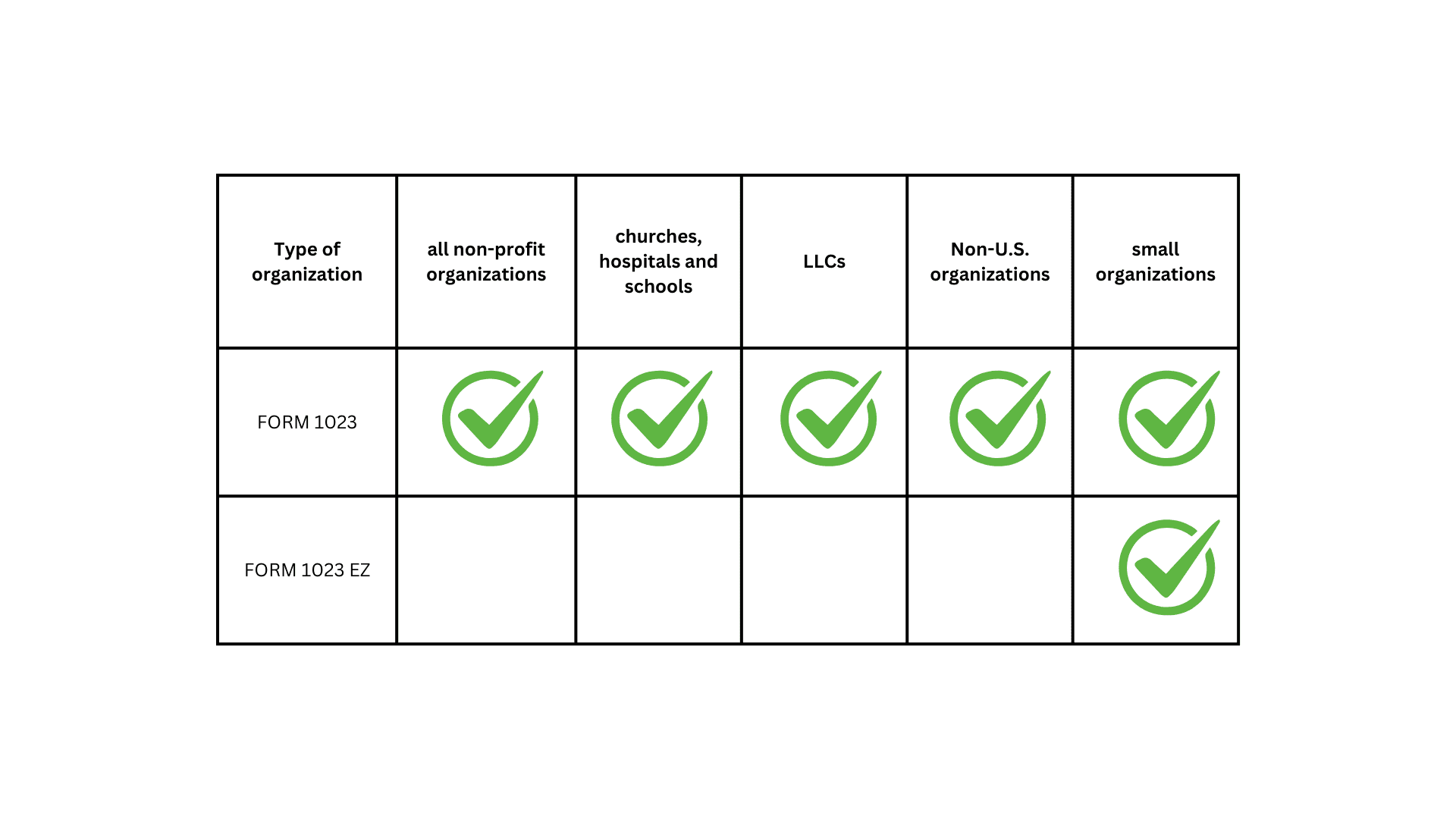

Types of Organizations

To be eligible to file Form 1023, your organization must fall under specific categories. These include charitable, religious, educational, scientific, and literary groups. If your organization fits one of these types, you can apply for recognition of tax-exempt status.

Gross Receipts Threshold

One key factor to determine if you are eligible is your organization’s gross receipts. If your group has gross receipts of $50,000 or less annually, you might qualify for the simpler Form 1023-EZ. However, if your receipts exceed this amount, you’ll need to file the standard Form 1023.

Form 1023 vs. Form 1023-EZ

There are two versions of the form: the long Form 1023 and the shorter Form 1023-EZ. To find out if you can submit the streamlined form, you must complete the eligibility worksheet provided in the instructions for Form 1023-EZ. This worksheet helps you determine if you are eligible to file the shorter form. If not, you’ll need to go with the longer version.

Before you start, make sure to check all the requirements to determine if you are eligible. This will save you time and effort in the long run.

Common Mistakes to Avoid

Filing Form 1023 can be a bit tricky, and making mistakes can delay your application or even get it rejected. Here are some common pitfalls to watch out for:

Incomplete Information

One of the most frequent errors is leaving sections blank or not providing enough details. Make sure you fill out all required parts of the form. Double-check your work to ensure nothing is missing.

Missing Deadlines

Timing is crucial. If you miss the deadline, your application could be delayed or denied. Keep track of important dates and submit your form on time.

Incorrect Fees

Paying the wrong fee is another common mistake. The fee you need to pay depends on your organization’s gross receipts. Make sure you know the correct amount before you submit your application. When filing Form 1023, it’s important to know the costs involved. The filing fee for the full Form 1023 is currently $600. For smaller organizations, there’s a shorter version called Form 1023-EZ, which has a lower fee of $275.

If your organization’s gross receipts exceed $50,000, you’ll need to file the full Form 1023 and pay the $600 fee. However, if your gross receipts are normally not more than $5,000, you might not need to file at all.

State vs. Federal Tax-Exempt Status

Federal Tax Exemption

After you’ve incorporated, obtaining federal tax-exempt status is a critical step in forming a nonprofit organization. Most of the real benefits of being a nonprofit flow from your 501(c)(3) tax-exempt status, such as the tax-deductibility of donations, access to grant money, and income and property tax exemptions.

State Tax Exemption

Other unique provisions tend to vary by state. Like federal law, most states allow for deductibility for state income tax purposes. Also, many states allow 501(c)(3) organizations to be exempt from property taxes and sales tax on purchases. Special nonprofit, bulk-rate postage discounts are available from the Post Office to qualifying organizations.

Additional State Requirements

Keep in mind that an organization’s tax-exempt status isn’t permanent. The IRS can revoke a nonprofit’s federal exemption status if, for example, it fails to provide the government with updated information (that it must submit annually) for three consecutive years. Even if a nonprofit applies to have its tax-exempt status reinstated, it may end up on the Automatic Revocation of Exemption List. That could create problems for donors who want a tax break.

Wrapping It Up

Getting tax-exempt status for your nonprofit by filing Form 1023 might seem like a big job, but it’s totally doable with the right info and a bit of patience. Remember, this form is key if you want to avoid federal taxes and make your organization more appealing to donors. Just make sure to follow the IRS guidelines closely and consider getting some help if you need it. Whether you’re a small group or a larger organization, completing Form 1023 will prove very beneficial in your nonprofit journey so don’t give up!

You can always contact us, if you feel like you need to learn more.